A Monetary Minsky Model of the Great Moderation and

the Great Recession

Abstract

Steve Keen’s model of Minsky’s Financial Instability Hypothesis (Steve Keen, 1995) displayed

qualitative characteristics that matched the real macroeconomic and income-distributional

outcomes of the preceding and subsequent fifteen years: a period of economic volatility followed

by a period of moderation, leading to a rise of instability once more and a serious economic

crisis. This paper extends that model to build a strictly monetary macroeconomic model which

can generate the monetary as well as the real phenomena manifested by both “The Great

Recession” and “The Great Moderation”.

Introduction

The financial and economic crisis that began in 2007 brought to an abrupt end a period of

economic tranquility that many macroeconomists had celebrated as "The Great Moderation"

(Luca Benati and Paolo Surico, 2009, Ben S. Bernanke, 2004, Steven J Davis and James A Kahn,

2008, Jordi Gali and Luca Gambetti, 2009). The trend for recessions to become less frequent and

milder abruptly gave way to a sharp decline in output, a doubling of unemployment, and a

temporary fall into deflation.

Monetary Minsky Model of the Great Moderation and Great Recession

2

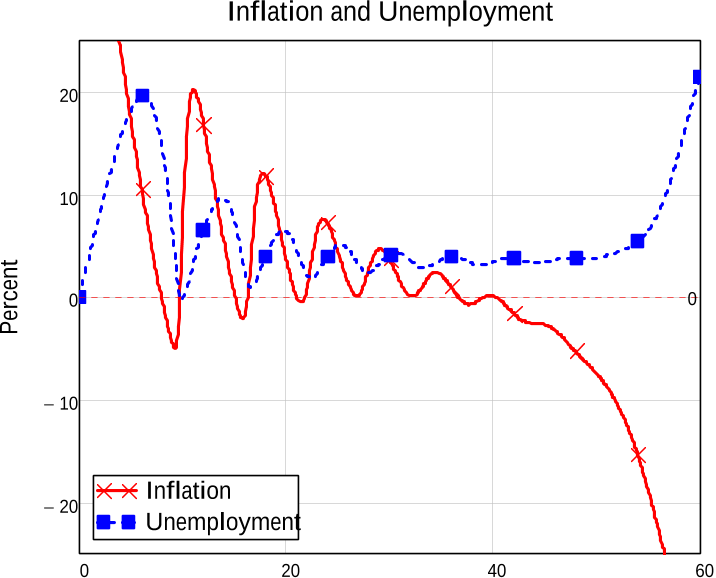

Figure 1:The Great Moderation gives way to the Great Recession

The causes of this economic calamity will be debated for decades, but there should be little

debate with the proposition that it was not predicted by any variant of mainstream economic

analysis available at the time. It was however a prediction of the non-mainstream "Financial

Instability Hypothesis" (FIH) developed by Hyman Minsky.

Steve Keen’s 1995 model of this hypothesis generated qualitative characteristics that matched

the real macroeconomic and income-distributional outcomes of the preceding and subsequent

fifteen years: a period of economic volatility followed by a period of moderation, leading to a

rise of instability once more and a serious economic crisis; and the wage share of income

declining while non-financial business incomes stabilised and financial sector earnings rose

(Steve Keen, 1995; 2000, p. 93). This model is acknowledged as the reason why Keen was one

of the handful of economists to anticipate and warn of the approaching economic and financial

crisis well before it actually occurred (Steve Keen 2007; Dirk J Bezemer, 2009, 2010; Edward

Fullbrook, 2010).

This paper extends that model to build a strictly monetary macroeconomic model of the FIH,

which can generate the monetary as well as the real qualitative characteristics of both “The Great

Recession” and “The Great Moderation” that preceded it. I begin with an overview of Minsky’s

1980 1985 1990 1995 2000 2005 2010 2015

5

2.5

0

2.5

5

7.5

10

12.5

15

Unemployment

Inflation

Unemployment and Inflation

Year

Percent

0

Monetary Minsky Model of the Great Moderation and Great Recession

3

Financial Instability Hypothesis, since many economists are unfamiliar with this non-

neoclassical integrated theory of macroeconomics and finance.

1

The language and concepts in Minsky's theory were also developed completely outside the

mainstream economic debate of the past 30 years,

2

and will therefore appear very foreign to

most macroeconomists today. I hope that readers can look past this unfamiliarity to apply the

spirit of Friedman's methodological dictum, that what matters is not the assumptions of a theory,

but its capacity to give accurate predictions (Milton Friedman, 1953).

The Financial Instability Hypothesis—Genesis

Minsky’s motivation for developing the Financial Instability Hypothesis was that, since the

Great Depression had occurred, a valid economic theory had to be able to generate such an

outcome as one of its possible states:

Can “It”—a Great Depression—happen again? And if “It” can

happen, why didn’t “It” occur in the years since World War II?

These are questions that naturally follow from both the historical

record and the comparative success of the past thirty-five years. To

answer these questions it is necessary to have an economic theory

which makes great depressions one of the possible states in which

our type of capitalist economy can find itself. (Hyman P. Minsky,

1982a, p. 5)

1

In addition to being based on unfamiliar theoretical and philosophical foundations, Minsky’s

work has mainly been published in non-mainstream journals such as the Journal of Post

Keynesian Economics and the Journal of Economic Issues, and minor journals such as the

Nebraska Journal of Economics and Business. Minsky has appeared only twice in the AER:

Hyman Minsky 1957 and 1971.

2

The evolution of Minsky’s hypothesis is discussed in detail in Steve Keen, 1995 and 2001.

Hyman Minsky, 1982b provides his most important papers (the introduction and Chapters 1-5

are sufficient). I also recommend Minsky 1975. His final book Stabilizing an Unstable Economy

Hyman Minsky, 1986, is a far less useful guide to his theories than these earlier works.

Monetary Minsky Model of the Great Moderation and Great Recession

4

For this reason, Minsky explicitly rejected neoclassical economics:

The abstract model of the neoclassical synthesis cannot generate

instability. When the neoclassical synthesis is constructed, capital

assets, financing arrangements that center around banks and money

creation, constraints imposed by liabilities, and the problems

associated with knowledge about uncertain futures are all assumed

away. For economists and policy-makers to do better we have to

abandon the neoclassical synthesis. (Hyman P. Minsky, 1982a, p.

5)

Minsky instead combined insights from Schumpeter, Fisher and Keynes to develop a theory of

financially-driven business cycles which can lead to an eventual debt-deflationary crisis.

The Financial Instability Hypothesis—a Précis

3

Minsky’s analysis of a financial cycle begins at a time when the economy is doing well (the rate

of economic growth equals or exceeds that needed to reduce unemployment), but firms are

conservative in their portfolio management (debt to equity ratios are low and profit to interest

cover is high), and this conservatism is shared by banks, who are only willing to fund cash-flow

shortfalls or low-risk investments. The cause of this high and universally practised risk aversion

is the memory of a not too distant system-wide financial failure, when many investment projects

foundered, many firms could not finance their borrowings, and many banks had to write off bad

debts. Because of this recent experience, both sides of the borrowing relationship prefer

extremely conservative estimates of prospective cash flows: their risk premiums are very high.

However, the combination of a growing economy and conservatively financed investment means

that most projects succeed. Two things gradually become evident to managers and bankers:

“Existing debts are easily validated and units that were heavily in debt prospered: it pays to

lever.” (Hyman P. Minsky, 1982a, p. 6). As a result, both managers and bankers come to regard

the previously accepted risk premium as excessive. Investment projects are evaluated using less

33

This summary of Minsky is reproduced from Steve Keen (1995) with the kind permission of

the Journal of Post Keynesian Economics.

Monetary Minsky Model of the Great Moderation and Great Recession

5

conservative estimates of prospective cash flows, so that with these rising expectations go rising

investment and asset prices. The general decline in risk aversion thus sets off both growth in

investment and exponential growth in the price level of assets, which is the foundation both of

the boom and its eventual collapse.

More external finance is needed to fund the increased level of investment and the speculative

purchase of assets, and these external funds are forthcoming because the banking sector shares

the increased optimism of investors (Hyman P. Minsky, 1982b, p. 65). The accepted debt to

equity ratio rises, liquidity decreases, and the growth of credit accelerates.

This marks the beginning of what Minsky calls “the euphoric economy” (Hyman P. Minsky,

1982b, p. 121), where both lenders and borrowers believe that the future is assured, and therefore

that most investments will succeed. Asset prices are revalued upward as previous valuations are

perceived to be based on mistakenly conservative grounds. Highly liquid, low-yielding financial

instruments are devalued, leading to a rise in the interest rates offered by them as their purveyors

fight to retain market share.

Financial institutions now accept liability structures both for themselves and their customers

“that, in a more sober expectational climate, they would have rejected” (Hyman P. Minsky,

1982b, pp. 120-125). The liquidity of firms is simultaneously reduced by the rise in debt to

equity ratios, making firms more susceptible to increased interest rates. The general decrease in

liquidity and the rise in interest paid on highly liquid instruments triggers a market-based

increase in the interest rate, even without any attempt by monetary authorities to control the

boom. However the increased cost of credit does little to temper the boom, since anticipated

yields from speculative investments normally far exceed prevailing interest rates, leading to a

decline in the elasticity of demand for credit with respect to interest rates.

The condition of euphoria also permits the development of an important actor in Minsky’s

drama, the Ponzi financier (Hyman P. Minsky, 1982b, p. 123; James K. Galbraith, 1955, pp. 4-

5). These capitalists profit by trading assets on a rising market, and incur significant debt in the

process. The servicing costs for Ponzi debtors exceed the cash flows of the businesses they own,

but the capital appreciation they anticipate far exceeds the interest bill. They therefore play an