Did you find this useful? Give us your feedback

147 citations

...These recent studies look at consumers’ preparedness to use mobile payment systems (Humbani & Wiese, 2017), use of mobile phone by entrepreneurs (Afutu-Kotey, Gough, & Owusu, 2017), the role of networks in the financial inclusion – financial literacy nexus (Okello Candiya Bongomin, Ntayi, Munene, &…...

[...]

144 citations

124 citations

...…enhancing financial inclusion (Asongu, 2013; Gosavi, 2017; Kirui, Okello, Nyikal, & Njiraini, 2013; Singh, 2012), supporting electronic payments (Humbani & Wiese, 2017), promoting business development and entrepreneurship (Afutu-Kotey, Gough, & Owusu, 2017; Mishra & Bisht, 2013; Ondiege, 2010),…...

[...]

...Moya, 2016; Fu & Akter, 2016; Jain et al., 2016; Lee & Bellemare, 2013; Mohamed & Abdel-Ghany, 2014; Mokotjo & Kalusopa, 2010; Zhang et al., 2016). Second, there is literature linking mobile technologies to agricultural marketing (see, e.g., Li, Fu, & Li, 2007; Molony, 2008; Tadesse & Bahiigwa, 2015). Third, some studies link mobile technologies to agricultural land management (see, e.g., Jordan, Eudoxie, Maharaj, Belfon, & Bernard, 2016). Despite the extant literature, one area that is under-exploited is the impact of mobile phone ownership and use on agricultural productivity. Meanwhile, agricultural productivity is a key development issue as far as fighting poverty and boosting food security of smallholder farmers are concerned. The argument this study makes is that farmers who own and use mobile phones would have better access to information on services such as inputs and extension that would improve their productivity. Some fine contributions to the study of the effect of mobile technologies on agricultural productivity are the studies of Ogutu, Okello, and Otienoc (2014), Chavula (2014), Houghton (2009) and Lio and Liu (2006)....

[...]

120 citations

119 citations

65,095 citations

...…model (TAM) (Davis, 1989), universal technology adoption and use theory (UTAUT) (Venkatesh & Davis, 2000), the theory of reasoned action (TRA) (Ajzen, 1991), the theory of planned behavior (TPB) (Ajzen, 1991), the diffusion of an innovation theory (IDT) (Rogers, 1995), as well as the…...

[...]

...…adoption and use theory (UTAUT) (Venkatesh & Davis, 2000), the theory of reasoned action (TRA) (Ajzen, 1991), the theory of planned behavior (TPB) (Ajzen, 1991), the diffusion of an innovation theory (IDT) (Rogers, 1995), as well as the technology readiness index (TRI) (Parasuraman, 2000) models…...

[...]

...These include the technology-acceptance model (TAM) (Davis, 1989), universal technology adoption and use theory (UTAUT) (Venkatesh & Davis, 2000), the theory of reasoned action (TRA) (Ajzen, 1991), the theory of planned behavior (TPB) (Ajzen, 1991), the diffusion of an innovation theory (IDT) (Rogers, 1995),...

[...]

...These include the technology-acceptance model (TAM) (Davis, 1989), universal technology adoption and use theory (UTAUT) (Venkatesh & Davis, 2000), the theory of reasoned action (TRA) (Ajzen, 1991), the theory of planned behavior (TPB) (Ajzen, 1991), the diffusion of an innovation theory (IDT) (Rogers, 1995), as well as the technology readiness index (TRI) (Parasuraman, 2000) models which have prominently been instrumental in explaining the adoption of new technology in a variety of contexts....

[...]

56,555 citations

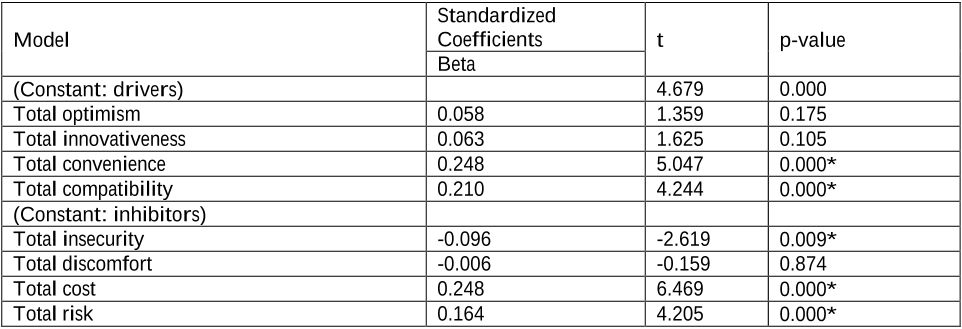

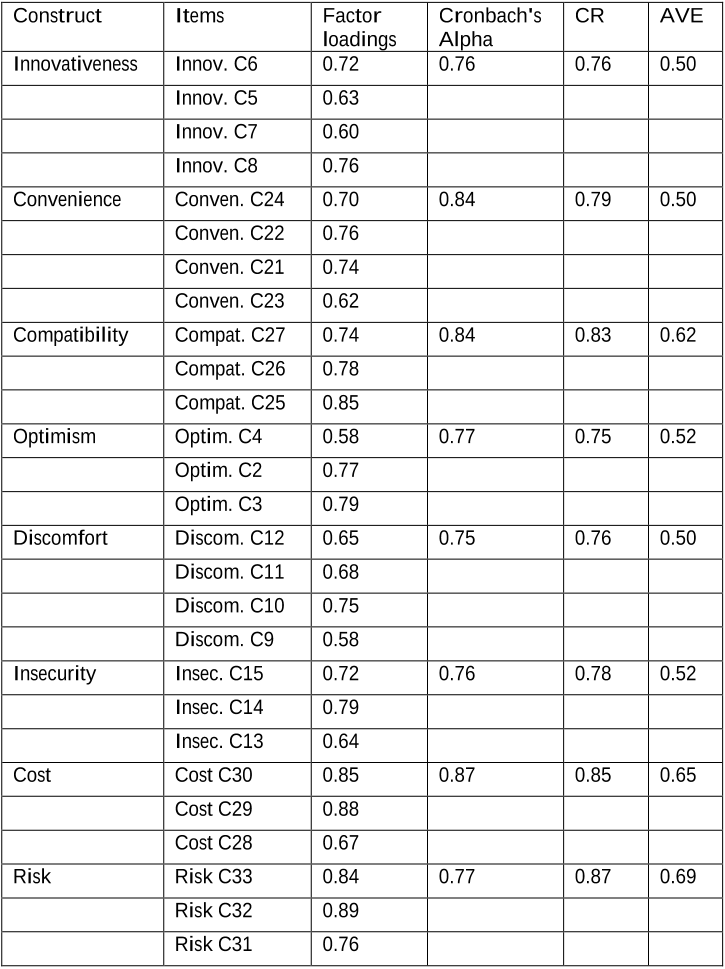

...The discriminant validity of the scales was assessed by considering the square roots of the AVE scores and the cross loading criterion as recommended by Fornell and Larcker (1981)....

[...]

40,975 citations

...The TRI is individual-specific, as opposed to other models, such as the TAM, which is system-specific (Parasuraman, 2000)....

[...]

...These include the technology-acceptance model (TAM) (Davis, 1989), universal technology adoption and use theory (UTAUT) (Venkatesh & Davis, 2000), the theory of reasoned action (TRA) (Ajzen, 1991), the theory of planned behavior (TPB) (Ajzen, 1991), the diffusion of an innovation theory (IDT)…...

[...]

...These include the technology-acceptance model (TAM) (Davis, 1989), universal technology adoption and use theory (UTAUT) (Venkatesh & Davis, 2000), the theory of reasoned action (TRA) (Ajzen, 1991), the theory of planned behavior (TPB) (Ajzen, 1991), the diffusion of an innovation theory (IDT) (Rogers, 1995),...

[...]

...These include the technology-acceptance model (TAM) (Davis, 1989), universal technology adoption and use theory (UTAUT) (Venkatesh & Davis, 2000), the theory of reasoned action (TRA) (Ajzen, 1991), the theory of planned behavior (TPB) (Ajzen, 1991), the diffusion of an innovation theory (IDT) (Rogers, 1995), as well as the technology readiness index (TRI) (Parasuraman, 2000) models which have prominently been instrumental in explaining the adoption of new technology in a variety of contexts....

[...]

40,720 citations

16,513 citations

As in any other study, this study has limitations but these limitations could provide direction for future research. Further studies are therefore required to test and validate the results of this study in other emerging countries. Other demographic factors such as age, household income, or education may require further investigation. Ongoing research is needed to further explore the impact of these three factors on the adoption of mobile payment services.