Did you find this useful? Give us your feedback

1,023 citations

...For example, the real and in ation factors we study may be reasonable proxies for the consumption and in ations shocks that enter models of time-varying risk premia like those of Campbell and Cochrane (1999), Brandt and Wang (2003) and Wachter (2006)....

[...]

...For example, Campbell and Cochrane (1999) and Wachter (2006) study models in which risk aversion varies over the business cycle and is low in good times when the economy is growing quickly....

[...]

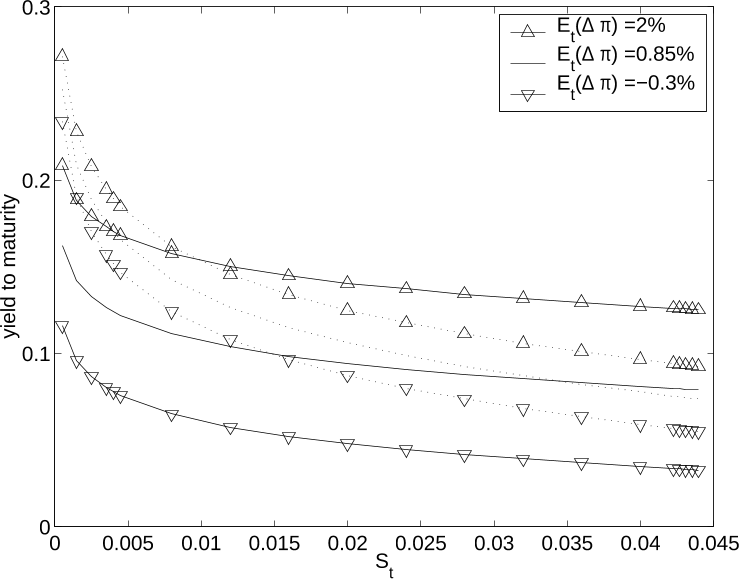

...Wachter (2006) adapts the Campbell-Cochrane habit model to examine the nominal term structure of interest rates, and shows that bond risk premia (as well as equity premia) should vary with the slow-moving consumption habit....

[...]

952 citations

526 citations

...In the models of Bekaert, Engstrom, and Grenadier (2005) and Wachter (2006), increases in risk aversion unambiguously increase equity and bond premiums, but their effect on interest rates is actually ambiguous....

[...]

505 citations

433 citations

1,601 citations

...Dai and Singleton (2002) study three-factor term structure models in the essentially affine class of Duffee (2002) (see also Fisher, 1998)....

[...]

...Dai and Singleton (2002) study three-factor term structure models in the essentially affine class of Duffee (2002) (see also Fisher, 1998)....

[...]

1,595 citations

...0304-405X/$ doi:10.1016/j $I thank John Cochra Lasse Pederso Telmer, Rob Western Fina Paris, the 20 HEC Montr Washington Tel....

[...]

...…from the author show that price–dividend ratios have the ability to predict excess returns on equities, just as in the data (Campbell and Shiller, 1988; Fama and French, 1989), and that declines in the price–dividend ratio predict higher volatility (Black, 1976; Schwert, 1989; Nelson, 1991)....

[...]

1,472 citations

1,408 citations

1,242 citations