Did you find this useful? Give us your feedback

815 citations

327 citations

186 citations

173 citations

...Broner et al., 2011; Milesi-Ferretti and Tille, 2011). The mechanism that we highlight in this paper is not in contrast with this channel and can be viewed as complementary, as both mechanisms rely on a high degree of financial integration across countries. Furthermore, the return-equalization channel that we highlight is fully consistent with the observed evidence on increased financial globalization. Yet, our paper suggests some caution in giving causal interpretations to this quantitative evidence, since credit volumes might be of limited importance for the international transmission of shocks when financial markets are strongly integrated. An across-the-board slump in domestic and foreign credit, consistent with the global fall in capital demand and investment brought about by an adverse financial shock in our model would be consistent with the evidence of a ‘Great Retrenchment’ in global flows provided by Milesi-Ferretti and Tille (2011). However, our analysis falls short of an explicit account of the gross capital flows observed before, during and after the recent crisis....

[...]

...Kaminsky and Reinhart (2000) for early evidence on this ‘common investor’ or ‘common lender’ channel, and Broner et al. (2006) for more recent evidence)....

[...]

...Although the large variation in gross capital flows during crises is consistent with the empirical evidence, crises are usually associated with a reduction in gross capital flows, as shown by Milesi-Ferretti and Tille (2011) for the latest crisis and by Broner et al. (2011) more broadly....

[...]

...Kaminsky and Reinhart (2000) for early evidence on this ‘common investor’ or ‘common lender’ channel, and Broner et al. (2006) for more recent evidence).(2) However, in the context of the recent financial crisis it has been forcefully argued that even within the US financial system ‘the outstanding amount of subprime-related assets was not large enough to cause a systemic financial crisis by itself’ (Gorton, 2010). Furthermore, the high degree of home bias in international financial markets should suggest that the cross-border propagation via balance sheet effects would be relatively contained; for instance Kamin and Pounder DeMarco (2010) find that direct exposure to US mortgages fails to account for the crosscountry transmission of the crisis....

[...]

...…and Quadrini, 2010; and Kollmann et al., 2011).7 This literature stresses the fact that cross-border lending by financial intermediaries has increased dramatically since the early 1990s and has contracted severely during the crisis (e.g. Broner et al., 2011; Milesi-Ferretti and Tille, 2011)....

[...]

148 citations

4,595 citations

...Banking crises come from the dating of crisis periods available in Honohan and Laeven (2005), Laeven and Valencia (2008 and website update), and Reinhart and Rogoff (2009)....

[...]

...We also consider episodes identified in Reinhart and Rogoff (2009)....

[...]

2,536 citations

1,996 citations

...…capital flows (Lane and Milesi-Ferretti, 2001 and 2007; Kraay et al., 2005, Devereux, 2007, and Gourinchas and Rey, 1 See, for example, Dornbusch, Goldfajn, and Valdés (1995), Kaminsky, Lizondo, and Reinhart (1998), Broner and Rigobon (2006), Levchenko and Mauro (2007), and Mendoza (forthcoming)....

[...]

1,827 citations

...Following the methodology in Frankel and Rose (1996), a country experiences a currency crisis if there is a nominal depreciation of the exchange rate of at least 30 percent, which also represents at least a 10 percent increase in the rate of depreciation over the previous year....

[...]

...Currency crises are identified through the methodology in Laeven and Valencia (2008), which in turn follows Frankel and Rose (1996)....

[...]

...Following the methodology in Frankel and Rose (1996), a country experiences a currency crisis if there is a nominal depreciation of the exchange rate of at least 30 percent, which also represents at least a 10 percent increase in the rate of depreciation over the previous year. 9 Debt crises, comprising both domestic and external debt crises, are those identified in Reinhart and Rogoff (2009). To complete the data set for the countries in our sample, we complement the Reinhart and Rogoff (2009) dating of debt crises...

[...]

1,551 citations

...Currency crises are identified through the methodology in Laeven and Valencia (2008), which in turn follows Frankel and Rose (1996)....

[...]

...Analogously, for external debt crises, we consider the crisis dating in Laeven and Valencia (2008) and Reinhart and Reinhart (2009), as well as Standard & Poor’s downgrades to default levels of foreign currency debt and foreign currency bank loans of a given country (up to 2009)....

[...]

...Analogously, for external debt crises, we consider the crisis dating in Laeven and Valencia (2008) and Reinhart and Reinhart (2008) as well as Standard & Poor’s downgrades of foreign currency debt and foreign currency bank loans of an economy to default levels (up to 17 See Appendix Table 1 for the…...

[...]

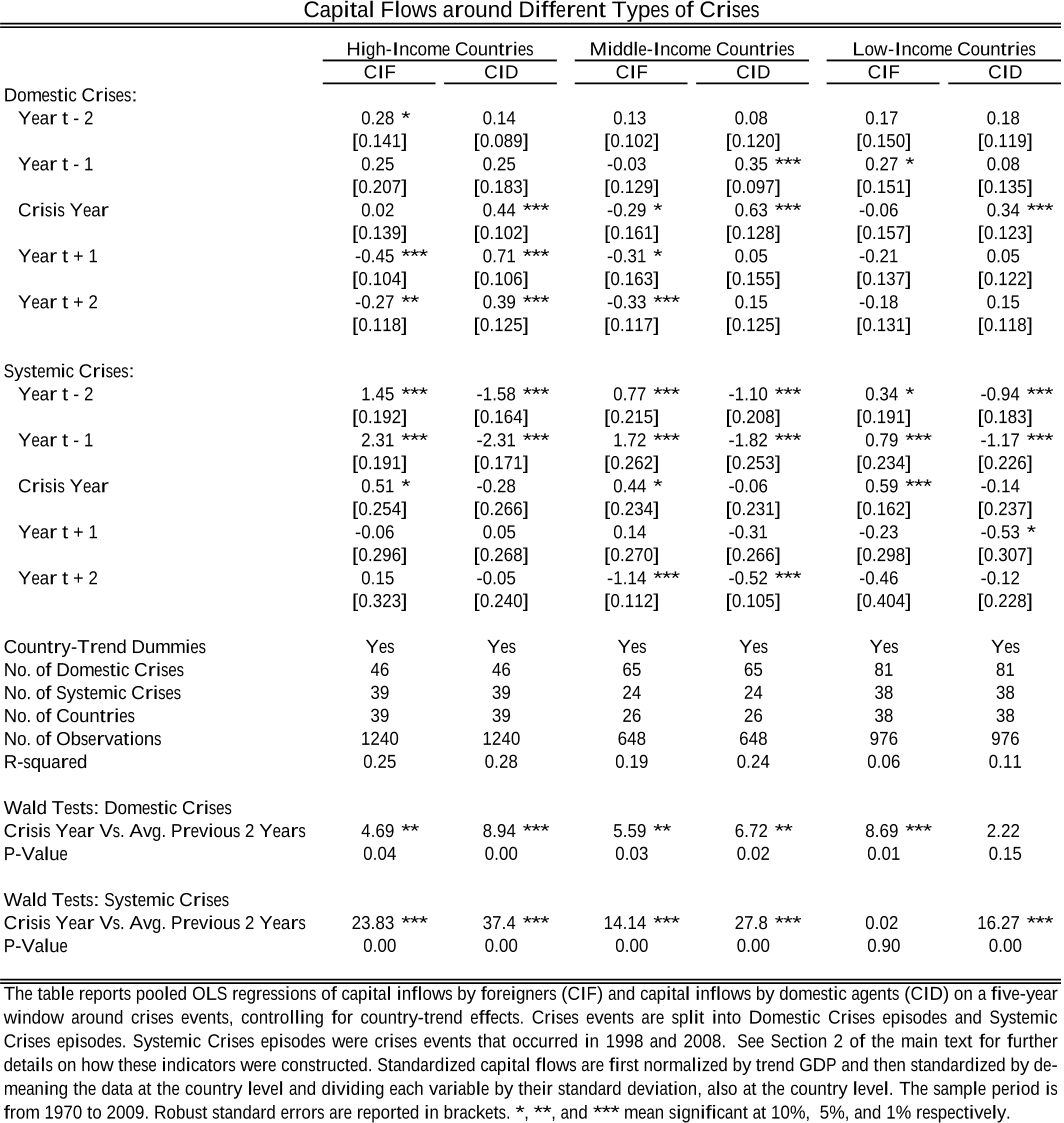

for example, crises were associated with a worsening of investor property rights that affected foreign creditors more than domestic creditors, the authors would expect the type of retrenchment observed in the data.

Some small countries are a concern due to their possible role as offshore financial centers or tax havens; many small economies often display an artificially high volume of financial transactions.

a negative CID should be interpreted as capital outflows by domestic agents whereas a positive CID means capital inflows.

All countries faced at least one crisis within their sample period and a total of 78 crises episodes (24 severe ones) have been observed in these countries.

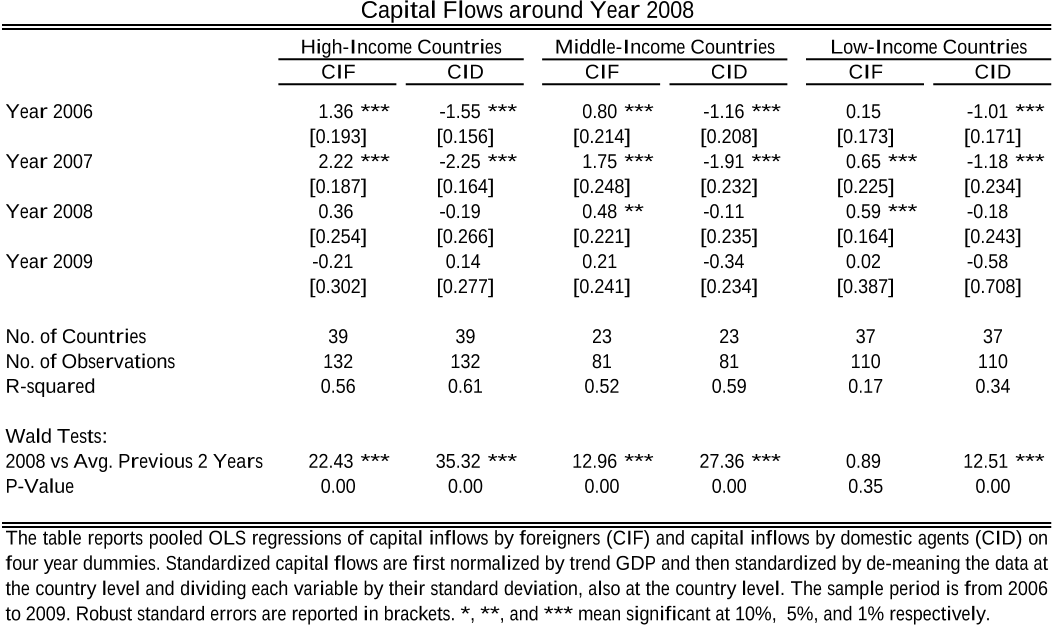

capital inflows by foreigners remained at depressed levels (or declined even more for middle-income countries) during the two-year period after the onset of the crisis.

During the last decades, international capital flows have played an increasinglyimportant role in the business cycles of developed and developing countries, particularly during episodes of financial crises.

The evidence in Table 1 and Figure 3 suggests that capital inflows by domesticand foreign agents have become very large in recent years, surpassing the size of net international capital inflows.

The authors do so by estimating the following regressions:,,,, tctctc ControlsXY εβα +++= (3)where Y stands for CIF, CID, or a measure of aggregate flows, CIF-CID; X represents either net capital flows, the trade balance in goods and services, or measures of the GDP fluctuations; and Controls stand for additional controls the authors include in the regressions such as country-trends or year dummies.

The milder reaction of capital flows in low-income countries might be related to the relative size of official funding in comparison to total flows for these economies as these flows are unlikely to decline during crises.

capital inflows by foreigners have grown considerably less, going from about 4 percent of trend GDP in the 1980s to only 4.2 percent in the 2000s.

the boundaries of the ellipses capture two standard deviations, which should encompass 86% of the total probability mass.