Q1. What are the contributions in "The case for nit+ft in europe. an empirical optimal taxation exercise" ?

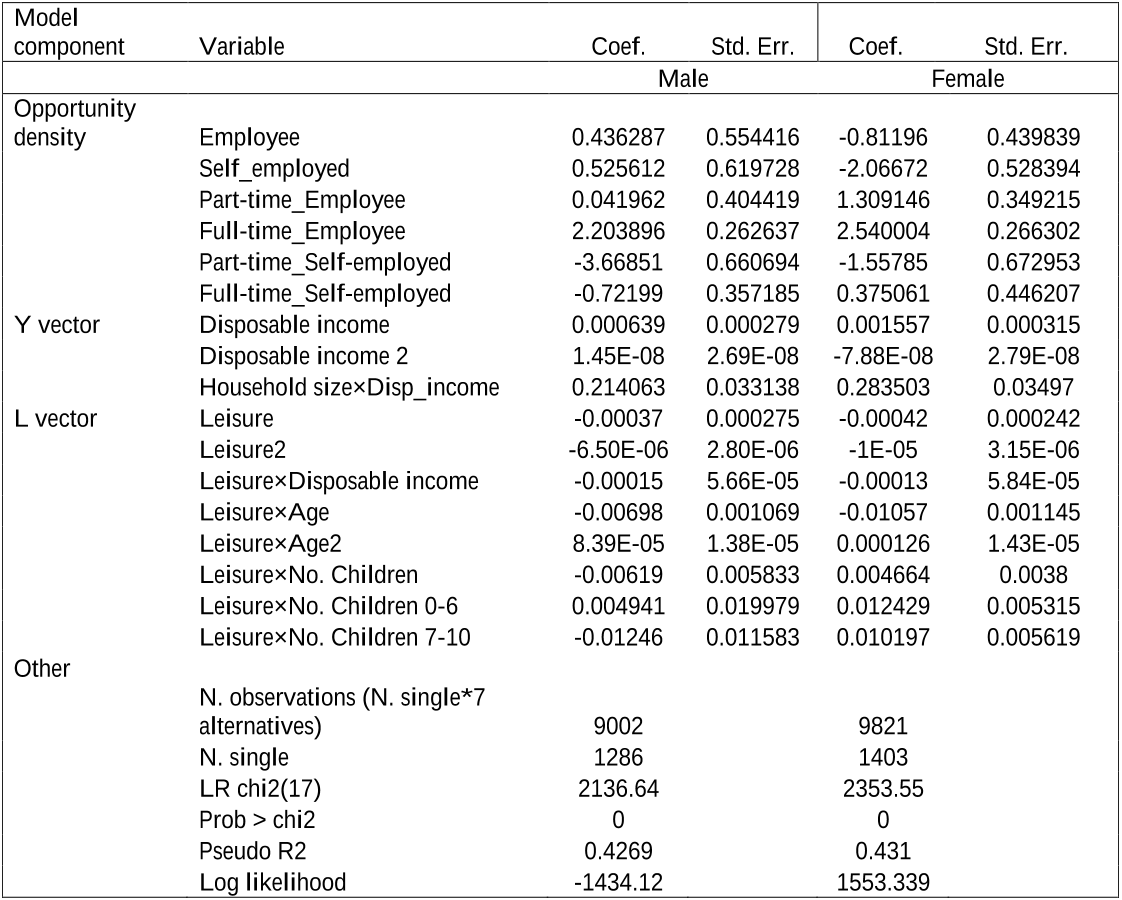

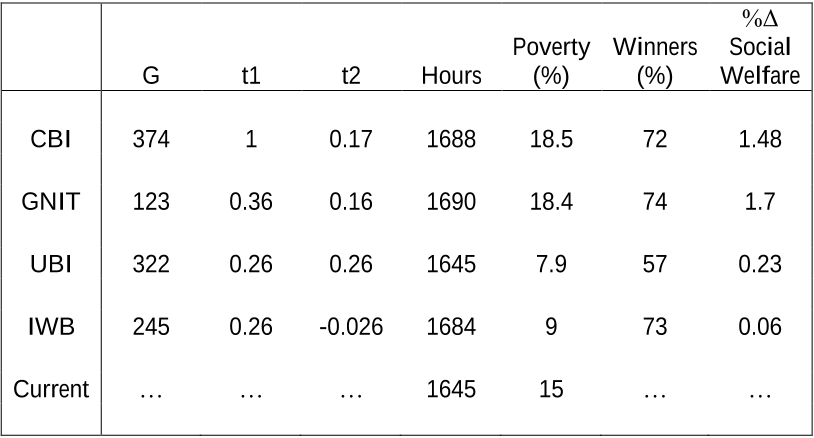

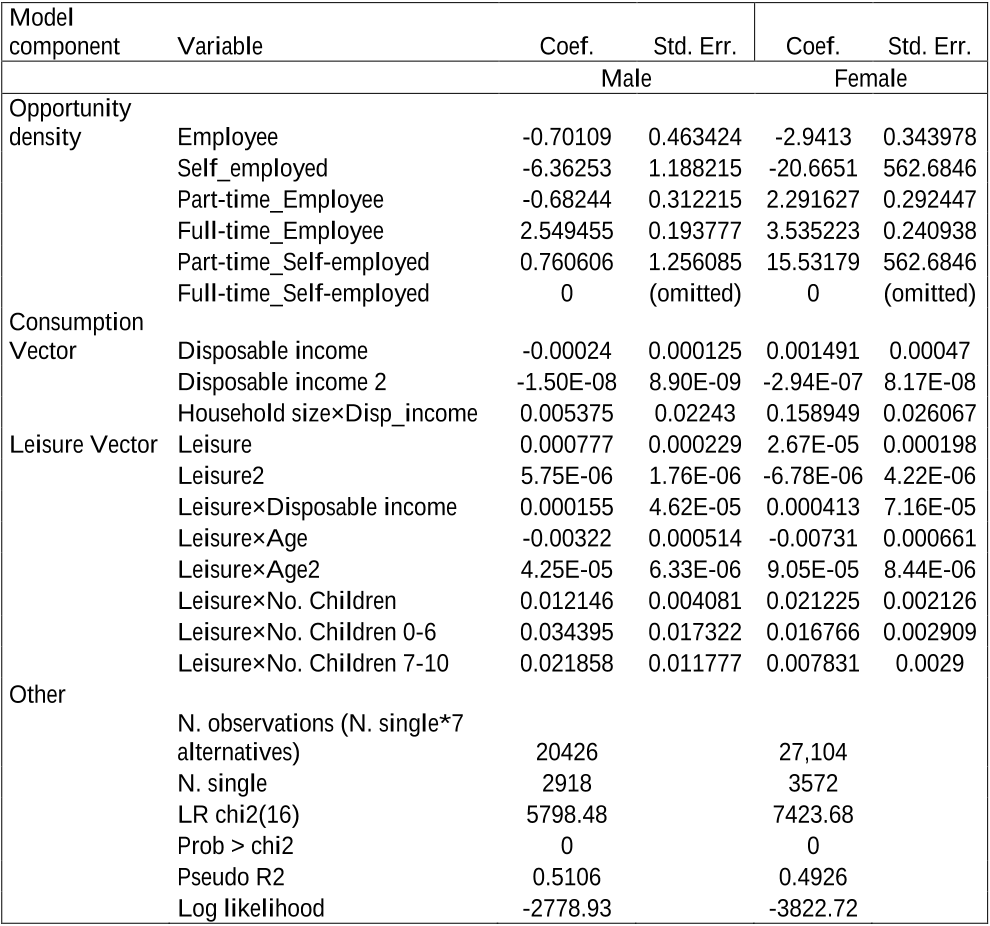

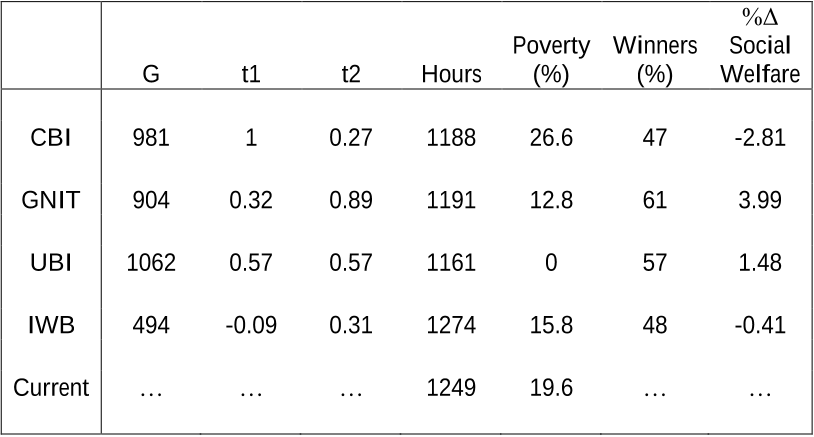

The authors present an exercise in empirical optimal taxation for European countries from three areas: Southern, Central and Northern Europe.

Did you find this useful? Give us your feedback

21 citations

14 citations

9 citations

1 citations

1 citations

...For instance, Islam & Colombino (2018), Aaberge and Colombino (2013) and many others adopt a procedure that consists of using a common utility function as an argument of the social welfare function following Deaton and Muelbauer (1980) approach18....

[...]

...Islam & Colombino (2018)....

[...]

42 citations

37 citations

...Decoster and Haan (2015) provide an empirical application of Fleurbaey’s ethical criteria....

[...]

34 citations

34 citations

...…theoretical models (e.g. Besley 1990, Saez 2002, FittzRoy and Jin 2015), with microsimulation models (e.g. Scutella 2004, Horstschräer et al. 2010, Clavet et al. 2013, Jensen et al. 5 2014, Colombino 2015b, and Sommer 2016) and with dynamic general equilibrium models (e.g. Van der Linden 2004,…...

[...]