A

A

C

C

h

h

a

a

r

r

a

a

c

c

t

t

e

e

r

r

i

i

z

z

a

a

t

t

i

i

o

o

n

n

o

o

f

f

t

t

h

h

e

e

N

N

o

o

n

n

r

r

e

e

s

s

i

i

d

d

e

e

n

n

t

t

i

i

a

a

l

l

F

F

e

e

n

n

e

e

s

s

t

t

r

r

a

a

t

t

i

i

o

o

n

n

M

M

a

a

r

r

k

k

e

e

t

t

Nonresidential Fenestration Market Research

July 25, 2002

Prepared for

Lawrence Berkeley National Laboratory (LBNL)

Northwest Energy Efficiency Alliance (NEEA)

142 Minna Street

San Francisco, California 94105

(415) 957 1977 Voice

(415) 957 1381 Fax

www.eley.com

A Characterization of the Nonresidential Fenestration Market Final Report

Eley Associates, May 19, 2003 Page i

$FNQRZOHGJHPHQWV

Eley Associates prepared this report under contract to the Lawrence Berkeley National

Laboratory (LBNL. The Northwest Energy Efficiency Alliance (NEEA) also provided

financial support to Eley Associates for the completion of this project.

The authours would like to thank and acknowledge the contributions of their colleagues.

Kimberly Got (Eley Associates) was the copy editor and also assisted with the graphics

production. Joe Eto (LBNL), John Jennings (NEEA), and Jeff Harris (NEEA) also

reviewed the document and provided valuable comments.

An outside review group contributed significantly to the development of this document

through their review and feedback. This group included Carl Wagus (American

Architectural Manufacturers Association), Jim Benney (National Fenestration Rating

Council), and John Hogan (City of Seattle). Finally, special acknowledgement must be

given to the many industry representatives interviewed who volunteered their time to

provide valuable insight into the fenestration industry contained in this report.

This work was supported by the Assistant Secretary for Energy Efficiency and

Renewable Energy, Building Technologies Program, of the U.S. Department of Energy

under Contract No. DE-AC03-76SF00098.

A Characterization of the Nonresidential Fenestration Market Final Report

Eley Associates, May 19, 2003 Page ii

Acknowledgements..................................................................................................................i

Executive Summary.................................................................................................................2

Introduction..............................................................................................................................6

Methodology.............................................................................................................................7

The Supply Side of the Market .............................................................................................10

Primary Glass Manufacturers .......................................................................................15

Coaters .........................................................................................................................15

Fabricators ....................................................................................................................16

Specialty Equipment Suppliers.....................................................................................17

Glazing Contractors ......................................................................................................18

Framing Suppliers.........................................................................................................19

Window Manufacturers .................................................................................................20

The Demand Side of the Market...........................................................................................21

Architects ......................................................................................................................21

Owners/Developers ......................................................................................................22

Mechanical Engineers...................................................................................................23

Electrical Engineers ......................................................................................................23

Glazing Contractors ......................................................................................................23

Industry Trends......................................................................................................................25

Transparent Glass ........................................................................................................26

Greater Use of Punched Opening Windows.................................................................27

Low-e Coatings.............................................................................................................27

Post-Temperable Coatings...........................................................................................29

Thermally Broken and Thermally Improved Frames ....................................................30

Vinyl Frames.................................................................................................................32

IG Units .........................................................................................................................32

Triple Pane Fenestrations.............................................................................................32

Spacers.........................................................................................................................33

Argon Fill.......................................................................................................................34

Tinted Glass..................................................................................................................35

Reflective coatings........................................................................................................35

Laminated Glass...........................................................................................................36

Energy Efficiency Codes...............................................................................................37

ASHRAE/IESNA Standard 90.1....................................................................................39

Product Certification and NFRC ...................................................................................41

Other Trends.................................................................................................................44

Barriers ...................................................................................................................................45

Custom Fabricators.......................................................................................................45

Owner Incentive............................................................................................................45

Initial Cost .....................................................................................................................45

Reliability Concerns ......................................................................................................46

Traditional Bid Process.................................................................................................46

Performance Options in Energy Codes ........................................................................47

Downsizing is a Hard Sell.............................................................................................47

Vague Specifications ....................................................................................................47

Improper Design ...........................................................................................................47

Historic Buildings ..........................................................................................................48

Opportunities .........................................................................................................................49

Reduce the Use of Monolithic Glass.............................................................................49

Analysis Tools...............................................................................................................49

Help Owners Understand the Benefits .........................................................................50

Education......................................................................................................................51

A Characterization of the Nonresidential Fenestration Market Final Report

Eley Associates, May 19, 2003 Page iii

The Replacement Market .............................................................................................52

Glazing Films ................................................................................................................52

Energy Efficiency Programs .........................................................................................53

Better Communication Among the Design Team .........................................................53

Promote High Performance Tints .................................................................................54

Provide Showcase Buildings ........................................................................................54

Address Energy Efficiency at the Planning Stage ........................................................54

Energy Savings Potential......................................................................................................55

Glossary of Terms .................................................................................................................57

Bibliography...........................................................................................................................60

Appendices.............................................................................................................................61

Appendix A –NFRC Rating and Certification Procedures for Site-Built Fenestration ..61

Appendix B – Fenestration Product Flows in the Pacific Northwest.............................65

Appendix C –Survey Instruments .................................................................................69

Glass Manufacturers and Coaters............................................................................69

A&E Firms.................................................................................................................70

Glazing Contractors..................................................................................................72

Frame Manufacturers ...............................................................................................74

Shop-Built Window Manufactures ............................................................................75

Laminate and Applied Film Manufactures................................................................77

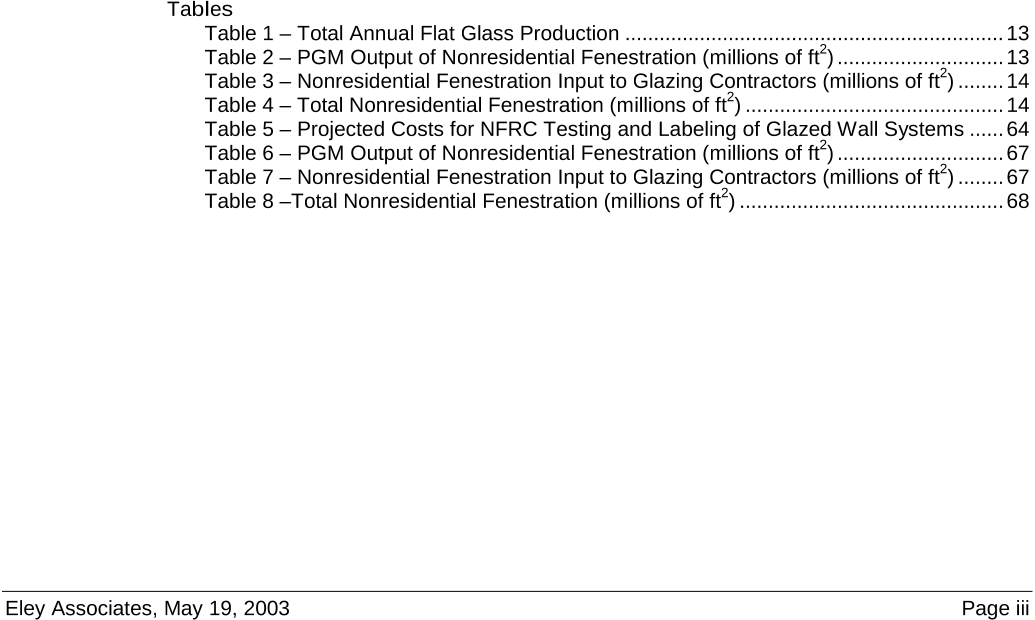

Figures

Figure 1 – Supply-Side Market Flow.................................................................................12

Figure 2 – ASHRAE 90.1-1999 Fenestration U-factor Requirements ..............................40

Figure 3 – ASHRAE 90.1-1999 Fenestration SHGC Requirements (0.2-0.3 WWR)........40

Figure 4 – Current Use of ASHRAE Standard by State....................................................41

Figure 5 – Heating and Cooling Loads Imposed by Nonresidential Glazing ....................55

Figure 6 – Pacific Northwest Supply-Side Market Flow....................................................66

Tables

Table 1 – Total Annual Flat Glass Production ..................................................................13

Table 2 – PGM Output of Nonresidential Fenestration (millions of ft

2

).............................13

Table 3 – Nonresidential Fenestration Input to Glazing Contractors (millions of ft

2

) ........14

Table 4 – Total Nonresidential Fenestration (millions of ft

2

) .............................................14

Table 5 – Projected Costs for NFRC Testing and Labeling of Glazed Wall Systems ......64

Table 6 – PGM Output of Nonresidential Fenestration (millions of ft

2

).............................67

Table 7 – Nonresidential Fenestration Input to Glazing Contractors (millions of ft

2

) ........67

Table 8 –Total Nonresidential Fenestration (millions of ft

2

) ..............................................68

A Characterization of the Nonresidential Fenestration Market Final Report

Eley Associates, May 19, 2003 Page 2

([HFXWLYH6XPPDU\

The U.S. glass industry is a $27 billion enterprise

1

with both large producers and small

firms playing pivotal roles in the industry. While most sectors of the glass industry have

restructured and consolidated in the past 20 years, the industry still employs 150,000

workers.

2

Nonresidential glazing accounts for approximately 18% of overall U.S. glass

production.

3

In 1999, nonresidential glazing was supplied to approximately 2.2 billion ft²

of new construction and additions.

4

That same year, nonresidential glazing was also

supplied to approximately 1.1 billion ft² of remodeling construction.

5

The nonresidential fenestration industry begins with the primary glass manufacturers

(PGMs), who manufacture flat glass. There are only six PGMs operating nearly 30

manufacturing plants nationally. PGMs are limited in number partly because of the large

investment required to construct a float line and the need for a strong customer base to

buy the product. The flat glass product that leaves the float line can be clear or tinted and

may have a pyrolytic coating applied to one surface of the glass. Flat glass may then go

to a coater, which may be part of the PGMs’ operation or a separate, independent entity.

Coaters use a high technology sputter process to apply a thin (usually multi-layer) coating

to the surface of the glass. Both pyrolytic and sputter coatings can be applied to either

clear or tinted glass. The coatings may have many properties such as a low emittance

(low-e) and/or low transmittance (high reflectance). After glass is coated, it moves to the

fabricator who assembles it into an insulated glass (IG) unit.

6

The IG units then go to

either a window manufacturer (shop-built windows) or to a glazing contractor (site-built

windows).

1

U.S. Department of Energy. “Glass Industry Analysis Brief.”

www.eia.doe.gov/emeu/mecs/iab/glass/index.HTML

, Aug. 2000.

2

Ibid.

3

Industry Statistics.

Glass Magazine

, Aug. 2000. Data for other glazing markets (residential,

automotive, and specialty) are located in Table 1.

4

Ducker Research Company. “The Distribution of Residential Doors and Windows in the 1999

U.S. Market.” April 2000.

5

Ibid.

6

IG unit is an industry term that is generally used to represent double pane windows.