Q1. What have the authors contributed in "Aboa centre for economics" ?

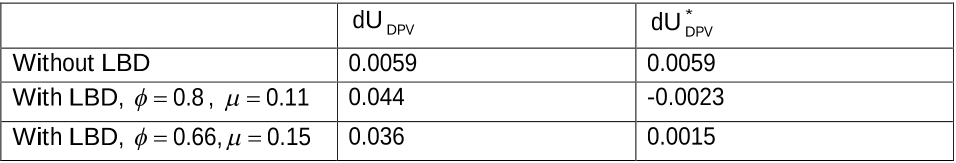

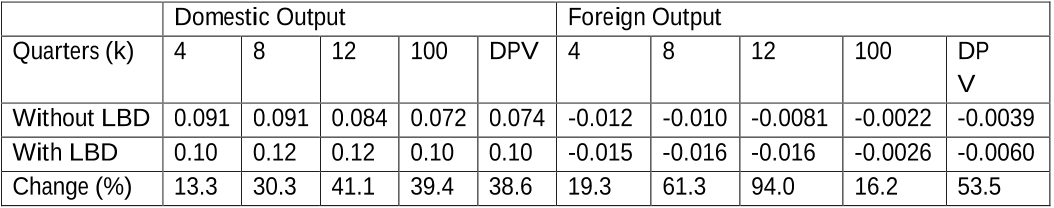

This study shows that the learning by doing ( LBD ) effect has substantial, both quantitative and qualitative, consequences for the international transmission of monetary policy.

Did you find this useful? Give us your feedback

23 citations

...We assume, unlike Chang et al. (2002) and Tervala (2013), that fluctuations in employment can affect TFP quasi-permanently....

[...]

...As in Tervala (2013), the level of TFP evolves according to the following log-linear equation: ât(z) = φât−1(z) + µˆ̀t−1 (z) , (10) where 0 ≤ φ ≤ 1 and µ are parameters....

[...]

...To model endogenous changes in TFP, we add a simple learningby-doing mechanism into the production function, following the formulation of Tervala (2013), based on the idea of Chang et al. (2002)....

[...]

...Following this, Tervala (2013) assumes that the level of TFP accumulates over time according to past employment....

[...]

15 citations

...The object of inquiry in a recent paper by Batabyal and Nijkamp (2010) is a two-sector 4 See Chou and Wong (2001), Goh and Wan (2005), Kutsoati and Zabojnik (2005), D’Albis et al. (2012) and Tervala (2013) for a more detailed corroboration of this claim....

[...]

12 citations

5 citations

5 citations

753 citations

642 citations

...This is consistent with the estimates of Bils and Klenow (2004), which are based on U.S. retail prices....

[...]

595 citations

347 citations

342 citations