Did you find this useful? Give us your feedback

56 citations

...…a large variety of external resources, particularly knowledge, which influences important aspects of firm strategies such as exploitation and exploration (Foss et al., 2013), open innovation (Cassiman and Veugelers, 2006; Laursen and Salter, 2006), and acquisition decisions (Arora et al., 2014)....

[...]

55 citations

...The literature indicates that the acquisition of external knowledge is one of the most basic corporate practices in the management of innovation (Arora et al., 2014; W. M. Cohen, 2010; W. M. Cohen & Levinthal, 1990)....

[...]

53 citations

...In MFTs, universities and research institutes are key creators or suppliers of technological knowledge, and enterprises are potential users and adopters [Arora et al. 2014; Arora et al. 2001a, b; Arora and Gambardella 2010]....

[...]

...For example, by surveying recent research on MFTs, Arora and Gambardella [2010] analyzed the supply and demand of technology, examined what factors affect MFT formation and growth, and explored the dynamic interactions between industry structure and MFTs [Arora et al. 2014]....

[...]

...The aforesaid discussions allow us to summarize the solution procedure of the proposed decision method for two-sided matching technological knowledge supply and demand as follows: Step 1: Determine evaluation matrices A and B by using (1) and (2) based on the suppliers’ and users’ evaluations of the other party and criteria weights; Step 2: Find the positive and negative ideal users and suppliers as per Definition 2 and 3, and calculate positive and negative relational coefficients of the suppliers and users by using the grey relational analysis method; Step 3: Obtain prospect values and prospect matrices for the suppliers and users based on the positive and negative relational coefficients of the suppliers and users as per Eqs....

[...]

...Step 1: Given the suppliers’ evaluations of the users in Table 1 and the users’ assessments of the suppliers in Table 2 as well as the associated criteria weights, one can obtain the overall evaluation values based on formulas (1) and (2) as shown in Table 4....

[...]

51 citations

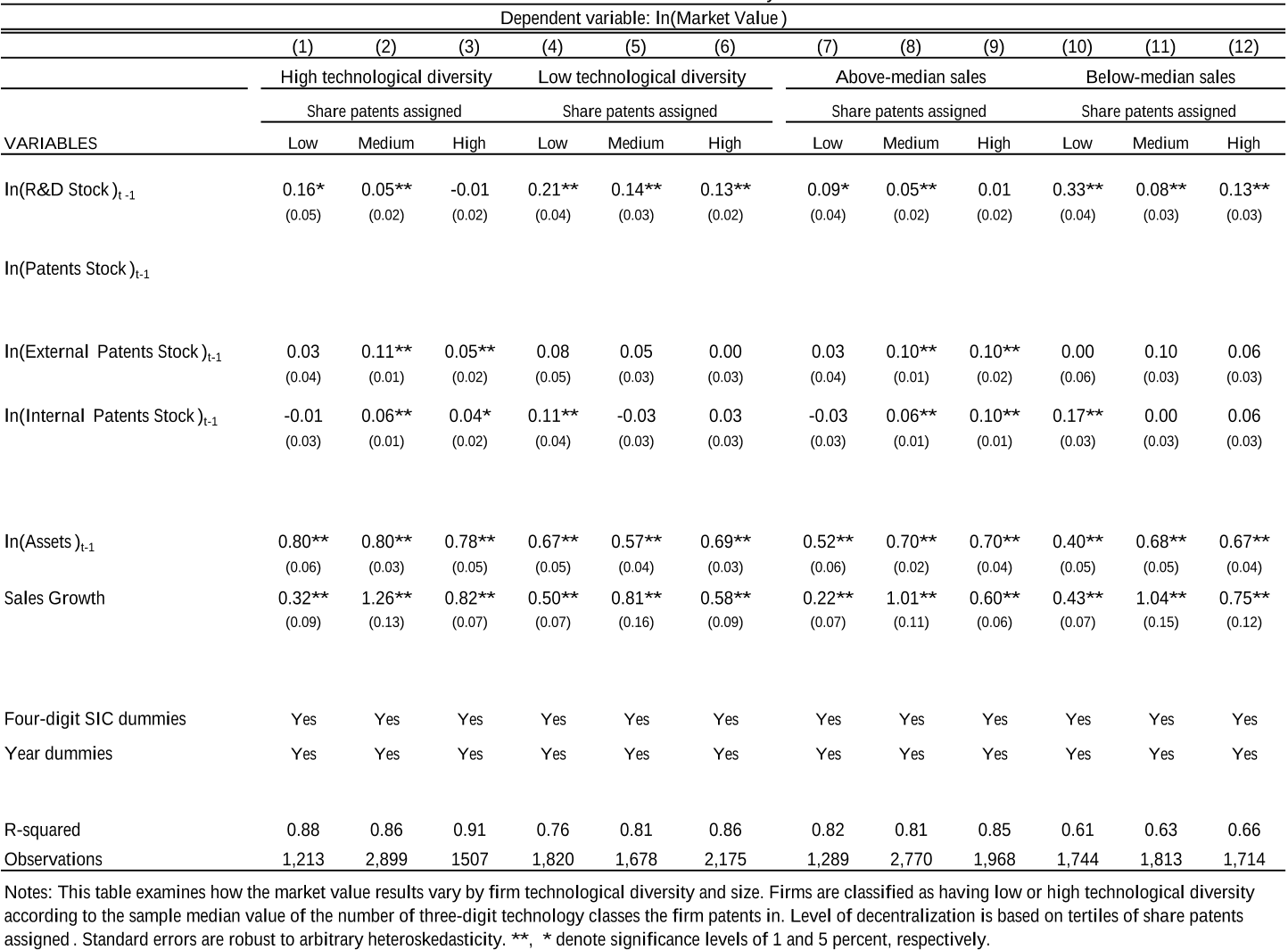

...Arora et al. (2014) find that the organization design of firms (centralized vs. decentralized) affects the integration of knowledge....

[...]

45 citations

31,623 citations

...Internal research helps rms identify, evaluate, and assimilate external knowledge (Rosenberg, 1979; Cohen and Levinthal, 1990), which often comes via acquisitions (Kogut and Zander, 1993; Fleming, 2001)....

[...]

...This lack of synthesis may be due to data constrains, since most work that considers such organizational dynamics tends to rely on small samples (Karim and Mitchell, 2004, and Cohen and Levinthal, 1990 are notable exceptions)....

[...]

...For example, a substantial body of work has advanced our understanding of the relationship between internal R&D and external knowledge, (e.g. Cohen and Levinthal, 1990; Pisano, 1990; Katz and Allen, 1982)....

[...]

...Internal research helps rms identify, evaluate, and assimilate external knowledge (Rosenberg, 1979; Cohen and Levinthal, 1990), which often comes via acquisitions (Kogut and Zander, 1993; Fleming, 2001)....

[...]

3,376 citations

3,355 citations

...…a rm s research focus and external knowledge-sourcing activities can be tracked using patents, R&D spending or alliances (Arora, Fosfuri, and Gambardella, 2001; Henderson and Cockburn, 1994; Mowery, Oxley, and Silverman, 1996), the internal organization of R&D is extremely di¢ cult to observe....

[...]

3,354 citations

...Internal research helps rms identify, evaluate, and assimilate external knowledge (Rosenberg, 1979; Cohen and Levinthal, 1990), which often comes via acquisitions (Kogut and Zander, 1993; Fleming, 2001)....

[...]

3,313 citations

The authors bridge current streams of innovation research to explore the interplay between R & D, external knowledge, and organizational structure–three elements of a firm 's innovation strategy which they argue should logically be studied together. The authors discuss how these findings should stimulate more integrative work on theories of innovation. Using within-firm patent assignment patterns, the authors develop a novel measure of structure for a large sample of American firms.