OECD DEVELOPMENT CENTRE

Working Paper No. 113

(Formerly Technical Paper No. 113)

CHINESE OUTWARD INVESTMENT

IN HONG KONG: TRENDS, PROSPECTS

AND POLICY IMPLICATIONS

by

Yun-Wing Sung

Research programme on:

Reform and Growth of Large Developing Countries

July 1996

OCDE/GD(96)53

5

TABLE OF CONTENTS

RÉSUMÉ ................................................................................................................ 7

SUMMARY ............................................................................................................ 7

PREFACE ............................................................................................................... 9

I. INTRODUCTION.................................................................................................. 11

II. CHINESE INVESTMENT IN HONG KONG: AN APPRAISAL................................. 13

III. THE DETERMINANTS OF CHINESE INVESTMENT IN HONG KONG .................. 25

IV. PROBLEMS AND PROSPECTS.......................................................................... 33

NOTES ................................................................................................................... 35

APPENDIX TABLES ................................................................................................ 37

BIBLIOGRAPHY ..................................................................................................... 45

6

7

RÉSUMÉ

Depuis une dizaine d’années, la Chine est le premier investisseur parmi les pays

en développement, et Hong Kong la première destination des investissements chinois.

Toutefois, en raison de la sous-déclaration liée à la fraude du contrôle des changes,

les statistiques officielles sous-estiment largement les flux d’investissement extérieur

de la Chine. Ce document technique tente d’évaluer le montant de ces flux

d’investissement et d’en décrire la nature.

Il recense les nombreuses estimations des investissements chinois vers Hong

Kong, en identifiant leurs sources, ainsi que les informations sur lesquelles elles sont

fondées. Il apparaît que la plupart de ces estimations sont des approximations

grossières, établies sur la base de données très incomplètes. Néanmoins, il est possible

d’évaluer le niveau de ces investissements d’après la valeur des actifs des entreprises

chinoises à Hong Kong et leur capitalisation boursière, ainsi que sur la base d’entretiens

avec des interlocuteurs informés. De plus, ce document évalue le poids des entreprises

chinoises dans l’économie de Hong Kong. Il analyse la répartition de leurs

investissements par secteur et selon la nature des investisseurs (ministères centraux,

gouvernements locaux ou provinciaux, organismes militaires). Enfin, il analyse les

déterminants économiques et politiques des flux d’investissement de la Chine vers

Hong Kong, et présente des conclusions de politique économique pour les deux

économies.

SUMMARY

Over the last decade, China has been the leading investor among developing

countries and Hong Kong is the foremost destination of Chinese investment. However,

China’s outward investment has been grossly understated in official statistics due to

avoidance of China’s foreign exchange controls. This paper tries to appraise those

investment flows both quantitatively and qualitatively.

It examines the many estimates of Chinese investment in Hong Kong, tracing

their sources and bases of estimation. Most of these estimates are found to be crude

guesses with very little empirical support. However, from the data on asset value and

market capitalisation of listed Chinese companies in Hong Kong, and also from

interviews with knowledgeable sources, it is possible to gauge the rough size of Chinese

investment in Hong Kong. The paper also examines China’s economic presence in

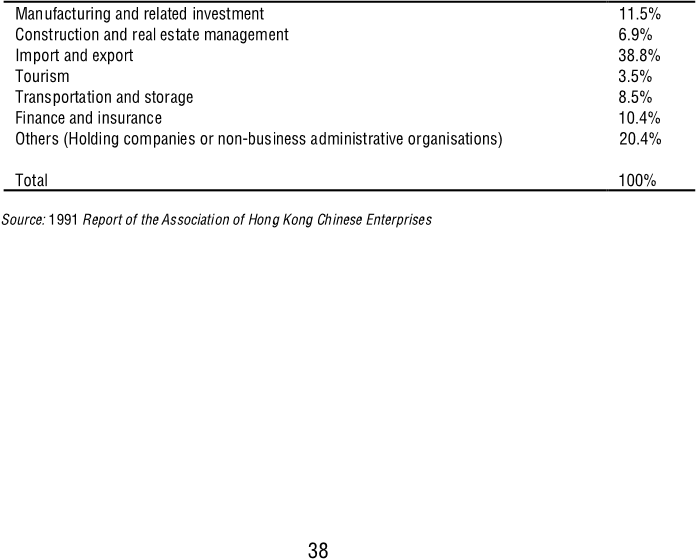

major sectors of the Hong Kong economy. It discusses the composition of Chinese

investment by industry and by ownership (central ministries, provincial and local

governments, and military-backed). The economic and political determinants of China’s

investment in Hong Kong are analysed, and the policy implications for Hong Kong

and China are examined.

8