Chapman University

Chapman University Digital Commons

"-,-+("0 "2*16/1("*$0 ,#$0$ /"' "-,-+("0

An Experimental Study of Competitive Market

Behavior

Vernon L. Smith

Chapman University30+(1'"' .+ ,$#2

-**-41'(0 ,# ##(1(-, *4-/)0 1 ';.#(&(1 *"-++-,0"' .+ ,$#2$"-,-+("0 /1("*$0

/1-%1'$ "-,-+(":$-/6-++-,0

:(0/1("*$(0!/-2&'11-6-2%-/%/$$ ,#-.$, ""$00!61'$"-,-+("0 1' .+ ,,(3$/0(16(&(1 *-++-,01' 0!$$, ""$.1$#%-/(,"*20(-,

(,"-,-+("0 "2*16/1("*$0 ,#$0$ /"'!6 , 21'-/(7$# #+(,(01/ 1-/-%' .+ ,,(3$/0(16(&(1 *-++-,0-/+-/$(,%-/+ 1(-,.*$ 0$

"-,1 "1 * 2&'1(,"' .+ ,$#2

$"-++$,#$#(1 1(-,

+(1'$/,-,8,5.$/(+$,1 *12#6-%-+.$1(1(3$ /)$1$' 3(-/9 Journal of Political Economy

An Experimental Study of Competitive Market Behavior

Comments

:(0 /1("*$4 0-/(&(, **6.2!*(0'$#(, Journal of Political Economy3-*2+$(002$(,

Copyright

,(3$/0(16-%'(" &-

:(0 /1("*$(0 3 (* !*$ 1' .+ ,,(3$/0(16(&(1 *-++-,0 ';.#(&(1 *"-++-,0"' .+ ,$#2$"-,-+("0 /1("*$0

THE JOURNAL

OF

POLITICAL

ECONOMY

Volume LXX

APRIL 1962

Number 2

AN

EXPERIMENTAL

STUDY

OF

COMPETITIVE

MARKET

BEHAVIOR'

VERNON

L.

SMITH

Purdue University

I. INTRODUCTION

RECENT years

have

witnessed

a grow-

ing

interest

in

experimental

games

such as management

de-

cision-making

games and

games

designed

to simulate

oligopolistic

market

phenom-

ena.

This article

reports

on a

series of

experimental

games designed

to study

some of the

hypotheses

of

neoclassical

competitive

market

theory.

Since

the

organized

stock,

bond,

and commodity

exchanges

would

seem

to

have

the best

chance

of

fulfilling

the conditions

of

an

operational

theory

of

supply

and de-

mand,

most

of these

experiments

have

I

The experiments

on

which

this

report

is based

have been

performed

over

a six-year

period

begin-

ning in 1955.

They are

part

of a continuing

study,

in which the

next

phase is

to include

experimentation

with monetary

payoffs

and

more complicated

ex-

perimental

designs

to which passing

references

are

made

here

and there

in

the present

report.

I

wish

to thank

Mrs. Marilyn

Schweizer

for

assistance

in

typing

and

in

the

preparation

of charts

in this

paper,

R. K. Davidson

for performing

one of

the

experi-

ments

for

me,

and

G. Horwich,

J.

Hughes,

H.

Johnson,

and J.

Wolfe

for reading an earlier

version

of the paper

and enriching

me

with their comments

and encouragement.

This

work was supported

by

the

Institute

for

Quantitative

Research

at

Purdue,

the

Purdue

Research

Foundation,

and in part

by

National Science

Foundation,

Grant No.

16114,

at

Stanford University.

been designed

to simulate,

on

a

modest

scale,

the multilateral

auction-trading

process

characteristic

of these

organized

markets.

I

would

emphasize,

however,

that

they

are

intended

as

simulations

of certain

key

features

of the organized

markets

and

of competitive

markets

gen-

erally,

rather

than

as

direct,

exhaustive

simulations

of any particular

organized

exchange.

The experimental

conditions

of

supply

and demand

in force

in

these

markets

are modeled

closely

upon

the

supply

and demand

curves

generated

by

the

limit

price

orders

in the hands

of

stock

and

commodity

market brokers

at the

opening

of a

trading

day

in

any

one

stock

or

commodity,

though

I

would

consider

them to be

good

general

models

of received short-run

supply

and demand

theory.

A

similar

experimental

supply

and

demand

model

was

first used

by

E.

H.

Chamberlin

in

an interesting

set

of

experiments

that

pre-date

contem-

porary

interest

in

experimental

games.2

2

"An

Experimental

Imperfect

Market,"

Journal

of

Political

Economy,

LVI

(April,

1948),

95-108.

For an

experimental

study

of bilateral

monopoly,

see

S.

Siegel

and L. Fouraker,

Bargaining

and

GJoitp

Decision

SMaking

(New

York: McGraw-Hill

Book

Co.,

1960).

ll

This content downloaded from 206.211.139.204 on Thu, 2 Oct 2014 19:45:24 PM

All use subject to JSTOR Terms and Conditions

112

VEl"RN(N L. SMI'Tll

Chamberlin's paper

was highly sugges-

tive

in

demonstrating the

potentialities

of

experimental

techniques in the

study

of

applied

market

theory.

Parts

II

and III of

this paper

are

devoted

to a descriptive

discussion of

the

experiments and some

of their

detailed

results.

Parts IV and

V present an em-

pirical

analysis of

various

equilibrating

hypotheses and a

rationalization of

the

hypothesis found to be

most successful

in these

experiments.

Part

VI provides a

brief

summary

which the

reader

may

wish

to consult

before

reading

the

main

body of the paper.

II.

EXPERIMENTAL

PROCEDURE

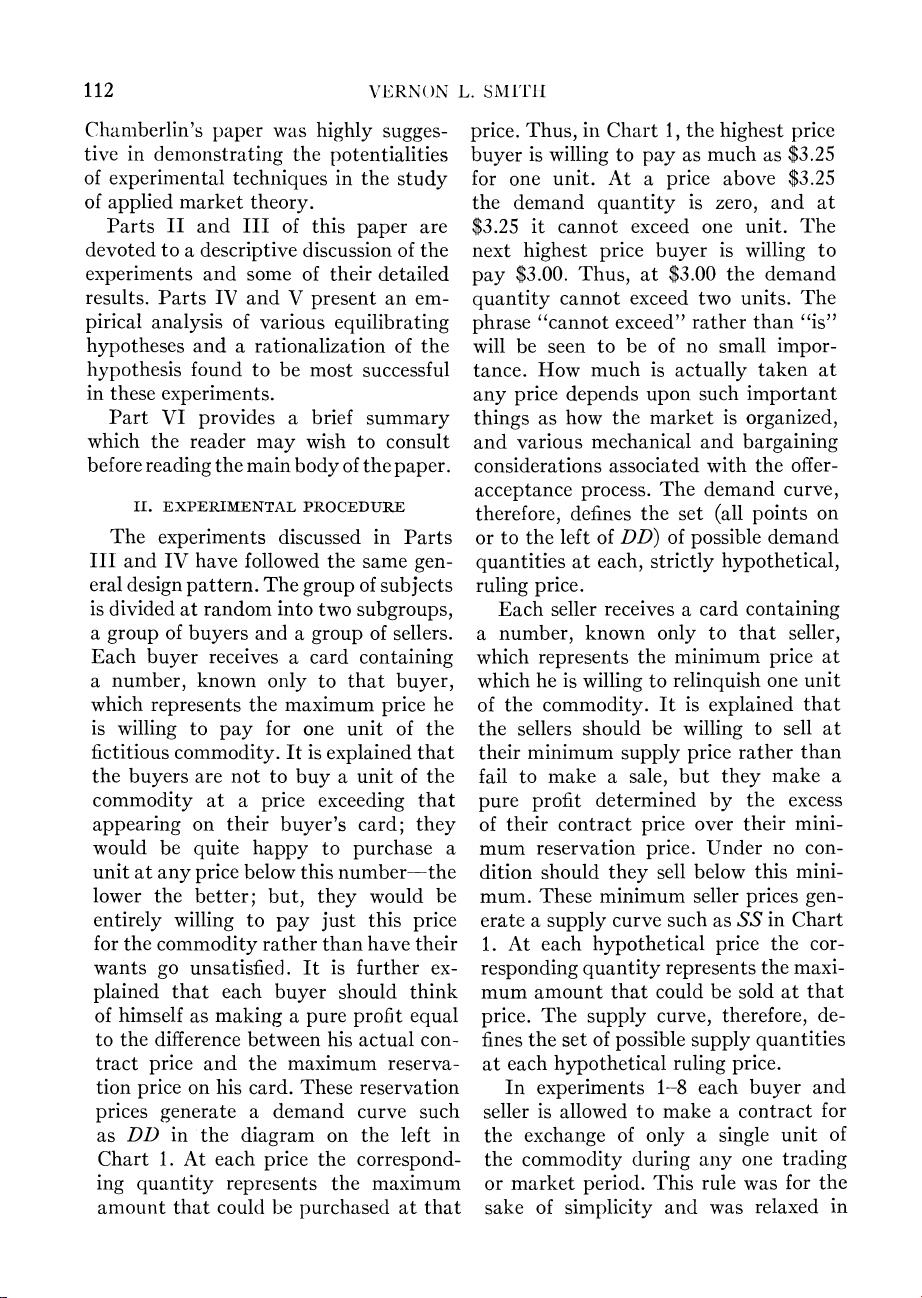

The

experiments

discussed in

Parts

III

and

IV have

followed the same gen-

eral

design pattern. The

group

of

subjects

is divided

at random

into two

subgroups,

a

group

of

buyers

and

a

group

of

sellers.

Each

buyer receives a

card

containing

a

number,

known

only

to

that

buyer,

which

represents

the maximum

price

he

is

willing to pay for

one unit of

the

fictitious

commodity.

It

is

explained

that

the

buyers

are not to

buy

a unit of the

commodity at a price

exceeding

that

appearing

on

their

buyer's card;

they

would be

quite

happy

to

purchase

a

unit at

any price

below

this

number-the

lower

the

better;

but, they would

be

entirely willing

to

pay just this price

for

the

commodity

rather

than have

their

wants

go

unsatisfied.

It is further ex-

plained that each

buyer should

think

of himself

as

making

a

pure profit equal

to the difference

between

his actual

con-

tract

price

and the maximum reserva-

tion

price

on

his card. These

reservation

prices

generate

a

demand curve such

as

DD

in

the

diagram

on

the

left

in

Chart

1.

At each

price

the

correspond-

ing

quantity represents the maximum

amount that could

be

purchased

at

that

price.

Thus,

in Chart

1,

the

highest

price

buyer

is willing

to

pay

as

much

as $3.25

for one

unit. At

a

price

above

$3.25

the demand

quantity

is

zero,

and

at

$3.25

it cannot

exceed

one

unit.

The

next

highest

price

buyer

is

willing

to

pay

$3.00.

Thus,

at $3.00

the demand

quantity

cannot

exceed

two

units.

The

phrase

"cannot

exceed"

rather

than

"is"

will be

seen

to be of no

small

impor-

tance.

How

much is

actually

taken

at

any price

depends

upon

such

important

things

as

how

the

market

is organized,

and

various

mechanical and

bargaining

considerations

associated

with

the

offer-

acceptance

process.

The demand curve,

therefore,

defines

the

set

(all

points

on

or

to the left of DD)

of

possible

demand

quantities

at

each, strictly

hypothetical,

ruling

price.

Each

seller

receives

a card

containing

a

number,

known only

to that seller,

which

represents

the minimum

price

at

which

he

is

willing

to

relinquish

one unit

of the

commodity.

It

is

explained

that

the

sellers

should

be willing

to sell

at

their

minimum

supply

price

rather

than

fail

to make a

sale,

but

they

make

a

pure

profit

determined

by

the

excess

of

their

contract

price

over their

mini-

mum

reservation

price.

Under

no con-

dition

should

they sell

below

this

mini-

mum.

These

minimum seller

prices

gen-

erate

a

supply

curve such as SS

in

Chart

1.

At

each

hypothetical

price

the

cor-

responding

quantity

represents

the

maxi-

mum amount

that

could be sold

at

that

price.

The

supply

curve,

therefore,

de-

fines

the set

of

possible

supply

quantities

at each

hypothetical

ruling price.

In

experiments

1-8

each

buyer

and

seller

is allowed

to

make

a

contract

for

the

exchange

of

only

a

single

unit

of

the

commodity

during

any

one

trading

or market

period.

This

rule was

for the

sake

of

simplicity

and was

relaxed

in

This content downloaded from 206.211.139.204 on Thu, 2 Oct 2014 19:45:24 PM

All use subject to JSTOR Terms and Conditions

EXPERIMENTAL

STUDY OF

COMPETITIVE MARKET

BEHAVIOR 113

subsequent

experiments.

Each

experiment was

conducted over

a

sequence

of

trading periods five to

ten minutes

long

depending upon the

number

of

participants

in

the test

group.

Since

the

experiments

were

conducted

within a class

period,

the

number of

trading periods

was not uniform

among

CHART

1

TEST

1

$4.00

P

X_.

$4.00

ta80

- 3.20

32t

to'

2.60

2A0

,20

2.40

2.20.

tao.2

too

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~-1.60

too

-

1.60

140UANT I TY

TRANSACTION

NU

R

I

PERIOD

)1.40

1.20

1

.20

too10.0

oc1LS. ca=sa Oca52 0C=5.5

a1=ss

1

.60

D

.60

.40 1

- .40

.20-

PERIOD

1

PERIOD

2

PERIOD

S

P ERIOD

4

PERIOD

5

.20

ol

1

2

3 4

5

6 7 8

9 10

11

12

012 3

4

51

23

4

512 3

4

5123

4

5

671

23 4 56

QUANTITY

TRANSACTION

NUMBER

1SY

PERIOD)

the various

experiments.

In

the

typical

experiment, the

market

opens

for

trad-

ing

period 1. This

means that

any

buyer

(or

seller)

is

free

at

any

time to

raise

his

hand

and

make a

verbal

offer to

buy (or

sell)

at

any

price

which

does

not

violate his

maximum

(or

minimum)

reservation

price.

Thus,

in

Chart

1,

the

buyer

holding the

$2.50

card

might raise

his

hand

and

shout,

"Buy

at

$1.00."

The

seller

with

the

$1.50

card

might

then

shout,

"Sell

at

$3.60."

Any

seller

(or

buyer)

is

free to

accept

a

bid (or

offer),

in

which

case a

binding

contract

has been

closed, and the

buyer and

seller

making the

deal drop

out of the market

in the sense

of no longer

being

permitted

to make

bids, offers, or

contracts

for

the

remainder of

that

market period.3

As

soon

as a

bid or offer

is

accepted,

the

contract price

is

recorded together

with

the

minimum

supply price

of the

seller

and

the

maximum

demand

price

of

the

buyer

involved in the

transaction. These

observations

represent the

recorded data

of

the

experiment.4

Within the

time

limit

3

All

purchases are

for

final

consumption.

There

are

no

speculative

purchases

for

resale in

the

same

or

later

periods.

There

is

nothing,

however, to

pre-

vent

one from

designing an

experiment in

which

purchases for

resale

are

permitted if

the

objective

is to

study

the

role of

speculation in

the

equilibrating

process.

One

could, for

example, permit

the

carry-

over

of

stocks

from one

period

to

the next.

4

Owing to

limitations

of

manpower and

equip-

ment

in

experiments

1-8,

bids

and

offers

which

did

not

lead to

transactions

could

not be

recorded.

In

subsequent

experiments a

tape

recorder

was

used

for

this

purpose.

This content downloaded from 206.211.139.204 on Thu, 2 Oct 2014 19:45:24 PM

All use subject to JSTOR Terms and Conditions