"2-:)67-8=3*)227=0:%2-%"2-:)67-8=3*)227=0:%2-%

',30%60=311327 ',30%60=311327

-2%2')%4)67 #,%6832%'908=)7)%6',

3279148-32%7)(3()03*8,)!)61 869'896)3*28)6)783279148-32%7)(3()03*8,)!)61 869'896)3*28)6)78

%8)7%8)7

)77-'%#%',8)6

"2-:)67-8=3*)227=0:%2-%

3003;8,-7%2(%((-8-32%0;36/7%8,88476)437-836=94)22)(9*2')$4%4)67

%683*8,)-2%2')311327%2(8,)-2%2')%2(-2%2'-%0%2%+)1)28311327

)'311)2()(-8%8-32)'311)2()(-8%8-32

#%',8)63279148-32%7)(3()03*8,)!)61 869'896)3*28)6)78%8)7

3962%03*

-2%2'-%0'3231-'7

,884(<(3-36+..@2)'3

!,-74%4)6-74378)(%8 ',30%60=311327,88476)437-836=94)22)(9*2')$4%4)67

36136)-2*361%8-3240)%7)'328%'86)437-836=43&3<94)22)(9

3279148-32%7)(3()03*8,)!)61 869'896)3*28)6)78%8)73279148-32%7)(3()03*8,)!)61 869'896)3*28)6)78%8)7

&786%'8&786%'8

!,-74%4)6463437)7%'3279148-32&%7)(13()08,%8%''39287*361%2=*)%896)73*8,)231-2%08)61

7869'896)3*-28)6)786%8)7!,)(6-:-2+*36')&),-2(8,)13()0-7%8-1):%6=-2+46-')3*6-7/+)2)6%8)(&=

)<8)62%0,%&-831-2%0&32(7()4)2(324%78'3279148-32+63;8,8,639+,,%&-8%2(32)<4)'8)(

-2A%8-32#,)2'%0-&6%8)(83(%8%32'3279148-32-2A%8-32%2(8,)%++6)+%8)1%6/)88,)13()0

463(9')76)%0-78-'1)%27%2(:30%8-0-8-)73*&32(=-)0(7%2(%''39287*368,))<4)'8%8-32749>>0)!,)

13()0%073'%4896)78,),-+,)59-8=46)1-91%2()<')77783'/1%6/)8:30%8-0-8=

-7'-40-2)7-7'-40-2)7

-2%2')?-2%2')%2(-2%2'-%0%2%+)1)28

!,-7.3962%0%68-'0)-7%:%-0%&0)%8 ',30%60=311327,88476)437-836=94)22)(9*2')$4%4)67

The Rodney L. White Center for Financial Research

A Consumption-Based Model of the

Term Structure of Interest Rates

Jessica A. Wachter

27-04

A Consumption-Based Model of the Term Structure

of Interest Rates

∗

Jessica A. Wachter

†

University of Pennsylvania and NBER

July 9, 2004

∗

I thank Andrew Ang, Ravi Bansal, Michael Brandt, Geert Bekaert, John Campbell, John Cochrane,

Francisco Gomes, Vassil Konstantinov, Martin Lettau, Anthony Lynch, David Marshall, Lasse Pederson,

Andre Perold, Ken Singleton, Christopher Telmer, Jeremy Stein, Matt Richardson, Stephen Ross, Robert

Whitelaw, Yihong Xia, seminar participants at the 2004 Western Finance Association meeting in Vancouver,

the 2003 Society of Economic Dynamics meeting in Paris, and the 2001 NBER Asset Pricing meeting in

Los Angeles, the the NYU Macro lunch, the New York Federal Reserve, Washington University, and the

Wharton School. I thank Lehman Brothers for financial support.

†

Address: The Wharton School, University of Pennsylvania, 3620 Locust Walk, Philadelphia, PA 19104;

Tel: (215) 898-7634; Email: jwachter@wharton.upenn.edu; http://finance.wharton.upenn.edu/˜ jwachter/

A Consumption-Based Model of the Term Structure

of Interest Rates

Abstract

This paper proposes a consumption-based model that can account for many features of the

nominal term structure of interest rates. The driving force behind the model is a time-varying

price of risk generated by external habit. Nominal bonds depend on past consumption growth

through habit and on expected inflation. When calibrated to data on consumption, inflation, and

the average level of bond yields, the model produces realistic volatility of bond yields and can

explain key aspects of the expectations puzzle documented by Campbell and Shiller (1991) and

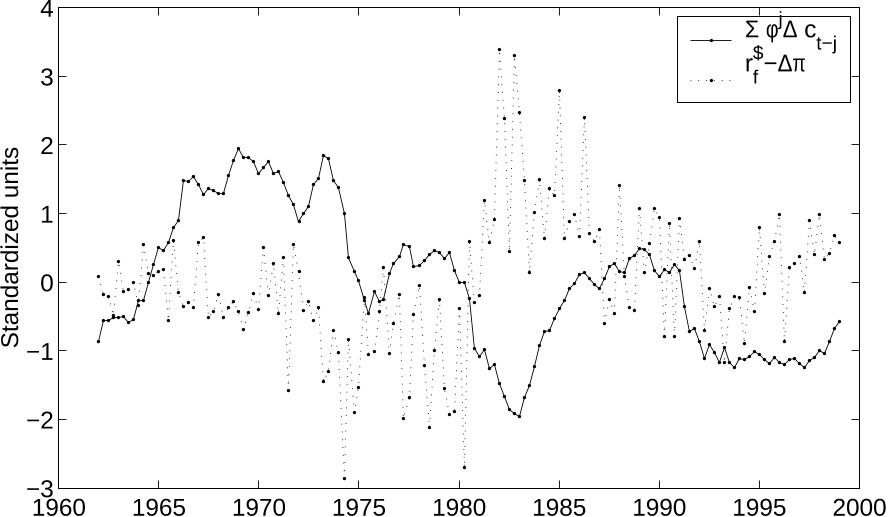

Fama and Bliss (1987). When actual consumption and inflation data are fed into the model, the

model is shown to account for many of the short and long-run fluctuations in the short-term interest

rate and the yield spread. At the same time, the model captures the high equity premium and

excess stock market volatility.