Did you find this useful? Give us your feedback

37 citations

37 citations

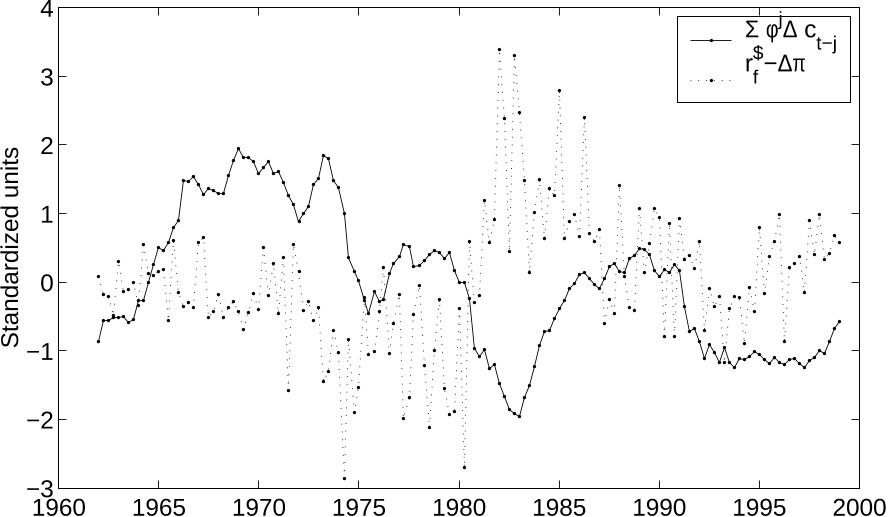

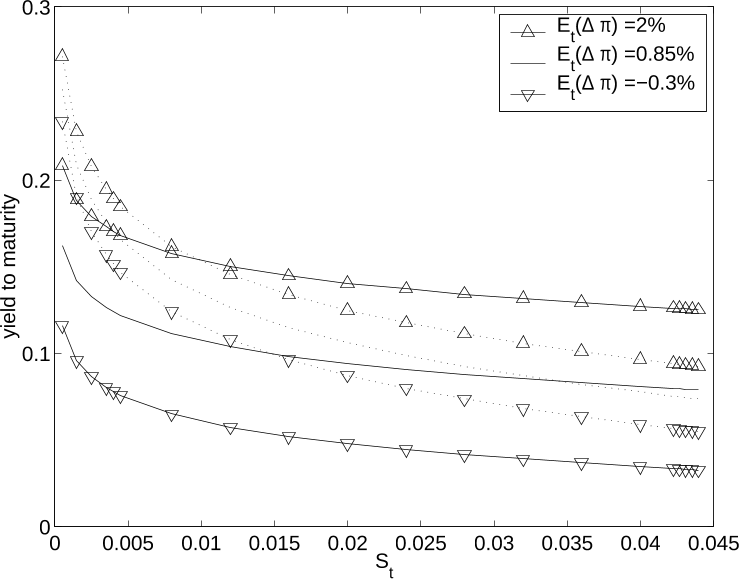

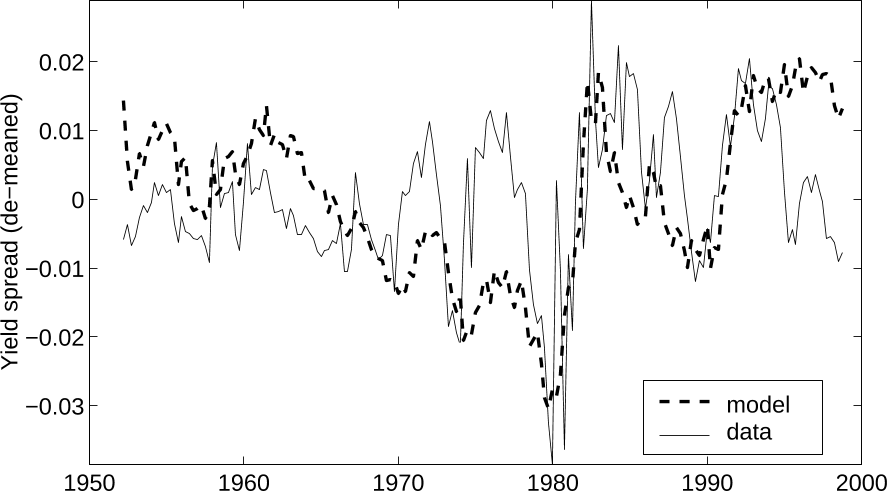

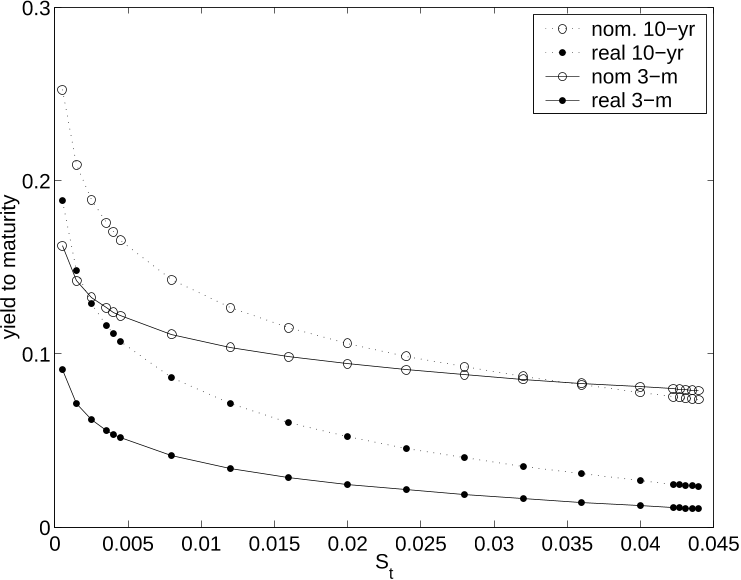

...Following the suggested extension in Wachter (2006), the paper allows for a time-varying real risk-free rate in order to generate cyclical variation in interest rates and a nontrivial term structure....

[...]

37 citations

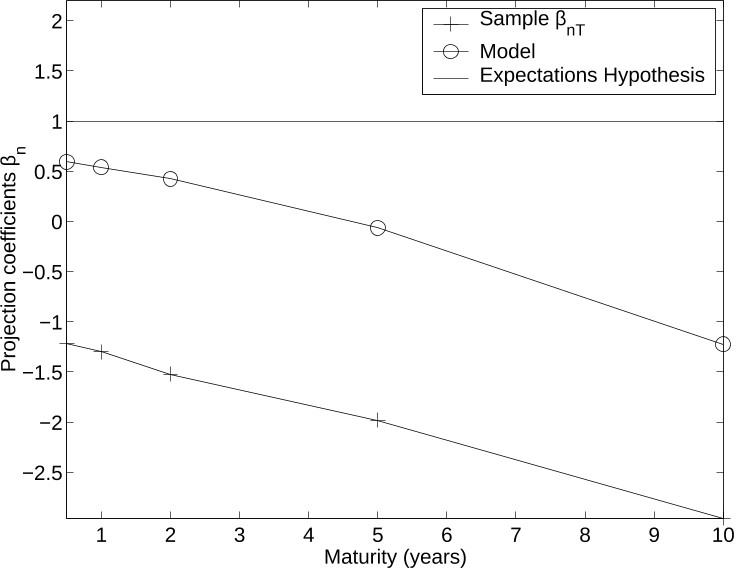

...Generally, these findings are consistent with the implications of the general equilibrium model developed in Wachter (2006)....

[...]

...Wachter (2006) generalizes the habit formation model of Campbell and Cochrane (1999) and shows that bond risk premia covary with consumption surplus, which is driven by shocks to aggregate consumption....

[...]

37 citations

36 citations

10,019 citations

...In addition, results available from the author show that price–dividend ratios have the ability to predict excess returns on equities, just as in the data (Campbell and Shiller, 1988; Fama and French, 1989), and that declines in the price–dividend ratio predict higher volatility (Black, 1976; Schwert, 1989; Nelson, 1991)....

[...]

...…from the author show that price–dividend ratios have the ability to predict excess returns on equities, just as in the data (Campbell and Shiller, 1988; Fama and French, 1989), and that declines in the price–dividend ratio predict higher volatility (Black, 1976; Schwert, 1989; Nelson, 1991)....

[...]

7,014 citations

6,141 citations

...Thus, the model can fit the equity premium puzzle of Mehra and Prescott (1985)....

[...]

4,110 citations

...In addition, results available from the author show that price–dividend ratios have the ability to predict excess returns on equities, just as in the data (Campbell and Shiller, 1988; Fama and French, 1989), and that declines in the price–dividend ratio predict higher volatility (Black, 1976; Schwert, 1989; Nelson, 1991)....

[...]

...…from the author show that price–dividend ratios have the ability to predict excess returns on equities, just as in the data (Campbell and Shiller, 1988; Fama and French, 1989), and that declines in the price–dividend ratio predict higher volatility (Black, 1976; Schwert, 1989; Nelson, 1991)....

[...]

3,886 citations