Abstract:

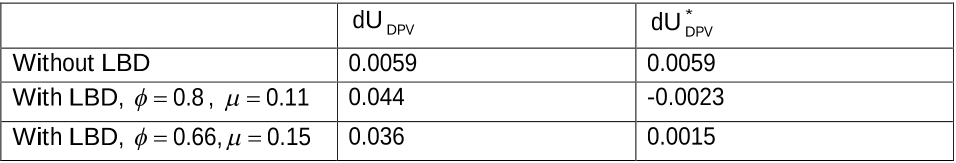

This study shows that the learning by doing (LBD) effect has substantial, both quantitative and qualitative, consequences for the international transmission of monetary policy. LDB implies that a country can increase its productivity-increasing skill level, at the expense of the neighbor, by competitive devaluation engineered through low interest rates. If measured by the cumulative change in output after 12 quarters, LBD increases the harmful effect of competitive devaluation on foreign output by 85–125%, when compared to the case without it. If LBD is sufficiently strong and the cross-country substitutability is high (low), it reverses the effect of monetary policy on foreign (domestic) welfare into negative (positive). Moreover, a combination of a high cross-country substitutability and a sufficiently strong LDB effect implies that competitive devaluation increases both domestic output and welfare, at the expense of foreign output and welfare.