Credit Constraints, Heterogeneous Firms and International Trade

Figures (12)

Table 10. Economic Significance: Predicted vs. Actual Trade Growth

Table 9. Economic Significance: Comparative Statics

Table 5. Financial Development and Firm-Level Exports

Figure 3. The Productivity Cut-off for Exporting

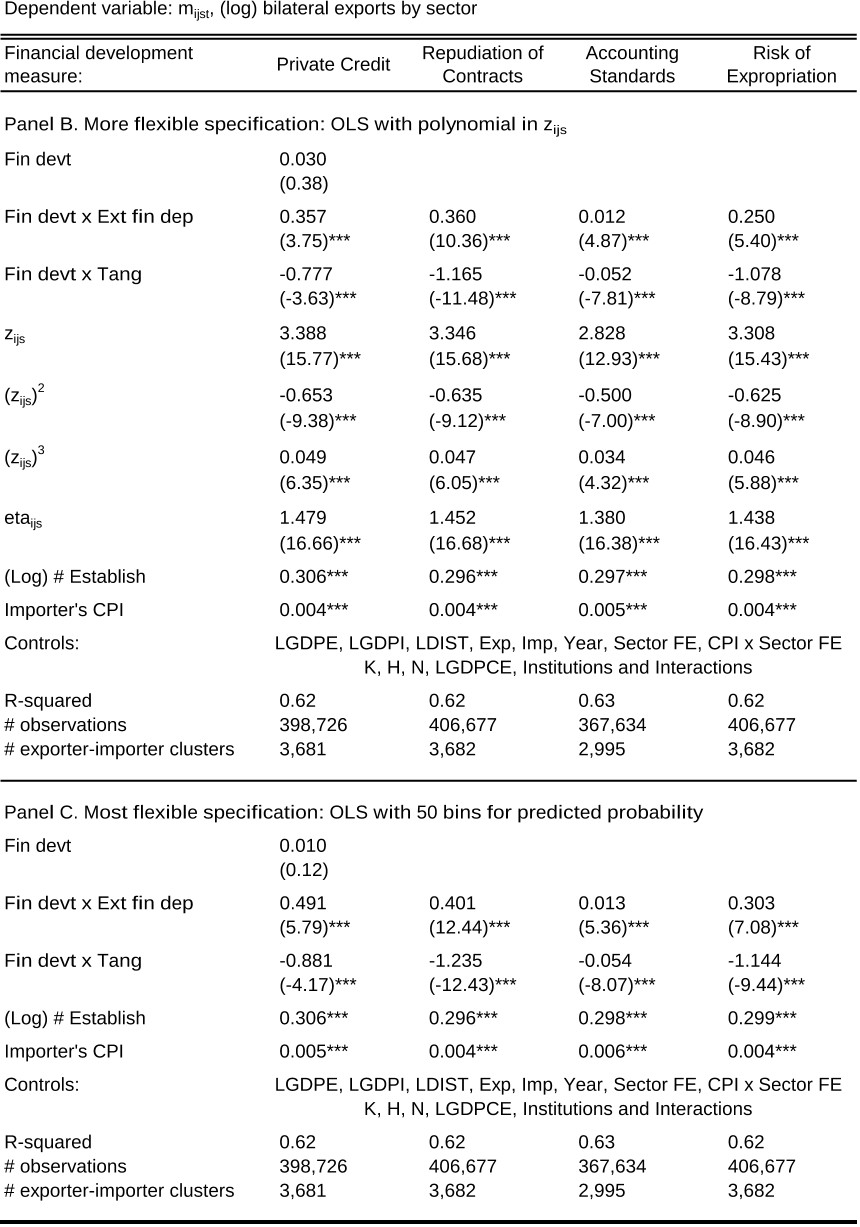

Table 5. Financial Development and Firm-Level Exports

Table 1. Export Patterns in the Data

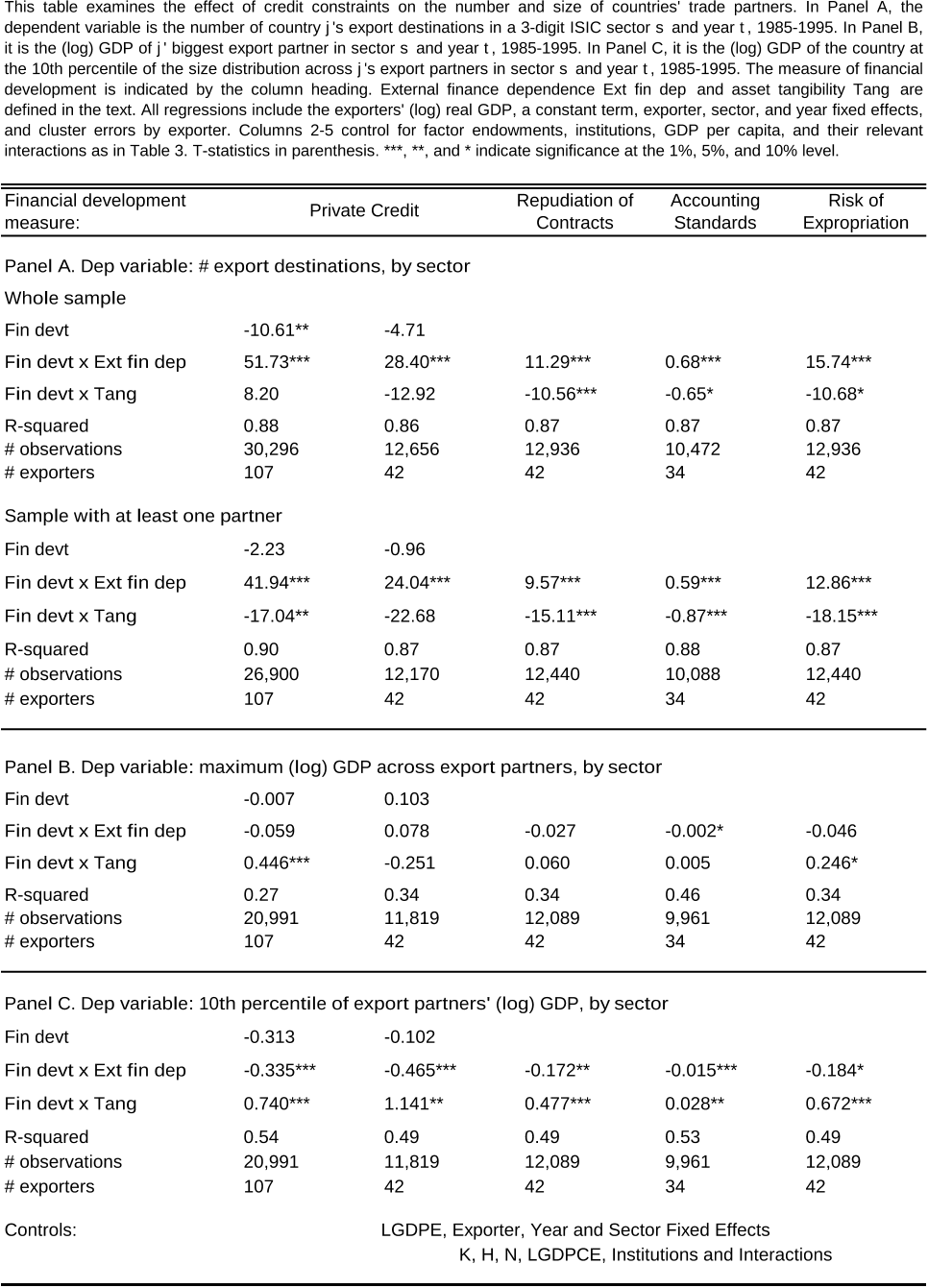

Table 8. Financial Development and Trade Partners

Table 2. Financial Development and Export Volumes

Table 6. Financial Development and Export Product Variety

Table 3. Financial Development and Export Volumes: Robustness

Table 7. Financial Development and Export Product Churning

Table 4. Financial Development and Firm Selection into Exporting

Citations

2,282 citations

884 citations

608 citations

591 citations

511 citations

Cites background or methods from "Credit Constraints, Heterogeneous F..."

...…frictions (Amiti & Davis 2011, Egger & Kreickemeier 2009, Helpman and Itskhoki 2010, and Helpman et al. 2011), and nancial constraints (Chaney 2005, Manova 2011), among other issues.1 We begin by reviewing the empirical challenges to traditional theories of international trade that emerged from…...

[...]

...For instance, Manova and Zhang (2011) use Chinese trade transaction data to highlight a number of systematic features of exports and imports by rm, product and destination that are consistent with heterogeneity in product quality....

[...]

...Manova (2011) develops a heterogeneous- rm model, in which countries vary in nancial development and sectors di er in nancial vulnerability, and provides empirical evidence on the model's predictions....

[...]

...For instance, Manova and Zhang (2011) use Chinese trade transaction data to highlight a number of systematic features of exports and imports by rm, product and destination that are consistent with heterogeneity in product quality.(14) For example, across rms selling a given product, rms that charge higher export prices earn greater revenues in each destination, have bigger worldwide sales, and export to more markets. Across destinations within a rm-product, rms set higher prices in richer, larger, bilaterally more distant and overall less remote countries. Finally, rms that export pay a wider range of input prices and source inputs from more countries. Taken together these features of the data are consistent with a heterogeneous rm model where more successful exporters use higher-quality inputs to produce higher-quality goods and rms vary the quality of their products across destinations. Using Colombian census of manufactures data, Kugler & Verhoogen (2011) provide evidence of di erences in product quality and highlight the relationship between rm export and import decisions....

[...]

...Manova (2011) develops a heterogeneous- rm model, in which countries vary in nancial development and sectors di er in nancial vulnerability, and provides empirical evidence on the...

[...]

References

[...]

14,563 citations

"Credit Constraints, Heterogeneous F..." refers background or methods in this paper

...Corruption and rule of law: from La Porta et al. (1998)....

[...]

...For robustness I also use indices for the repudiation of contracts, accounting standards, and the risk of expropriation from La Porta et al. (1998)....

[...]

[...]

13,984 citations

9,036 citations

8,204 citations

6,815 citations

"Credit Constraints, Heterogeneous F..." refers background or methods in this paper

...Rajan and Zingales (1998) and Braun (2003) argue that the measures they construct capture a large technological component that is innate to the manufacturing process in a sector and are thus good proxies for ranking industries in all countries....

[...]

...They do not ask, however, whether this re ects the fact that nancially developed countries produce more and grow faster in such industries (Rajan and Zingales 1998; Braun 2003; Fisman and Love 2007)....

[...]

...The relative importance of up-front costs varies across sectors for technological reasons speci c to the nature of each industry, as argued by Rajan and Zingales (1998)....

[...]

...Private credit has been used extensively in the nance and growth literature (Rajan and Zingales 1998; Braun 2003; Aghion et al. 2010), as well as in most papers on nance and trade....

[...]

...5For example, Rajan and Zingales (1998), Fisman and Love (2007), and Braun (2003) show that sectors intensive in outside nance and sectors with few collateralizable assets grow faster in nancially developed countries....

[...]