Did you find this useful? Give us your feedback

77 citations

76 citations

66 citations

59 citations

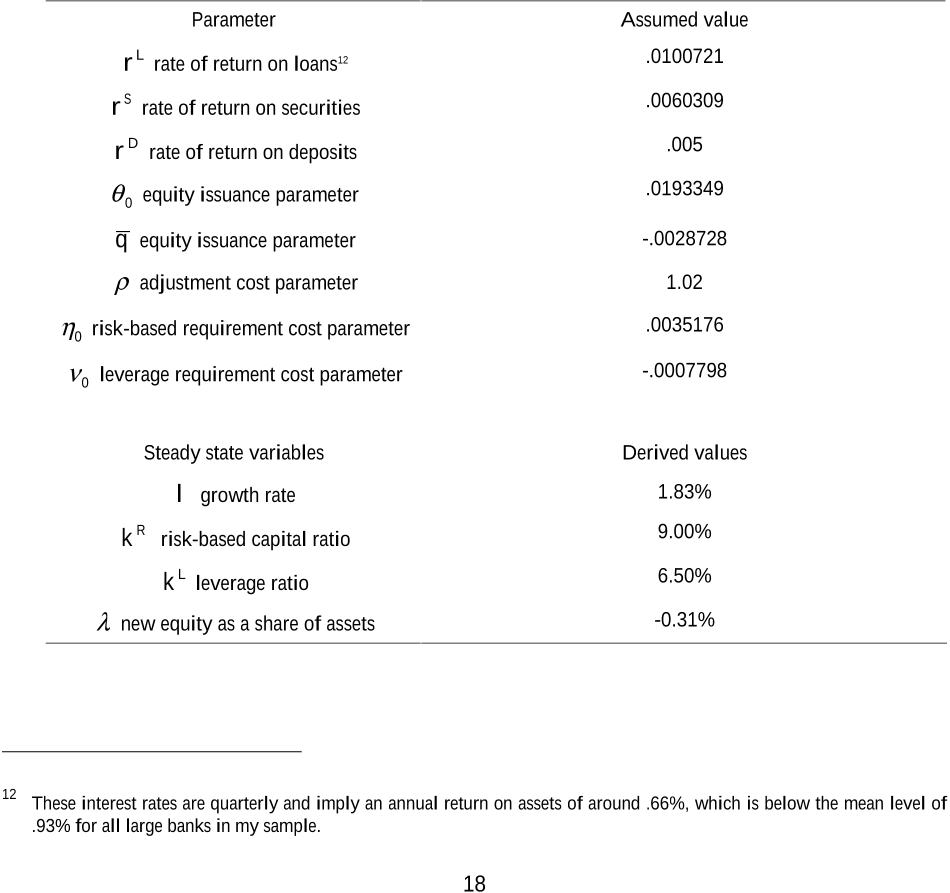

...Using panel data on large US commercial banks between 1989 and 1997, Furfine (2000) develops a structural dynamic model....

[...]

51 citations

...The empirical investigations concerning the effect of bank capital on lending mostly refer to the US banking system ( Hancock, Laing and Wilcox, 1995, Furfine, 2000, Kishan and Opiela, 2000; Van den Heuvel, 2001b)....

[...]

...A relevant measure is instead the excess capital, that is, the amount of capital that banks hold in excess of the minimum required to meet prudential regulation standards....

[...]

18,117 citations

7,982 citations

5,822 citations

2,064 citations

[...]

1,446 citations

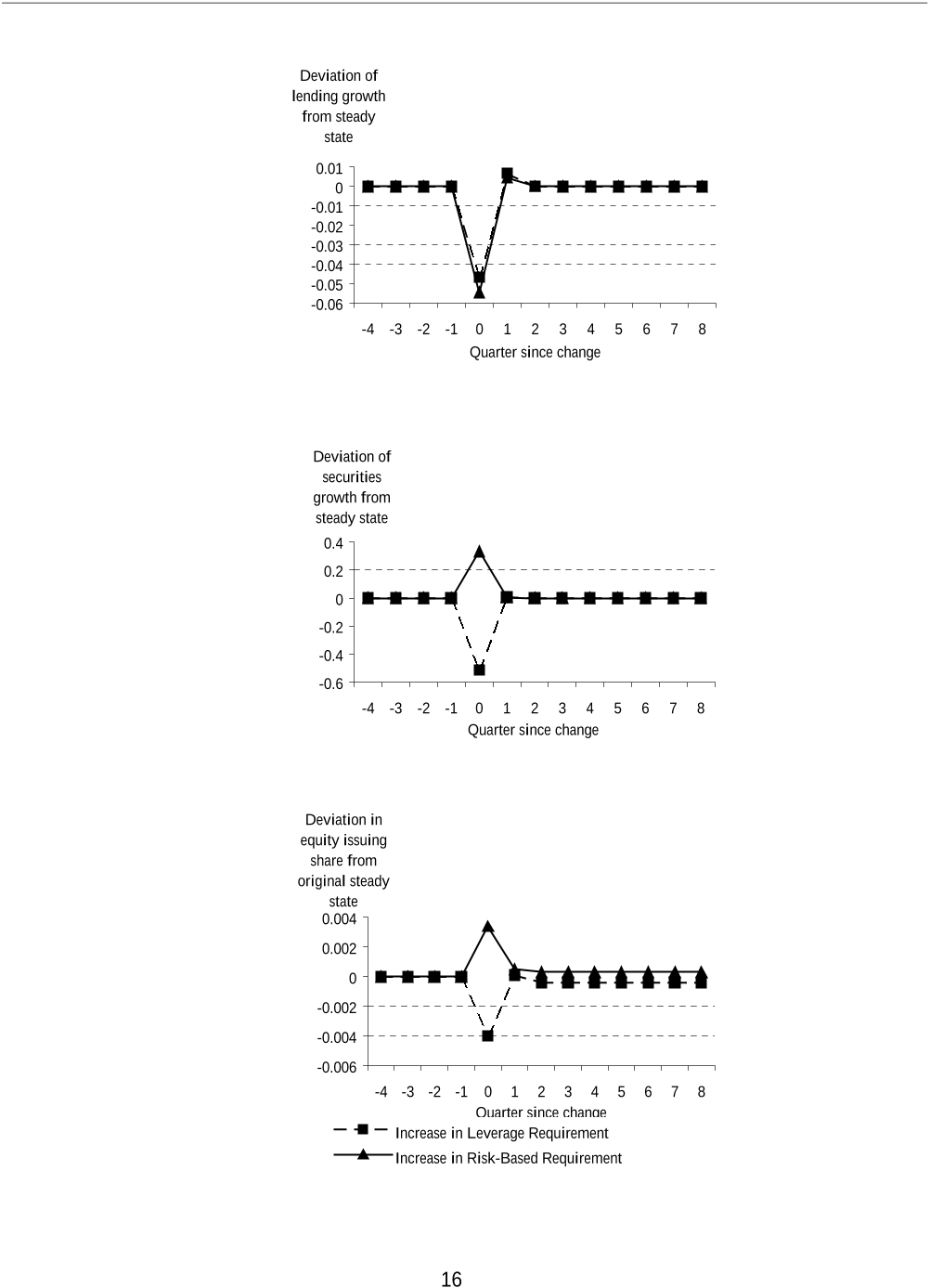

11 These results do not preclude the possibility that changing loan demand influenced bank portfolios, but only preclude that a decline in loan demand alone can explain all of the actual portfolio adjustments.