Did you find this useful? Give us your feedback

317 citations

...[109] examines the sensitivity of N3-X economics to maintenance cost and concludes that uncertainty in maintenance cost is an acceptable risk....

[...]

103 citations

...The most technologically overwhelmed notional design from NASA in the subsonic segment, the N3-X design, was assessed for many N+3-time framed environmental performance targets such as for noise and NOx emission [52], fuel burn [22,23], and for economic viability [108]....

[...]

12 citations

7 citations

6 citations

64 citations

...However, the relatively larger error of the estimate from the models by Younossi et al suggests it should be excluded from the cost estimating process....

[...]

...The Rand model by Resetar et al and Younossi et al produces a significantly lower cost estimate than Roskam’s model (Table 5)....

[...]

...Two publicly models were selected as models with this form of support: • Rand Corporation (Resetar et al, 1991 [19] with updates from Younossi et al, 2001 [20]) • Roskam, 1990 [21] Both models build up the cost of an aircraft from several subgroups, comprising of the requirements for the development program, the recurring aircraft manufacture cost, and the cost of other assorted components (e.g. aircraft interiors and engines)....

[...]

...The model by Rester et al and the updates provided by Younossi et al incorporate material factors that may be used to correct for the use of novel materials in an aircraft....

[...]

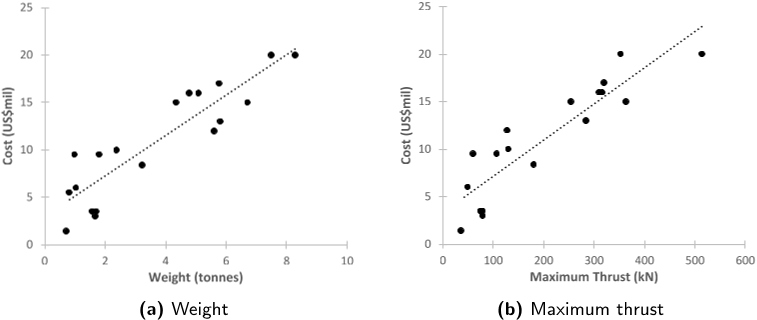

...As with the airframe costs, a number of models and relationships were selected for estimating the engine cost: • Weight and thrust liner regression fits • Younossi et al [25] • Birkler et al [26] For relationships requiring thrust as a variable, the equivalent engine was used, producing a maximum of approximately 52 kN of thrust at sea level static conditions....

[...]

34 citations

...However, PCM type relationships are better suited to an aircraft at the preliminary design stage, as the details necessary for a MPCM cost estimate are unlikely to be available....

[...]

...They can typically be split into two categories; Parametric Cost Models (PCM) and Manufacturing Process Cost Models (MPCM) [7]....

[...]

...BLI = Boundary layer ingestion BWB = Blended wing body CER = Cost-estimating relationship DOC = Direct operating cost IRR = Internal rate of return MPCM = Manufacturing process cost model PCM = Parametric cost model SEE = Standard error of estimate SFC = Specific Fuel Consumption TERA = Techno-economic and Environmental Risk Assessment TRL = Technology readiness level Symbols...

[...]

...MPCM models support a bottom-up design process, which assess each component and the processes required for its manufacture, building up to an estimation of the total aircraft cost....

[...]

32 citations

...The embedded engine and propulsor array location provide noise shielding to achieve the required noise targets [6]....

[...]

32 citations

...Roskam’s models follow a similar cost estimation procedure to the Rand Corporation models....

[...]

...Two publicly models were selected as models with this form of support: • Rand Corporation (Resetar et al, 1991 [19] with updates from Younossi et al, 2001 [20]) • Roskam, 1990 [21] Both models build up the cost of an aircraft from several subgroups, comprising of the requirements for the development program, the recurring aircraft manufacture cost, and the cost of other assorted components (e.g. aircraft interiors and engines)....

[...]

...Two publicly models were selected as models with this form of support: • Rand Corporation (Resetar et al, 1991 [19] with updates from Younossi et al, 2001 [20]) • Roskam, 1990 [21] Both models build up the cost of an aircraft from several subgroups, comprising of the requirements for the development program, the recurring aircraft manufacture cost, and the cost of other assorted components (e....

[...]

...Two publicly models were selected as models with this form of support: • Rand Corporation (Resetar et al, 1991 [19] with updates from Younossi et al, 2001 [20]) • Roskam, 1990 [21] Both models build up the cost of an aircraft from several subgroups, comprising of the requirements for the…...

[...]

31 citations

...Two publicly models were selected as models with this form of support: • Rand Corporation (Resetar et al, 1991 [19] with updates from Younossi et al, 2001 [20]) • Roskam, 1990 [21] Both models build up the cost of an aircraft from several subgroups, comprising of the requirements for the development program, the recurring aircraft manufacture cost, and the cost of other assorted components (e....

[...]

...Two publicly models were selected as models with this form of support: • Rand Corporation (Resetar et al, 1991 [19] with updates from Younossi et al, 2001 [20]) • Roskam, 1990 [21] Both models build up the cost of an aircraft from several subgroups, comprising of the requirements for the…...

[...]