A continuous-time model of the term structure of

interest rates with fiscal-monetary policy interactions

Massimiliano Marzo, Silvia Romagnoli and Paolo Zagaglia

∗

July 2008

Abstract

We study the term structure implications of the fiscal theory of price level

determination. We introduce the intertemporal budget constraint of the gov-

ernment in a general equilibrium model in continuous time. Fiscal policy is set

according to a simple rule whereby taxes react proportionally to real debt. We

show how to solve for the prices of real and nominal zero coupon bonds.

Keywords: Bond pricing, fiscal policy, mathematical methods.

JEL Classification: D9, G12.

∗

Marzo: Department of Economics, Universit`a di Bologna; massimiliano.marzo@unibo.it. Ro-

magnoli: Department of Mathematics, Universit`a di Bologna; silvia.romagnoli@unibo.it. Za-

gaglia: Research Unit, Bank of Finland, and Department of Economics, Stockholm University;

Paolo.Zagaglia@bof.fi. We are grateful to S. Alliney for many suggestions received on the first draft

of this paper. The views expressed here are those of the authors and should not be attributed to

the Bank of Finland.

1

1 Introduction

The theory of price level determination advocated by Leeper (1991), Sims (1994),

Woodford (1996) and Cochrane (1998) has brought to the attention of macroe-

conomists the role of interactions between fiscal and monetary policy. In a nutshell,

the idea is that the price level is determined by the degree of solvency of the govern-

ment. If the expected primary surplus is not sufficient to comply with the intertem-

poral budget constraint of the government, then part of the public debt should be

inflated away if it is default-free.

Although the fiscal theory of price level determination has generated a substan-

tial debate on the capability of fiscal and monetary policy to affect the price level,

study has considered its potential implications for asset prices. This considera-

tions holds both for the finance and macroeconomics literature. For instance, the

continuous-time model of the term structure of interest proposed by Buraschi (2005)

includes lump-sum taxes, but disregards the implications of the government’s budget

constraint. Dai and Philippon (2005) estimates a no-arbitrage ane term structure

model with fiscal variables on U.S. data. They find significant responses of the term

structure of interest rates to the deficit-GDP ratio. The macroeconomic restric-

tions they impose to identify the structural responses are fairly different from those

implied by the fiscal theory of the price level (see Sala, 2004).

The available finance models the term structure of interest rates consider an

explicit role for only two crucial factors, output growth and monetary policy, which

is typically expressed as a diffusion process for the growth of money supply. In this

paper, we consider a general-equilibrium model with money where the ow budget

constraint of the government plays an active role. This provides a link between

monetary and fiscal policy because lump-sum taxes are adjusted as a function of

real debt. We solve the structural model, and derive the law of motion for the

nominal and real interest rates. We also study how the term structure responds to

the fiscal parameters.

2

This paper is organized as follows. The first two sections introduce the reader

to the framework employed to develop the analysis, together with a brief discus-

sion on the fiscal and monetary policy rules adopted. Section 4 and 5, respectively,

discuss the optimization process form the representative investor’s side and the char-

acterization of the equilibrium. Section 6 outlines the continuous time limit of the

equilibrium relationships in discrete time presented in the previous sections. In sec-

tion 7, we consider a specialized economy with a more realistic set of assumptions

for the model. In section 8 we present the solution for the real spot rate. This is

extended in section 9 for the pricing of the entire real term structure. The nominal

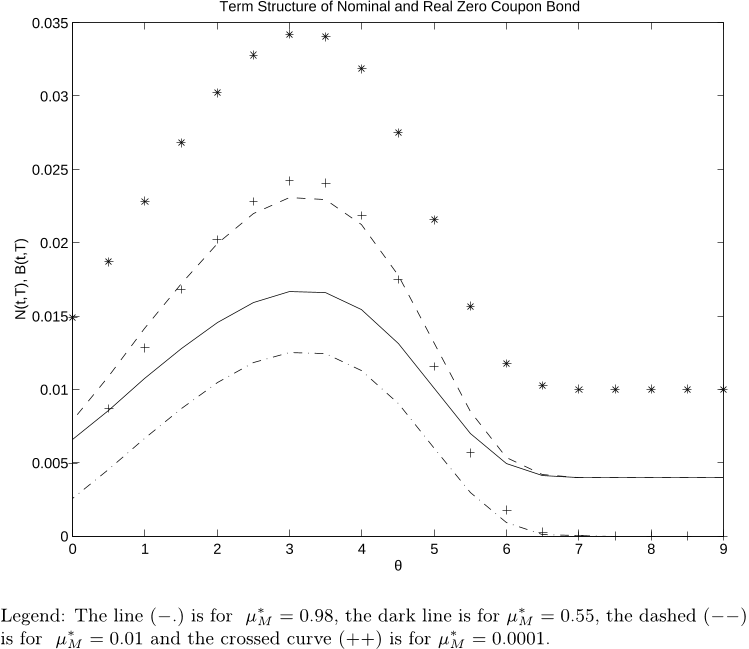

and real term structure for zero coupon bonds is derived in section 9. Since the

solution does not admit a closed form, we use numerical simulations in section 10

to generate some qualitative results on the shape of the term structure. Section 11

reports some concluding remarks.

2 The model economy

We study an economy populated by a representative agent that maximizes over the

composition of her portfolio along the lines of the traditional literature on consump-

tion and asset pricing. We model the economy at discrete time intervals of length ∆t.

The representative agent chooses its portfolio holdings by maximizing the following

utility function

∞

X

t=0

e

−βt

E

0

½

u

µ

C

t

,

M

t

P

t

¶¾

∆t (1)

where β is the discount factor. In equation (1), C

t

indicates the level of consumption

over the interval [t, t + ∆t], M

t

is the nominal money stock providing utility to the

representative agent over the interval of length [t − ∆, t], and P

t

is the price of the

consumption good. Real money balances M

t

/P

t

enter the utility function of the

household. The utility function is twice continuously differentiable and concave in

3

both consumption and real balances

u

c

> 0, u

m

> 0, u

cc

< 0, u

mm

< 0, u

cm

< 0, u

cc

u

mm

− (u

cm

)

2

> 0 (2)

where the subscript to u indicates the partial derivative. In what follows, we make

the following functional assumption on the utility function

u

µ

C

t

,

M

t

P

t

¶

= φ log C

t

+ (1 − φ) log

µ

M

t

P

t

¶

(3)

This type of utility function is used in Stulz (1986). In equation ( 3), the preference

parameter φ must be chosen so that the nominal and real spot rates determined

under the assumption of absence of arbitrage opportunities are also equilibrium

values (see Corollary 1 in the Appendix).

As a working hypothesis to derive the first order conditions, we consider a model

of pure endowment economy where output growth evolves as

∆Y

t

Y

t

=

Y

t+∆t

− Y

t

Y

t

= µ

Y,t

∆t + σ

Y,t

Ω

Y,t

√

∆t. (4)

The terms µ

Y,t

and σ

Y,t

are, respectively, the conditional expected value and the

standard deviation of output per unit of time and {Ω

Y,t

t = 0, ∆t, . . .} is a standard

normal process.

1

3 Fiscal and monetary policy

The main point of this paper is to examine the impact of the interaction between

monetary and fiscal policy on the the term structure of interest rates. We think

of ‘interactions’ in the sense captured by the “fiscal theory of the price level” of

Leeper (1991), Sims (1994), Woodford (1996), and recently extended by Cochrane

(1998, 1999). This approach states that a tight fiscal policy is a strictly necessary

complement to ensure price stability.

1

A more realistic law of motion for output is introduced in section 7.

4

We define the money supply aggregate (in nominal terms) as

M

s

t

= H

t

+ F

t

. (5)

In equation (5) we observe that the total money supply is determined by two com-

ponents. H

t

is the so called ‘high p owered money’ (or monetary base). F

t

represents

the amount of money needed by the government to budget its balance. Basically,

F

t

is an additional financing source for the government apart from taxes and debt

2

.

We assume that H

t

and F

t

follow the processes described by

∆H

t

H

t

=

H

t+∆t

− H

t

H

t

= µ

H,t

∆t (6)

∆F

t

F

t

=

F

t+∆t

− F

t

F

t

= µ

F,t

∆t + σ

F,t

Ω

F,t

√

∆t (7)

where µ

H,t

and µ

F,t

are, respectively, the mean of the stochastic process of the mon-

etary base and of the financing to public debt. In (6), the stochastic process for

H

t

does not have a standard error term, implying that the monetary base possesses

only a deterministic component. The process leading F

t

, instead, has a standard de-

viation term σ

F,t

, where {Ω

F,t

t = 0, ∆t, . . .} are standard normal random variables.

From (5), (6) and (7), we can write the stochastic process for the total money

supply M

s

∆M

s

t

M

s

t

=

M

s

t+∆t

− M

s

t

M

s

t

= µ

M,t

∆t + σ

M,t

Ω

M,t

√

∆t (8)

µ

M,t

= µ

H,t

+ µ

F,t

(9)

σ

M,t

Ω

M,t

= σ

F,t

Ω

F,t

. (10)

At a first glance, these expressions stress that the central bank is assumed to target

money growth.

The subsequent building block of the model assigns a proper macroeconomic

role to the government. The innovation introduced in this paper with respect to the

2

F

t

can be thought of as the demand for money balances expressed by the government.

5