Q1. What are the contributions in "The case for nit+ft in europe. an empirical optimal taxation exercise" ?

The authors present an exercise in empirical optimal taxation for European countries from three areas: Southern, Central and Northern Europe.

Did you find this useful? Give us your feedback

21 citations

14 citations

9 citations

1 citations

1 citations

...For instance, Islam & Colombino (2018), Aaberge and Colombino (2013) and many others adopt a procedure that consists of using a common utility function as an argument of the social welfare function following Deaton and Muelbauer (1980) approach18....

[...]

...Islam & Colombino (2018)....

[...]

15 citations

...…Saez 2002, FittzRoy and Jin 2015), with microsimulation models (e.g. Scutella 2004, Horstschräer et al. 2010, Clavet et al. 2013, Jensen et al. 5 2014, Colombino 2015b, and Sommer 2016) and with dynamic general equilibrium models (e.g. Van der Linden 2004, Fabre et al. 2014) with different results....

[...]

10 citations

...…Saez 2002, FittzRoy and Jin 2015), with microsimulation models (e.g. Scutella 2004, Horstschräer et al. 2010, Clavet et al. 2013, Jensen et al. 5 2014, Colombino 2015b, and Sommer 2016) and with dynamic general equilibrium models (e.g. Van der Linden 2004, Fabre et al. 2014) with different results....

[...]

...…direction somehow opposed to the one taken since the end of 70s: less conditioning, simpler designs and ultimately some form of Unconditional Basic Income (UBI), i.e. a policy based on non-means tested transfers (e.g. van Parijs 1995, Standing 2008, Atkinson 2015, Colombino 2015b, Sommer 2016)....

[...]

10 citations

...We wish to thank Flavia Coda Moscarola, Francesco Figari and Marilena Locatelli, who provided us the estimation programs, originally written for Coda Moscarola et al. (2014), which have been useful as a basis for developing our programs for the estimation of the microeconometric model....

[...]

...Following Coda-Moscarola et al. (2014) we write the utility function of the i-th household at a (h, s) job as ( , , ; ) ( , ; ) ' ( ) 'i i iU h s h s hε = + επ Y π γ + L λ (2) where: γ and λ are parameters to be estimated; ( , ; )i h sY π is a vector including - household disposable income on a…...

[...]

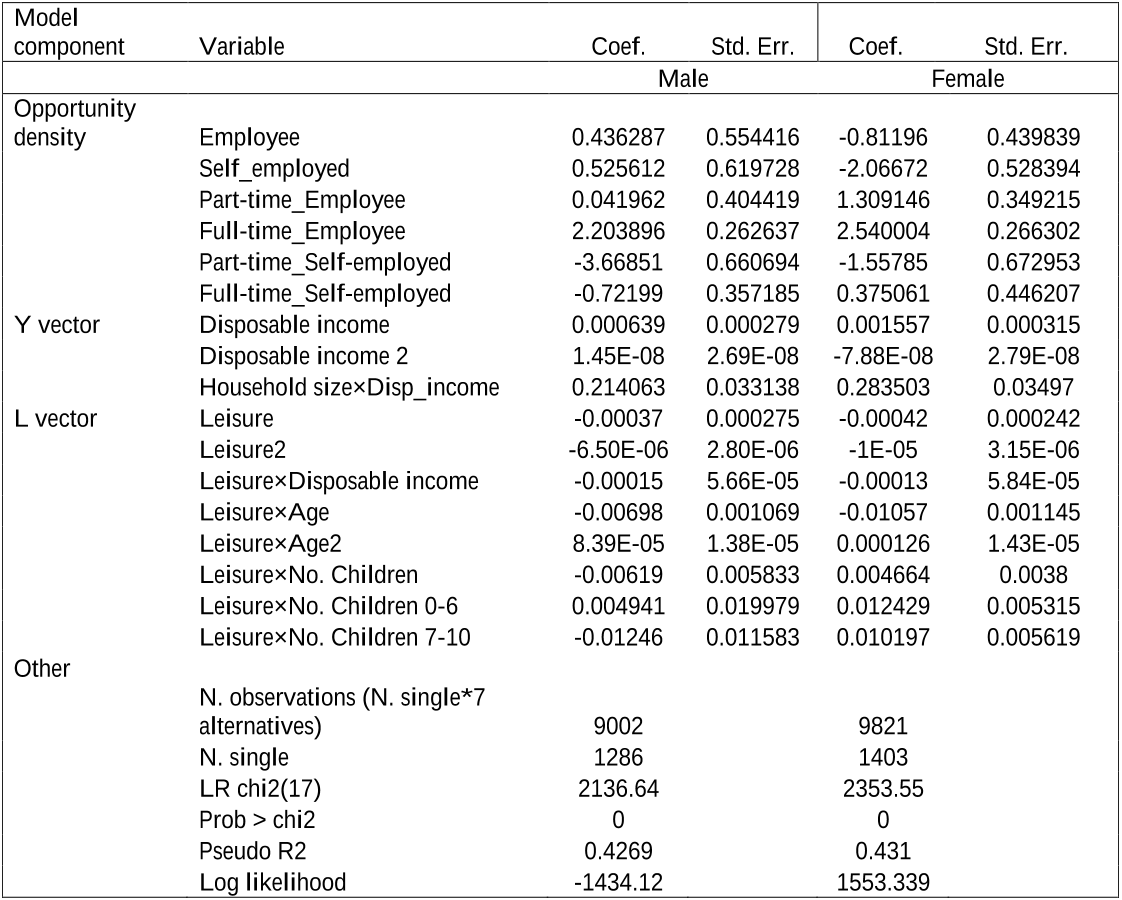

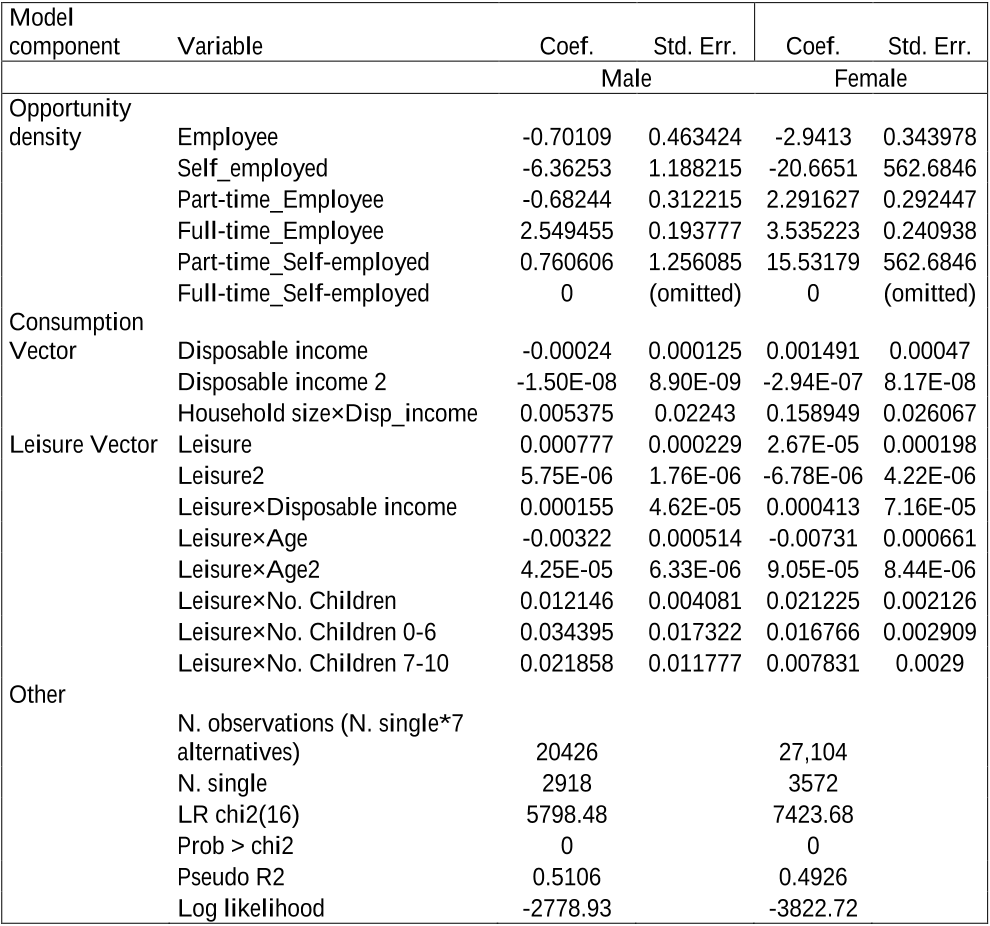

...Following Coda-Moscarola et al. (2014) we write the utility function of the i-th household at a (h, s) job as ( , , ; ) ( , ; ) ' ( ) 'i i iU h s h s hε = + επ Y π γ + L λ (2) where: γ and λ are parameters to be estimated; ( , ; )i h sY π is a vector including - household disposable income on a (h,s) job given the tax-benefit parametersπ , - the square of the household disposable income defined above - and the product of disposable income and household size (interaction term); Li(h) is a row vector including - the leisure time (defined as the total number of avail ble weekly hours (80) minus the hours of work h) separately of the two partners (for a couple) or of the individual (for a single) - the square of leisure time(s) - and the interaction(s) of leisure time(s) with household disposable income, age of the couple’ partners or of the single, age square and three dummy variables indicating presence of children of different age range (any age, 0-6, 7-10); ε is a random variable that accounts for the effect of unobserved (by the analyst) job characteristics....

[...]

...To deal with this issue, we follow a two-stage procedure presented in Dagsvik and Strøm (2006) and also adopted in Coda-Moscarola et al. (2014)....

[...]

9 citations

9 citations