Did you find this useful? Give us your feedback

6 citations

6 citations

4 citations

...We are also aware of a stream of work [6, 17 ,8,9] that constructs a weighted graph on time series in order to discover different interesting patterns....

[...]

3 citations

...Among these, Yamashita et al. (2005) applied a multi- branch artificial neural network (MBNN) to financial market applications. After investigating the predictive accuracy of the TOPIX index of the Tokyo Stock market using MBNN, the results evidenced that these multi-branch neural networks based on artificial intelligence might be more capable of generating greater generalization and representation, compared to simple conventional neural networks. Using the index value of TOPIX, multi-branch neural networks are better at predicting the next day TPOIX values. After various simulations were conducted to compare the multi-branch neural networks with other conventional neural networks, it was concluded that investors and economists can achieve a higher accuracy of forecasting with the proposed MBNN model. Moreover, Afolabi and Olatoyosiuse (2007) used the “Kohonen Self Organising Map (SOM) and hybrid Kohonen SOM” prediction of stock prices....

[...]

...Among these, Yamashita et al. (2005) applied a multi- branch artificial neural network (MBNN) to financial market applications....

[...]

...However, the prevalence of complexity in stock market prices made intelligent prediction paradigms highly significant, as well as forecasting stock prices using the conventional prediction models of CAPM and Fama and French (Huang et al., 2004; Wichard et al., 2004)....

[...]

...7 Adaptive Neural Fuzzy Inference Systems Zadeh (1965) introduced fuzzy logic to show and manipulate data and information involving several types of uncertainty....

[...]

1 citations

11,507 citations

...The model f(·) is a linear function that is fitted using the standard least squares approach (see for example Hastie et al. (2001)) for multiple linear regression models, i.e. it should minimize the residual sum of squares ∑ t(Ri(t) − f(~Ri,j(t)))2....

[...]

1,808 citations

...Mantegna (see Mantegna (1999)) discovered a hierarchical Preprint submitted to Elsevier Science 25 April 2004 organization inside a portfolio of stocks by introducing a metric related to the correlation coefficients....

[...]

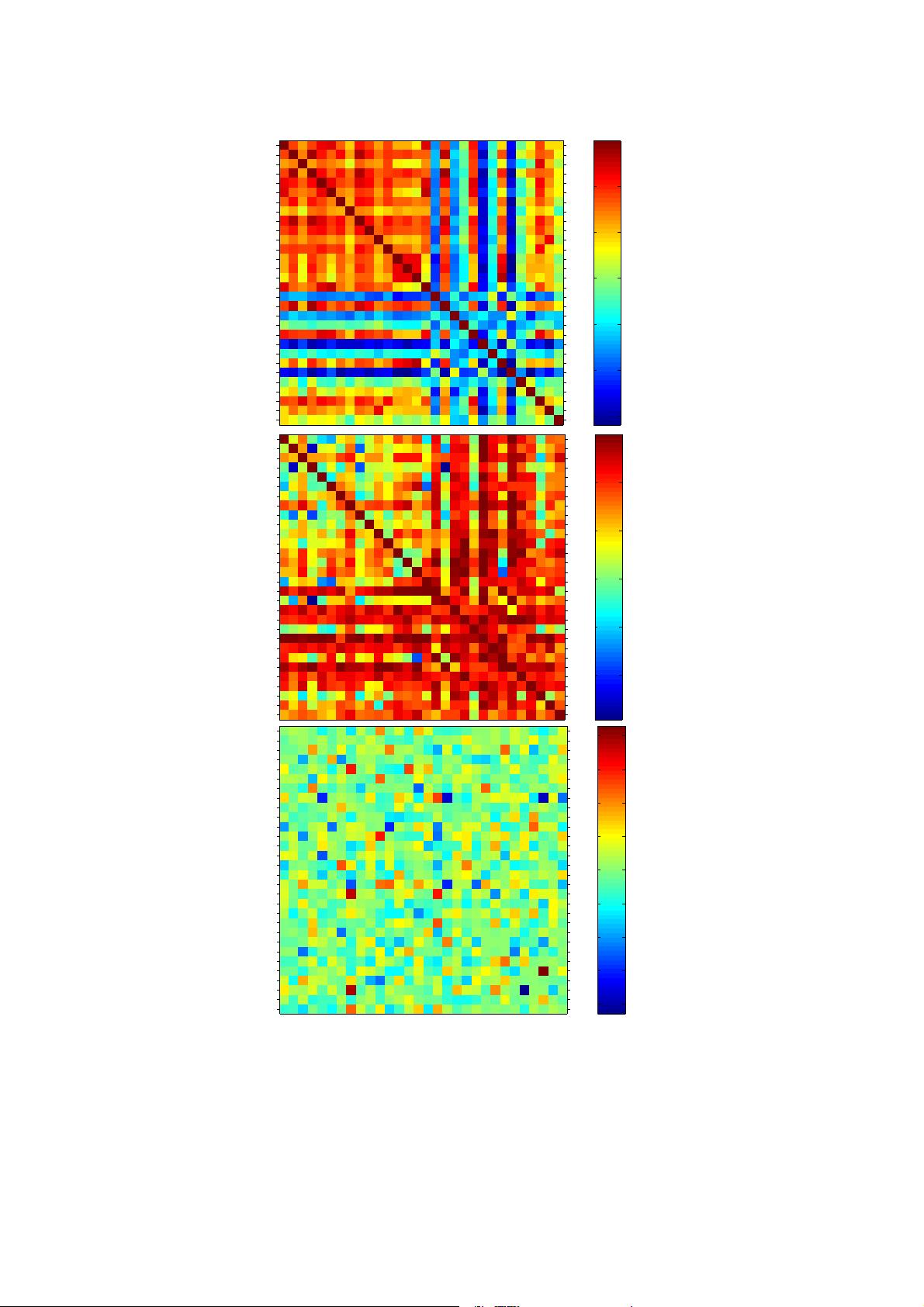

...The cross-correlation matrix shows some interesting structures, for example are there obvious clusters, there were described by Mantegna (1999)....

[...]

...Tp...

[...]

50 citations

...The scheme we introduce for market analysis is related to the “mixed state analysis” of multivariate time series which was developed to detect weak coupling between dynamical systems in the framework of chaotic synchronization (see Wiesenfeldt et al. (2001))....

[...]

...We build the time series of daily returns Ri(t) = Yi(t + 1)− Yi(t) Yi(t) , wherein Yi(t) denotes the closing-price of the i-th stock at day t....

[...]

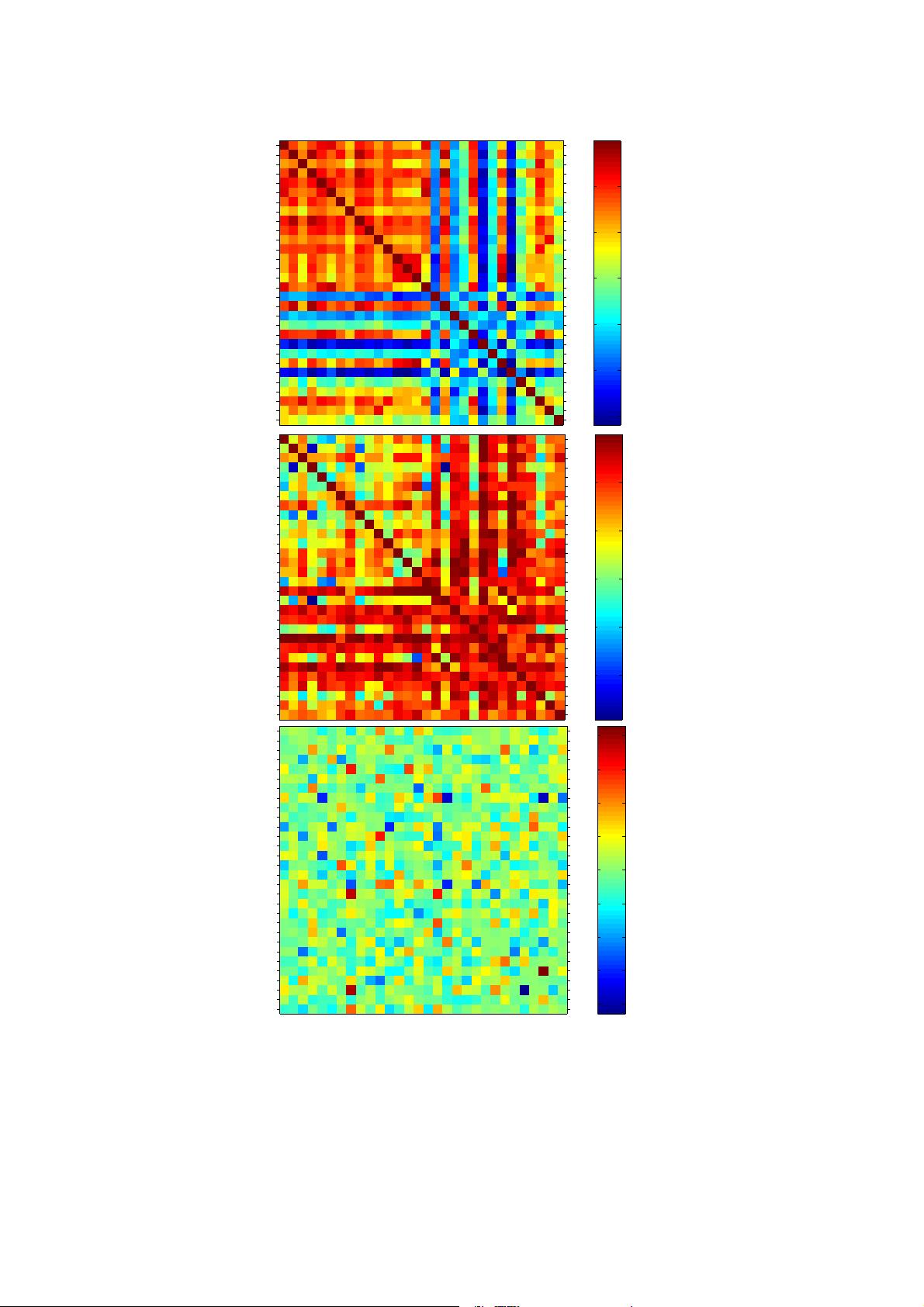

The scheme the authors introduce for market analysis is related to the “mixed state analysis” of multivariate time series which was developed to detect weak coupling between dynamical systems in the framework of chaotic synchronization (see Wiesenfeldt et al. (2001)).

The modeling error is normalized with the variance of the time series Ri(t) for a simple reason: A value of cp(i, j) ≥ 1.0 indicates that the mean value 〈Ri〉 is a more appropriate model than f(·), which means that there is no linear dependence in the the time series under investigation.

The model f(·) is a linear function that is fitted using the standard least squares approach (see for example Hastie et al. (2001)) for multiple linear regression models, i.e. it should minimize the residual sum of squares ∑t(Ri(t) − f(~Ri,j(t)))2.

The analysis of the the cross-correlation matrix of the returns plays an important role in portfolio theory and financial analysis.

By definition the correlation matrix is symmetric with respect to i and j and thus cannot be used to distinguish a symmetrical interaction between different stocks from an asymmetric one.

For the mixed state analysis the authors use a time lag of τ = 3 and the authors calculate the matrix of the modeling error 1 as defined in equation 2 and further the matrix of differences δ(i, j) from equation 3.

This approach is based on the reconstruction of mixed states consisting of delayed samples taken from simultaneously measured time series of both systems under investigation.