read more

Their results appear to justify their research design, as well as highlighting the need for future research to take into account a comprehensive set of CG mechanisms within a simultaneous 30 equation framework, which permits each mechanism to affect executive pay, but also allows executive pay to affect each mechanism when estimating the executive pay and corporate performance sensitivity. As data coverage improves, future studies may need to consider other CG mechanisms, such as data on the market for corporate control, 31 in estimating the executive pay and corporate performance sensitivity. Therefore, future research may improve their findings by investigating how different types of institutional owners influence the pay-for-performance elasticity. Incorporating such changes in CEO wealth in the total CEO pay package by future researchers may enhance their findings.

The theory that larger firms are more complex to manage, implies the need for higher quality managers capable of making frequent and significant decisions, but such talented managers are both scarce and highly mobile who can largely be attracted with competitive pay packages (Murphy, 1999; Sapp, 2008).

Apart from regulatory enforcement, their results further indicate that greater activism by institutional shareholders may help strengthen the executive pay and corporate performance link.

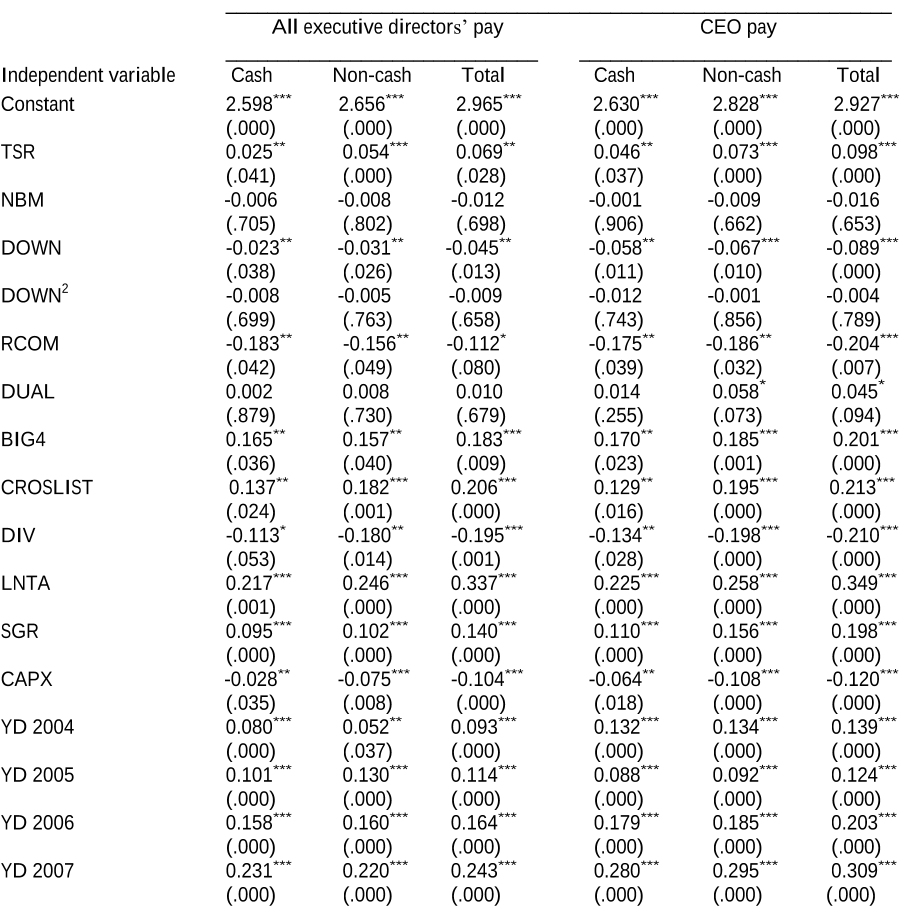

Evidence of a stronger link between corporate performance and equity-based compensation provides support to the recommendations of King II that non-cash pay should form a substantial portion of total executive compensation in order to align executive interests with those of shareholders.

It is also consistent with tournament theory (Sapp, 2008; Lee et al., 2008; Zhao, 2013), which suggests that CEOs are paid more to stimulate healthy competition among lower placed executives for the position of the CEO, ultimately resulting in the exertion of greater effort and improved corporate performance.

During the late 1990s, the country experienced a number of high profile corporate failures, such asthe collapse of the Macmed, Leisurenet and Nedbank companies, which were attributed mainly to poor CG practices, including increased executive compensation (Okeahalam, 2004; Sarra, 2004).

As data coverage improves, future studies may need to consider other CG mechanisms, such as data on the market for corporate control,31in estimating the executive pay and corporate performance sensitivity.