Institut de Recerca en Economia Aplicada Regional i Pública Document de Treball 2011/07 pàg. 1

Research Institute of Applied Economics Working Paper 2011/07 pag .1

1

Institut de Recerca en Economia Aplicada Regional i Pública Document de Treball 2012/22 33 pàg.

Research Institute of Applied Economics Working Paper 2012/22 33 pag

.

“Recovery Risk and Labor Costs in Public-Private-

Partnerships: Contractual Choice

in the U.S. Water industry”

Daniel Albalate, Germà Bel and R. Richard Geddes

Institut de Recerca en Economia Aplicada Regional i Pública Document de Treball 2012/22 pàg. 2

Research Institute of Applied Economics Working Paper 2012/22 pag. 2

2

WEBSITE: www.ub.edu/irea/ • CONTACT: irea@ub.edu

The Research Institute of Applied Economics (IREA) in Barcelona was founded in 2005, as a

research institute in applied

economics

. Three consolidated research groups make up the

institute: AQR, RISK and GiM, and a large number of members are involved in the Institute. IREA

focuses on four priority lines of investigation: (i) the quantitative study of regional and urban

economic activity and analysis of regional and local economic policies, (ii) study of public

economic activity in markets, particularly in the fields of empirical evaluation of privatization, the

regulation and competition in the markets of public services using state of industrial economy, (iii)

risk analysis in finance and insurance, and (iv) the development of micro and macro econometrics

applied for the analysis of economic activity, particularly for quantitative evaluation of public

policies.

IREA Working Papers often represent preliminary work and are circulated to encourage

discussion. Citation of such a paper should account for its provisional character. For that reason,

IREA Working Papers may not be reproduced or distributed without the written consent of the

author. A revised version may be available directly from the author.

Any opinions expressed here are those of the author(s) and not those of IREA. Research

published in this series may include views on policy, but the institute itself takes no institutional

policy positions.

Institut de Recerca en Economia Aplicada Regional i Pública Document de Treball 2012/22 pàg. 3

Research Institute of Applied Economics Working Paper 2012/22 pag. 3

3

Abstract

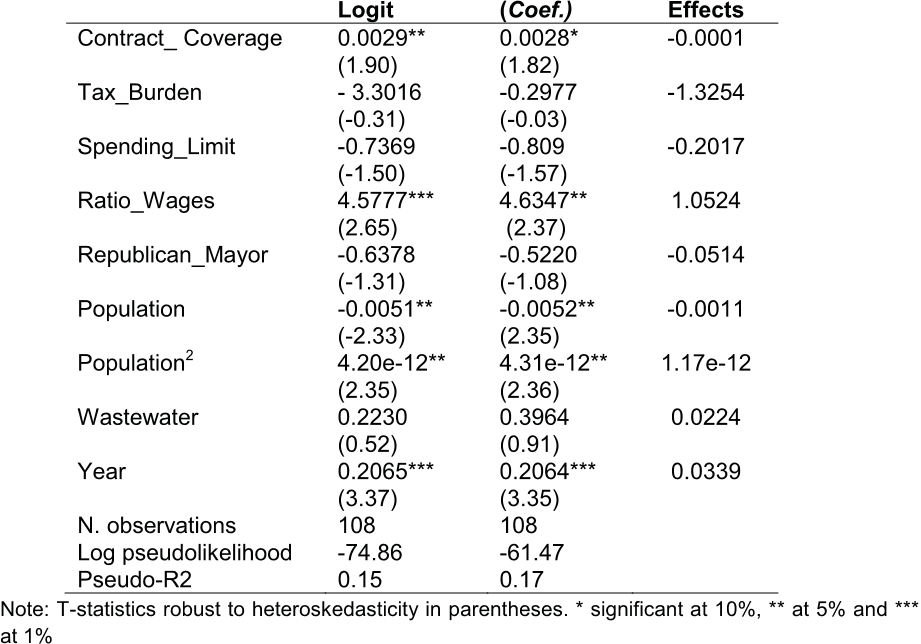

We use an ordered logistic model to empirically examine the

factors that explain varying degrees of private involvement

in the U.S. water sector through public-private partnerships.

Our estimates suggest that a variety of factors help explain

greater private participation in this sector. We find that the

risk to private participants regarding cost recovery is an

important driver of private participation. The relative cost of

labor is also a key factor in determining the degree of private

involvement in the contract choice. When public wages are

high relative to private wages, private participation is viewed

as a source of cost savings. We thus find two main drivers of

greater private involvement: one encouraging private

participation by reducing risk, and another encouraging

government to seek out private participation in lowering

costs.

JEL classification: H4; H54; H7; L88; L9

Keywords: Privatization, Public-Private Partnerships, Water, Contracting out.

Daniel Albalate: Department of Economic Policy & GiM-IREA, Universitat de Barcelona (Barcelona,

Spain) (albalate@ub.edu

).

Germà Bel: Department of Economic Policy & GiM-IREA, Universitat de Barcelona, (Barcelona,

Spain) and City and Regional Planning, Cornell University (Ithaca, NY, USA) (gbel@ub.edu

)

R. Richard Geddes: Department of Policy Analysis & Management, College of Human Ecology,

Cornell University (Ithaca, NY, USA) (rrg24@cornell.edu

)

Acknowledgements:

This research received financial help from the Spanish Government under Projects ECO2009-06946

and ECO2012-38004, the Regional Government of Catalonia under project SGR2009-1066. Germà

Bel acknowledges as well support from ICREA-Academia..

Institut de Recerca en Economia Aplicada Regional i Pública Document de Treball 2012/22 pàg. 4

Research Institute of Applied Economics Working Paper 2012/22 pag. 4

4

1. Introduction

After several decades of water delivery privatization, a widespread view among scholars is

that water delivery is a complex service featuring high contracting costs. In his study of

concession contract renegotiation, Guasch (2004) documents the high frequency of renegotiation

in Latin America and the Caribbean water and sanitation services between the mid-eighties and

2000. Renegotiation affected 74.4 percent of concession contracts in the sector, significantly

higher than in other important sectors, such as transportation. Moreover, the period of time

between contract award and renegotiation was only 1.7 years on average (Guasch, 2004).

Although overall favorable to privatization, Megginson (2005) considers water to be the clearest

case among user-paid services where privatization has failed to deliver clear welfare

improvements.

There is now a substantial empirical literature showing that water private delivery has not

provided superior efficiency and productivity relative to public delivery in most developed

countries (e.g., Warner and Bel 2008). However, because private participation allows access to

additional expertise and greater financial capabilities, studies suggest that private participation in

less-developed countries has delivered improvements in quality and accessibility. Mixed effects of

privatization in several services have led to reforms that go beyond a pure public/pure private split

(Warner and Bel, 2008; Bel and Fageda, 2010). Greater use of public-private partnerships (PPPs)

is one result of such a trend. In fact, PPPs can be viewed as a way to extend a standard

procurement method, similar to contracting out. Moral hazard and quality measurement problems,

among others, have arisen in contracting out (Levin and Tadelis, 2010). Contracting out has

evolved to include high-powered incentives, which require shifting substantial risk to the private

partner, to help address those problems. The private partner demands compensation to bear that

risk however, which requires the public sponsor to pay a risk premium.

The term “public-private partnership” has evolved to encompass any contractual framework

allowing for greater private sector participation in infrastructure projects than under a traditional

approach. PPPs range from relatively simple management contracts to complex design-build-

finance-operate (DFBO) contracts, to outright asset sales.

Institut de Recerca en Economia Aplicada Regional i Pública Document de Treball 2012/22 pàg. 5

Research Institute of Applied Economics Working Paper 2012/22 pag. 5

5

Under a traditional design-build (DB) approach, for example, private firms design and

construct an infrastructure facility on behalf of a public sponsor. The sponsor remains responsible

for financing, operating, and maintaining the facility. A greater degree of private involvement is

found in design-build-operate-maintain (DBOM) contracts. Under DBOM, the additional duties of

the private partner(s) include operating and maintaining the facility after it has been built. Both DB

and DBOM contracts take advantage of private sector incentives and expertise to design and

build facilities so as to minimize operation and maintenance costs.

Greater private involvement also occurs through design-build-finance-operate-maintain

(DBFOM) contracts, which extends private participation to the project’s financing. In a typical

DBFOM contract, the private partner uses some combination of debt and equity to design and

build a new facility, and then operates and maintains it for a specified time period in exchange for

the right to collect revenues from facility users over the lease term. Two versions of this project

type are (a) a greenfield PPP, through which the private partner builds a new facility; and (b) a

brownfield PPP, through which an upfront concession fee is paid by the private partner in order to

lease a pre- existing facility. Other contractual types include build-transfer-operate (BTO)

agreements, under which the private partner owns the facility until its ownership rights are

transferred to the public sector when construction is finished. Similarly, under a build-operate-

transfer (BOT) agreement, the private partner retains ownership rights until title is transferred at

the end of the specified operation and maintenance period. In a build-own-operate (BOO)

agreement, ownership remains with the private partner unless the public sector purchases it.

The contractual diversity facilitated by PPPs has increased the array of types and degrees of

private involvement in public infrastructure delivery. However, empirical analysis of the motivation

behind public services privatization has remained largely focused on a clear bifurcation between

pure-public and pure-private delivery (Bel and Fageda 2007, 2009), with few extensions to other

mixed forms such as mixed public-private firms (Bel and Fageda, 2010).

We contribute to the literature by empirically analyzing the factors that explain varying degrees

of private involvement through PPPs in the water sector. The water sector provides insights

relevant for the study of PPPs more broadly. First, water distribution involves large investments in

networks, which makes this sector subject to financial constraints. Second, water sector

investments typically require long amortization schedules. There is great uncertainty associated

with long-term changes in demand and other variables. Risk sharing and risk transfer over the life

of the contract are more important in the water sector than in many other local services. Water