FCN Working Paper No. 7/2016

Economic Viability of Second-Life Electric Vehicle

Batteries for Energy Storage in Private Households

Alexander Kirmas and Reinhard Madlener

July 2016

Revised April 2017

Institute for Future Energy Consumer

Needs and Behavior (FCN)

School of Business and Economics / E.ON ERC

FCN Working Paper No. 7/2016

Economic Viability of Second-Life Electric Vehicle Batteries for Energy Storage in

Private Households

July 2016

Revised April 2017

Authors´ addresses:

Alexander Kirmas

RWTH Aachen University

Templergraben 55

52056 Aachen, Germany

E-Mail: alexander.kirmas@rwth-aachen.de

Reinhard Madlener

Institute for Future Energy Consumer Needs and Behavior (FCN)

School of Business and Economics / E.ON Energy Research Center

RWTH Aachen University

Mathieustrasse 10

52074 Aachen, Germany

E-Mail: RMadlener@eonerc.rwth-aachen.de

Publisher: Prof. Dr. Reinhard Madlener

Chair of Energy Economics and Management

Director, Institute for Future Energy Consumer Needs and Behavior (FCN)

E.ON Energy Research Center (E.ON ERC)

RWTH Aachen University

Mathieustrasse 10, 52074 Aachen, Germany

Phone: +49 (0) 241-80 49820

Fax: +49 (0) 241-80 49829

Web: www.eonerc.rwth-aachen.de/fcn

E-mail: post_fcn@eonerc.rwth-aachen.de

1

Economic viability of second-life electric vehicle batteries

for energy storage in private households

Alexander Kirmas

a

and Reinhard Madlener

b,*

a

RWTH Aachen University, Templergraben 55, 52056 Aachen, Germany

b

Institute for Future Energy Consumer Needs and Behavior (FCN), School of Business and Economics / E.ON

Energy Research Center, RWTH Aachen University, Mathieustrasse 10, 52074 Aachen, Germany

July 2016, revised April 2017

Abstract

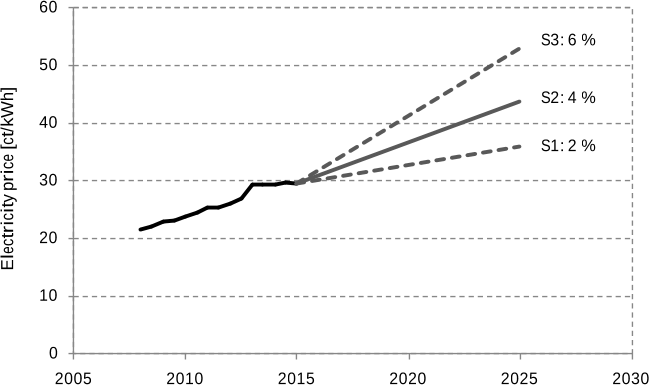

We examine the economic viability of second-life batteries from electric vehicles for load shifting and

peak shaving in residential applications. We further investigate the expected impact of a growing

number of residential storage systems on the electricity market. For the analysis a simulation model of

a private household with integrated PV-storage system is used that is parametrized for an electricity

demand of three people and a location in southern Germany. The conditions for which investments in

second use batteries are profitable are examined for three scenarios. The central scenario S2 tackles an

expected net increase in the electricity price by 4% per year. Upward and downward deviations from

this price trajectory are covered by scenarios S1 and S3. For scenario S1, we find that investments in

storage systems are profitable for all Li-ion battery costs assumed. In scenario S2, the breakeven battery

price is found to be 107 € kWh

-1

, whereas in scenario S3 with the lowest electricity price growth the

battery price has to be equal or lower than 73 € kWh

-1

to maintain economic viability.

Keywords: E-vehicle, Residential electricity, Battery storage, Load shifting, Peak shaving

1. Introduction

Renewable energy technologies are a promising way to mitigate the consequences of climate

change and the finiteness of fossil fuels. However, the intermittent electricity output from

technologies like solar photovoltaic systems is volatile and depends on daytimes or local

weather conditions. Energy storage technologies can help to match supply and demand. Reused

batteries from (hybrid) electric vehicles may provide a storage technology with environmental

*

Corresponding author. Tel.: +49-241-80-49-820; fax: +49-241-80-49-829; E-mail address:

RMadlener@eonerc.rwth-aachen.de (R. Madlener)

2

and economic benefits to utilities, companies and homeowners. In the upcoming years the

global society is confronted with a variety of challenges. Climate change and fossil fuel

resource depletion are some challenges the energy economy has to find solutions for.

Renewable energy technologies will play a significant role in mitigating the consequences of

these challenges [1]. Governments of many countries have passed laws to support the transition

to sustainable energy generation. In Germany policy makers decided to foster the development

of renewable energy technologies through the provision of guaranteed feed-in tariffs. This

funding made rooftop photovoltaic (PV) systems attractive to private homeowners. However,

the energy generation from PV systems strongly depends on time of day and local weather

conditions and brings an element of uncertainty to the power grid [2]. Furthermore, the peak in

energy generation around noon produces a mismatch in demand and supply and is a threat to

the stability of the electricity system [3].

A feasible way to compensate for this mismatch is to adjust the energy supply by using

conventional power plants (like modern gas-fired power plants) which can be modulated

relatively quickly. But with limited capacities and an increasing amount of energy fed in by

renewables, other options have to be considered. The mismatch exists because the power supply

generated by PV systems is highest during the day with a peak around noon, whereas power

demand is low during the day and increases in the evening hours. The use of storage

technologies and smart grid technologies represents a promising way to shift energy demand

from the evening hours to the hours with a surplus of renewable energy generation.

In battery storage systems the electricity is stored through an electro-chemical process. Due

to decreasing battery costs they have become a potentially important alternative to other storage

technologies and several pilot projects have been started in recent years. Although battery costs

have declined, [4]-[6] could not find evidence that investments in battery storage were

profitable under present conditions. The costs per kWh decrease further if used battery storage

units are taken into consideration. In this case, the benefits from lower costs have to be balanced

with the downsides (e.g., lower capacity and efficiency, earlier replacement need of used battery

systems).

In the automotive industry the “second life” of retired batteries from electric vehicles is a

much debated issue, and nearly all of the major car manufacturers are currently determining

possible applications for their batteries after they have reached a capacity between 70-80%

through aging during their “first life” in the vehicle. Most industry experts expect them to be

used as stationary storage for renewable energy production, since they still retain significant

capacity. In recent years, several projects were implemented in order to gather knowledge about

3

the feasibility and the capabilities of the second life usage. For instance, Nissan and Green

Charge Networks, a large provider of commercial energy storage, have embarked on a

partnership for the commercial use of the retired batteries from the Nissan Leaf, which is one

of the world’s top-selling electric vehicle [7]. Toyota started a partnership with the Yellowstone

National Park and provides a ranger station and education center with power from a hybrid PV-

battery system [8]. General Motors has tested their batteries from the Chevrolet Volt to provide

solar and wind power to their new IT center in Milford, Michigan. However, the projects of

Toyota and General Motors are mostly isolated applications, whereas in Germany grid-

connected solutions by Daimler and BMW are explored. A cooperation between Daimler, The

Mobility House, GETEC and REMONDIS provides a 13 MWh energy storage unit to balance

the energy in the electricity grid [9] and BMW, Bosch and Vattenfall operate a battery pack as

part of a virtual power plant in Hamburg [10]. The discussion shows the relevance of using

batteries as energy storage systems, and the importance of taking a closer look at the

requirements for a successful implementation, the consequences, and the resulting implications.

The question arises concerning the conditions under which the economic viability of the

residential PV-storage system is given. The purchase and maintenance not only of the battery

but of the other system components, like the inverter, has to provide a benefit to the decision

maker, in this case the homeowner. Possible benefits for other involved parties, like the grid

operators, may be shared with the decision maker in order to positively influence economic

viability. In addition to that, policy makers may foster the spread of the storage technology

through various incentives like credits at reduced interest rates. Further, it is important to

estimate what impact a growing number of residential battery storage systems has on the

market, the electricity sector, and policy-making. Finally, there is the question concerning

which implications and guidance can be derived from the results for energy companies, grid

operators, car manufactures, and policy makers.

The research objective is to determine the economic viability of the implementation of a

used battery from an electric (EV) or hybrid electric vehicle (HEV) in a residential application

for load-shifting and peak-shaving. Precisely, a household with a PV generation system is

considered and the benefit of combining it with a battery storage system is examined. The

battery technology is limited to lithium-ion as it is the dominant technology for EVs and HEVs

today.

The economic viability is evaluated based on literature research and a precise and time-

dependent calculation of the cash flows and the resulting net present value. The research issues

described can be examined using different approaches. Battke et al. [11] examined lifecycle

![Fig. 44. Comparison of (a) non grid-optimized; and (b) grid-optimized battery operating strategies. Source: [34], p.4.](/figures/fig-44-comparison-of-a-non-grid-optimized-and-b-grid-1iqi7law.png)

![Fig. 1. System architecture. Source: adopted from [1], p.7.](/figures/fig-1-system-architecture-source-adopted-from-1-p-7-2rdd00s0.png)