The Nature of Credit Constraints and Human Capital

Figures (14)

Table 3: Baseline Model Parameters

Figure 4: dU , hU , hX , and hG for high wealth individuals (w > w̄)

Figure 3: dU , hU , hX , and hG for low wealth individuals (w ≤ w̄)

Figure 8: ‘Year 2000’ GSL and Private Lending Constraints

Figure 9: Private Borrowing (‘Year 2000’)

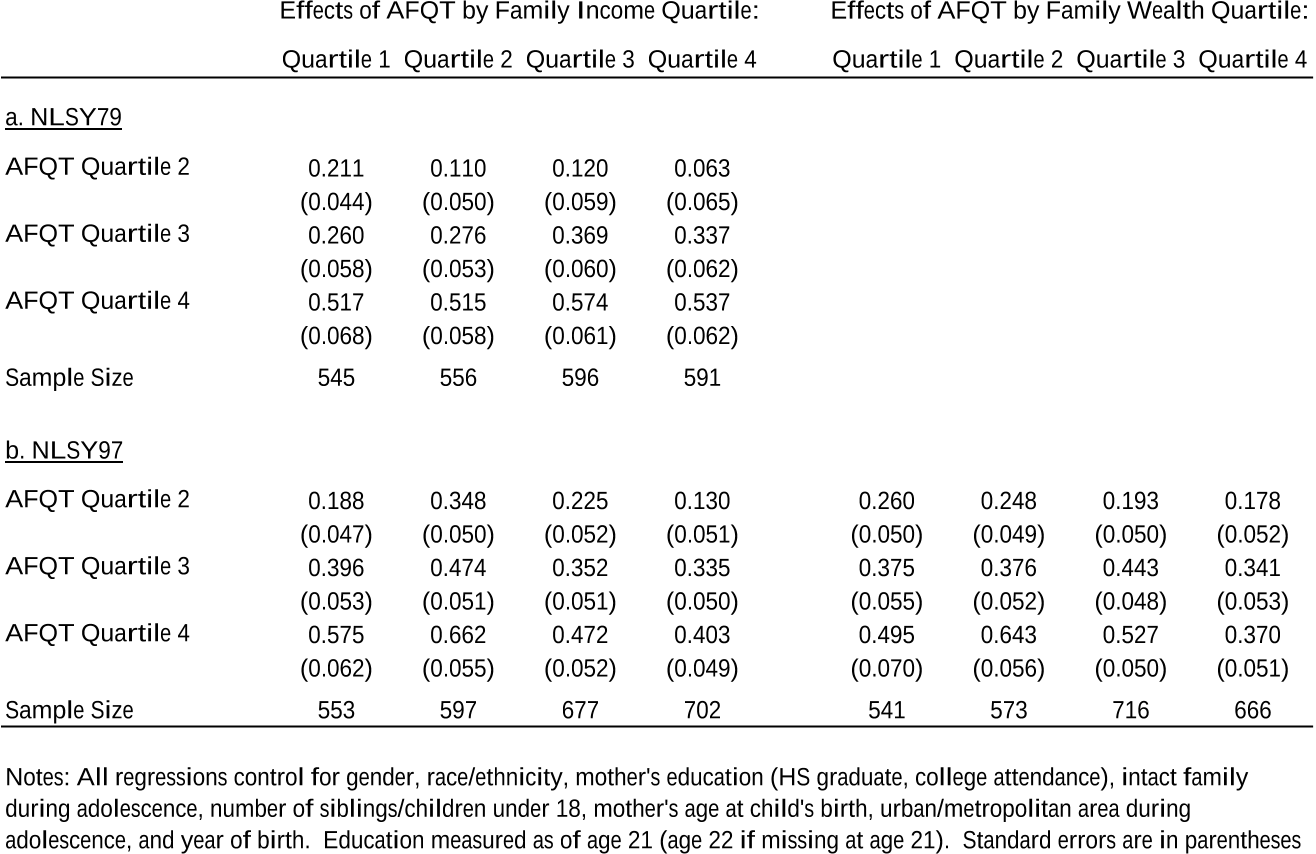

Table 2: Estimated Effects of AFQT on College Attendance by Family Income and Wealth (NLSY79 and NLSY97)

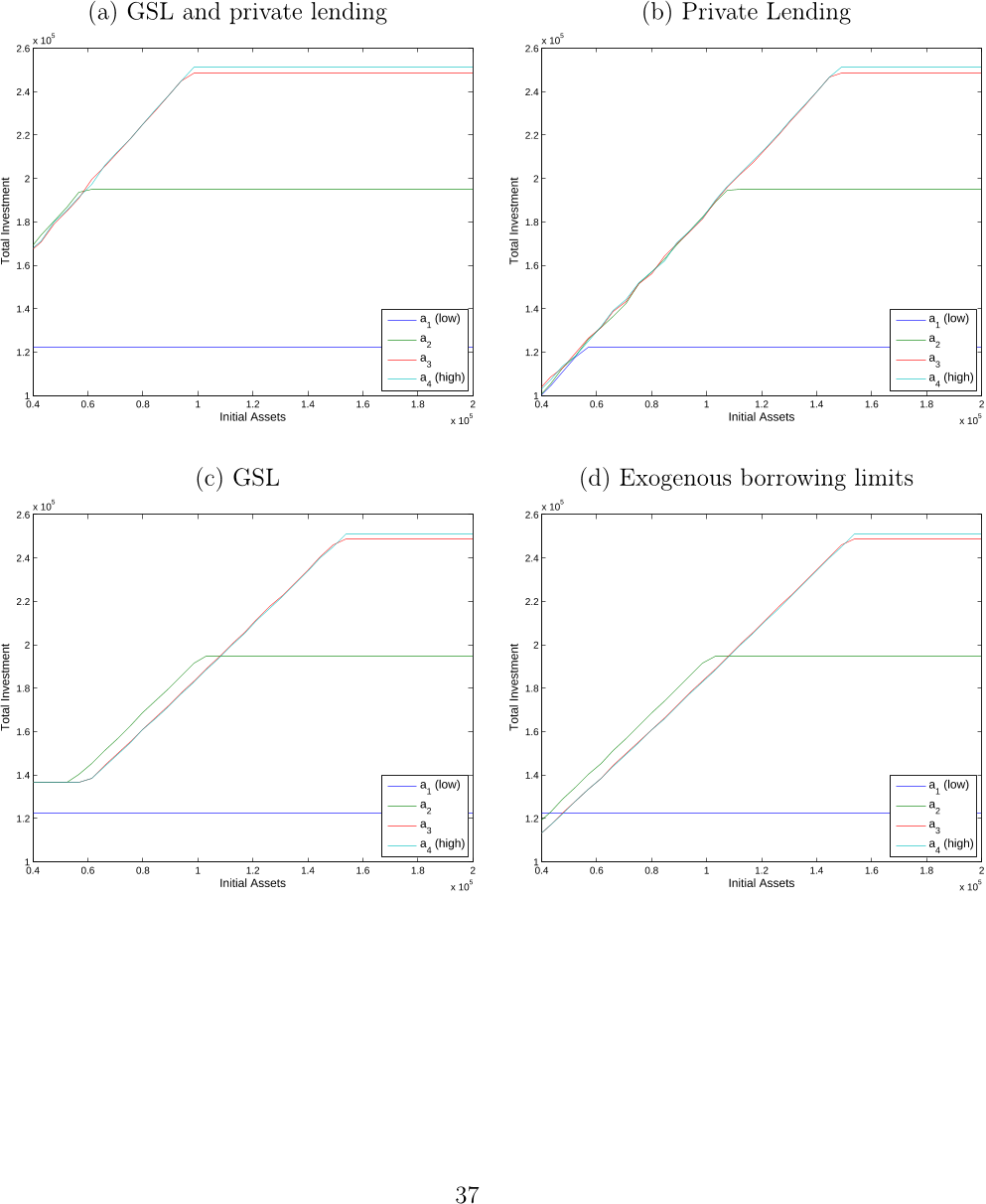

Figure 11: Consumption during Investment Period (‘Year 2000’) with Different Credit Market Assumptions

Figure 2: College Attendance by AFQT and Family Income or Wealth (NLSY79 and NLSY97)

Table 1: Borrowing Limits for Stafford and Perkins Student Loan Programs (1993-2007)

Figure 5: Sufficient Condition for a positive ability-investment relationship in the L model.

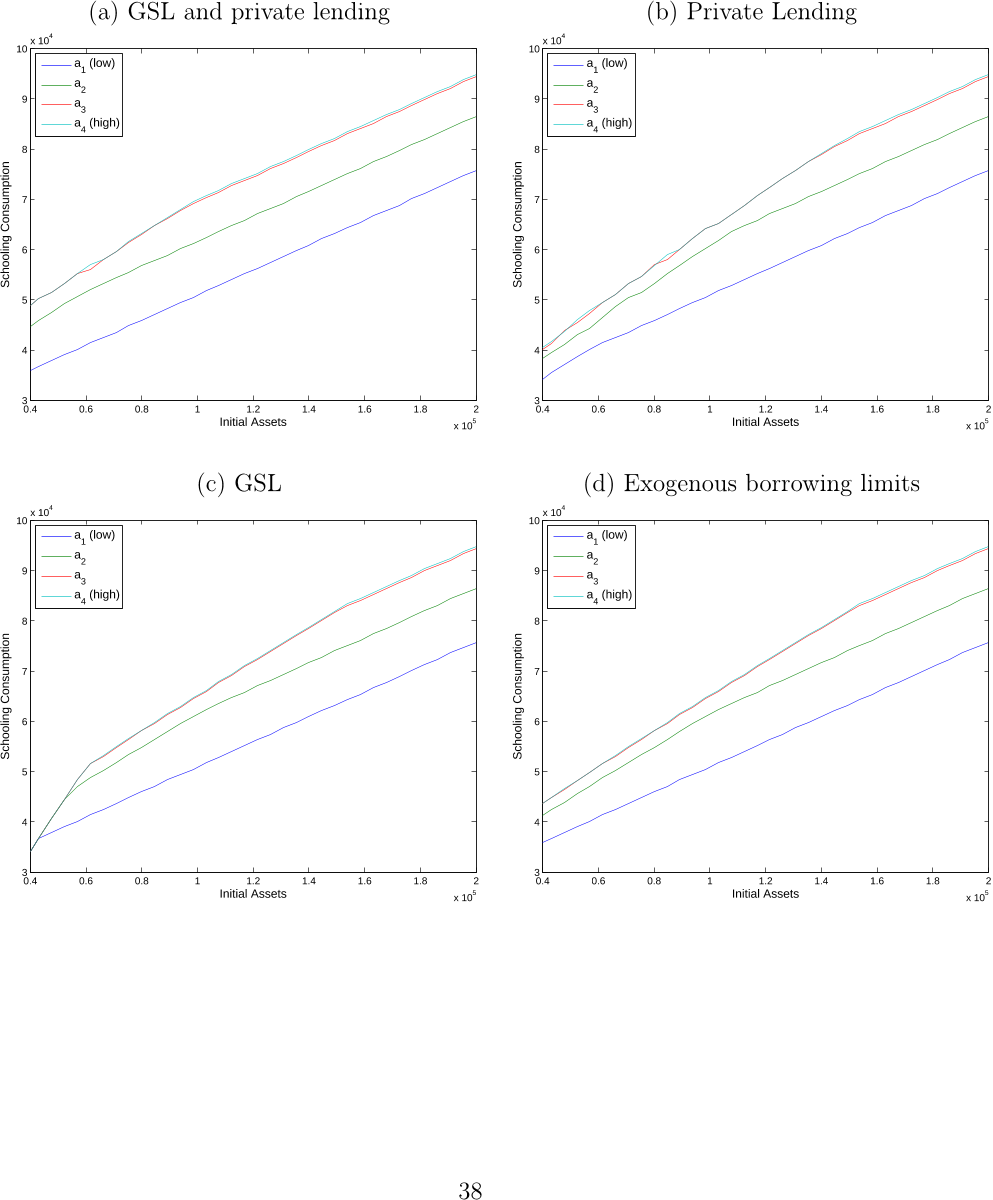

Figure 10: Total Investment (‘Year 2000’) with Different Credit Market Assumptions

Figure 1: Annual Stafford Loan Limits for Dependent Undergraduates from 1980-2006 (Year 2000 Dollars)

Figure 6: GSL and Private Lending Constraints (Baseline Economy)

Figure 7: Private Borrowing (Baseline Economy)

Citations

463 citations

383 citations

Cites background from "The Nature of Credit Constraints an..."

...…markets and full opportunities to borrow, the human capital investment decision of how much education to acquire is separable from the consumption and savings choice at each moment in time conditional on expected lifetime earnings (for a formal demonstration, see Lochner and Monge-Naranjo 2011)....

[...]

...Because private lenders have a greater capacity to discriminate among borrowers by their choice of collegiate investments, higher-ability students and students enrolled in the most remunerative degree programs will be offered more credit by private lenders (Lochner and Monge-Naranjo 2011)....

[...]

300 citations

276 citations

Additional excerpts

...3 See Cameron and Taber ð2004Þ, Belley and Lochner ð2007Þ, Stinebrickner and Stinebrickner ð2008Þ, or Lochner and Monge-Naranjo ð2011Þ....

[...]

203 citations

References

2,619 citations

"The Nature of Credit Constraints an..." refers methods in this paper

..., the widely used Yoram Ben-Porath (1967) model)....

[...]

2,272 citations

1,585 citations

1,079 citations

"The Nature of Credit Constraints an..." refers background in this paper

...Hansen and Weisbrod (1969) represents an early empirical analysis of educational attainment gaps by family income; although, their primary focus is on the redistributive effects of education subsidies....

[...]

...Hansen and Weisbrod (1969) represents an early empirical analysis of educational attainment gaps by family income; although, their primary focus is on the redistributive effects of education subsidies. Manski and Wise (1983) emphasize borrowing constraints specifically as an explanation for their estimated family income – schooling gaps....

[...]