Did you find this useful? Give us your feedback

177 citations

42 citations

...…including a decline in the value of the U.S. dollar relative to the Euro; increased materials, energy, and labor input prices; a general increase in turbine manufacturer profitability due in part to strong demand growth; and increased costs for turbine warranty provisions (Moné et al. 2017)....

[...]

...dollar relative to the Euro; increased materials, energy, and labor input prices; a general increase in turbine manufacturer profitability due in part to strong demand growth; and increased costs for turbine warranty provisions (Moné et al. 2017)....

[...]

...Absent better data, and consistent with NREL assumptions, we assume that all plants have common total operating costs, at $51/kW-yr (Moné et al. 2017)....

[...]

...Since 2008, wind turbine prices have declined substantially, reflecting a reversal of some of the previously mentioned underlying trends that had earlier pushed prices higher (Moné et al. 2017) as well as increased competition among manufacturers and significant cost-cutting measures on the part of turbine and component suppliers....

[...]

...…have declined substantially, reflecting a reversal of some of the previously mentioned underlying trends that had earlier pushed prices higher (Moné et al. 2017) as well as increased competition among manufacturers and significant cost-cutting measures on the part of turbine and component…...

[...]

38 citations

...The wind turbine represents around 30% of the overall CapEx costs for a typical fixed-bottom offshore wind project [36]; however, these costs are negotiated on an individual project basis and are typically kept confidential by the supplier and developer [10]....

[...]

...Values for the capacity-weighted global average project installed in 2019 are also reported [36]....

[...]

...The cost reductions are defined relative to a baseline project repesentative of the capacity-weighted average project installed in 2019, he most recent year for which data are available [36]....

[...]

...The modeling tools required for this analysis also require several additional parameters to be defined that are not specified in [36], including a 34-year wind and wave time series with hourly resolution taken at a representative point in the North Atlantic (41◦N, 71◦W) pulled from the ERA5 reanalysis data set at a 100-m measurement height [38]....

[...]

...7 ercentage of the BOS costs [36], the reduction contributes significantly to the overall cost decrease....

[...]

30 citations

107 citations

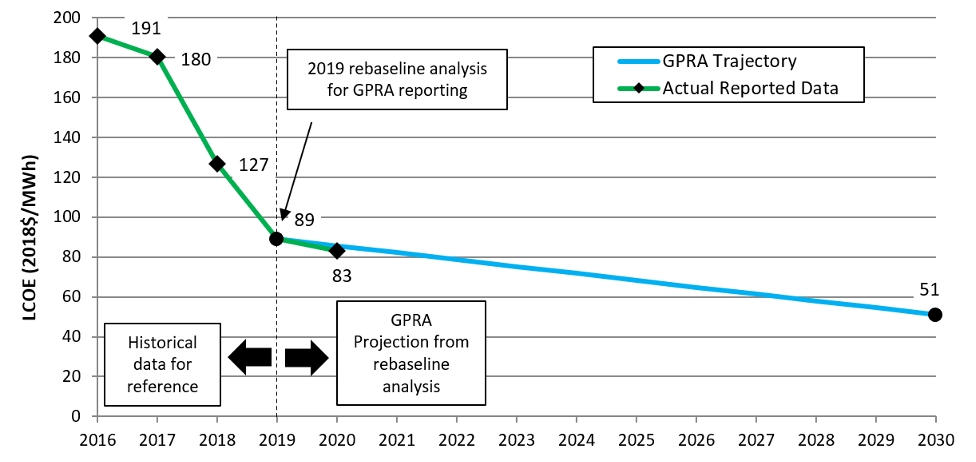

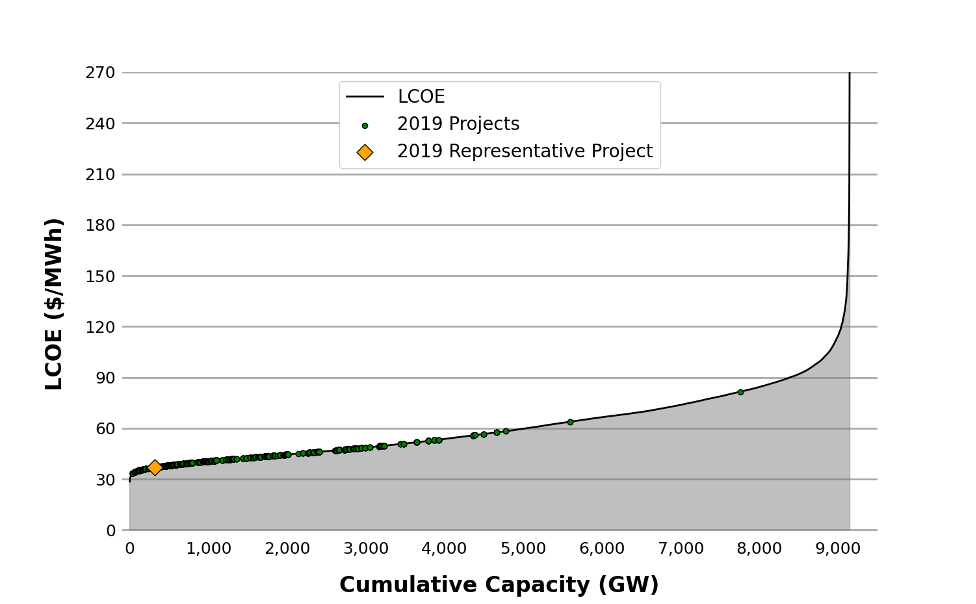

...• LCOE estimates continue to show a downward trend from the “2010 Cost of Wind Energy Review” (Tegen et al. 2012) to 2019....

[...]

...The analysis and findings in this report helped generate the following conclusions: • LCOE estimates continue to show a downward trend from the “2010 Cost of Wind Energy Review” (Tegen et al. 2012) to 2019....

[...]

...For specific approaches regarding additional turbine parameters (e.g., power curves), see the “2010 Cost of Wind Energy Review” (Tegen et al. 2012)....

[...]

...…assumptions and ranges for key LCOE input parameters From the analysis detailed in this report, we derived the following key conclusions: • Land-based wind power plant LCOE estimates continue to show a downward trend from the “2010 Cost of Wind Energy Review” (Tegen et al. 2012) to the 2019 review....

[...]

...3 Approach This “2019 Cost of Wind Energy Review” applies a similar approach as the past cost of wind energy review reports (Tegen et al. 2012, 2013; Moné et al. 2015a, 2015b, 2017; Stehly et al. 2017, 2018, 2019)....

[...]

100 citations

...…Operation and Maintenance Expenditures OpEx can vary greatly between projects for a number of reasons; however, the two largest cost drivers are the distance from the project to the maintenance facilities and the meteorological ocean climate at the site (Maples et al. 2013; Pietermen et al. 2011)....

[...]

...4 Offshore Operation and Maintenance Expenditures OpEx can vary greatly between projects for a number of reasons; however, the two largest cost drivers are the distance from the project to the maintenance facilities and the meteorological ocean climate at the site (Maples et al. 2013; Pietermen et al. 2011)....

[...]

73 citations

...…(2020) announced a 2024 target for the commercial release of a 14-MW turbine model, with a power boost feature increasing the capacity to 15 MW. Incorporating larger turbines in a project’s design may contribute to LCOE reductions via reduced balance-of-plant and O&M costs (Musial et al. 2017)....

[...]

...Additional information on the types of fixed-bottom and floating wind substructures can be found in Musial et al. (2017)....

[...]

...More information on the global trends for offshore wind power plant performance can be found in Musial et al. (2017)....

[...]

...Incorporating larger turbines in a project’s design may contribute to LCOE reductions via reduced balance-of-plant and O&M costs (Musial et al. 2017)....

[...]

67 citations

...3 Approach This “2019 Cost of Wind Energy Review” applies a similar approach as the past cost of wind energy review reports (Tegen et al. 2012, 2013; Moné et al. 2015a, 2015b, 2017; Stehly et al. 2017, 2018, 2019)....

[...]

...Nevertheless, their exclusion is consistent with past economic analyses conducted by NREL (Stehly et al. 2018), as LCOE is not traditionally defined as a measure of all societal costs and benefits associated with power generation resources....

[...]