Did you find this useful? Give us your feedback

4 citations

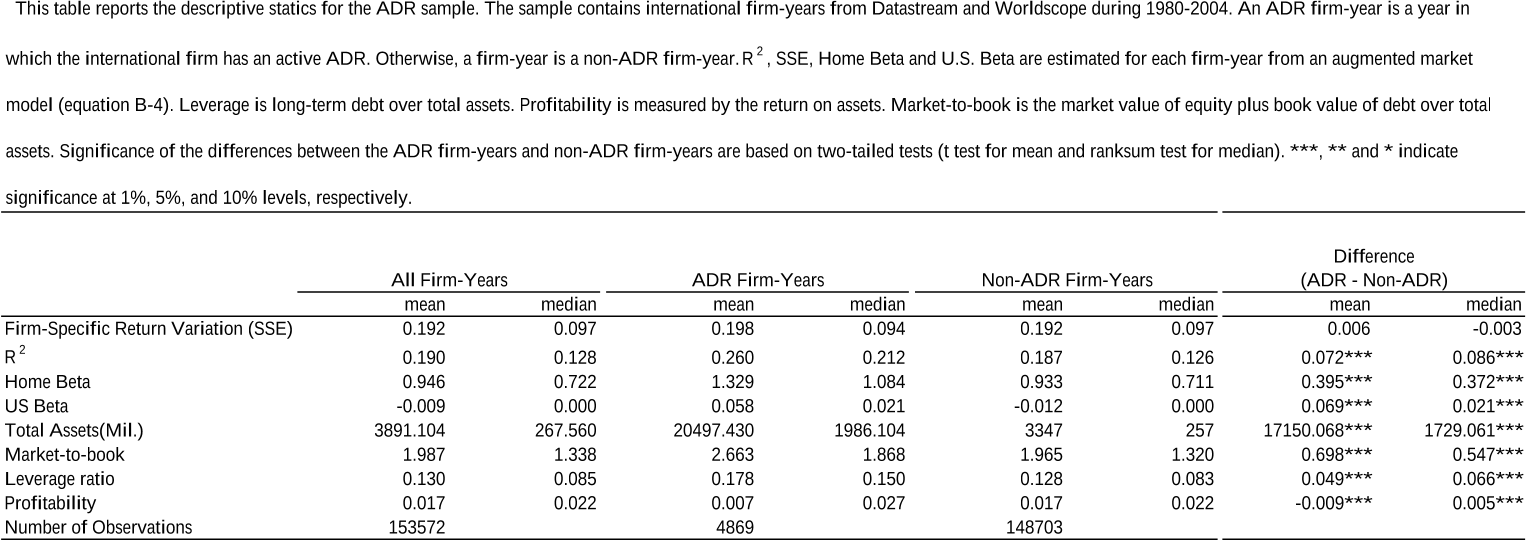

...This measure was first introduced in the seminal paper by Roll (1988) and has subsequently been commonly used in the literature on stock price informativeness (Dasgupta et al., 2010; Durnev et al., 2004; Morck et al., 2000)....

[...]

...In addition, I construct a measure of how much private information is impounded into stock prices of ADR shares based on price synchronicity (Chen et al., 2007; Dasgupta et al., 2010)....

[...]

4 citations

4 citations

4 citations

4 citations

...Dasgupta et al. (2010) document theoretically and empirically that price informativeness decreases with idiosyncratic volatility.8 A number of studies suggest that idiosyncratic volatility captures changes in asymmetric information in the time-series dimension (e.g., Dierkens (1991), Krishnaswami…...

[...]

...This relationship is corroborated by theoretical models (Glosten and Milgrom (1985)) and empirical evidence (French and Roll (1986))....

[...]

24,874 citations

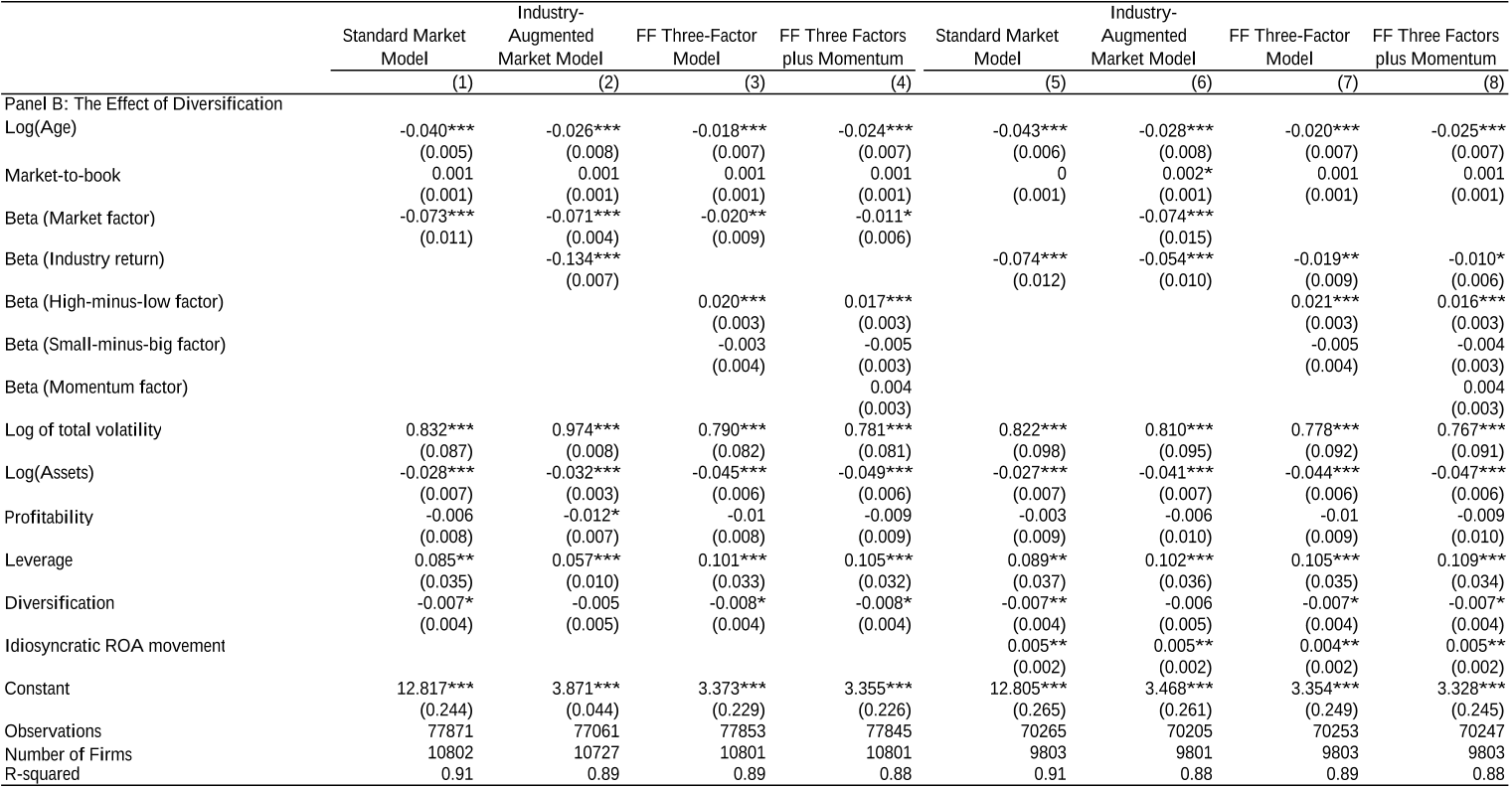

...Here R 2 and β are estimated from a market model (equation (B-1)) in columns (1) and (2); from an industry-augmented market model in column (3); from the Fama and French (FF) (1993) 3-factor model and a 4-factor model with momentum (equations (B-2) and (B-3)) in columns (4) and (5)....

[...]

13,489 citations

...For share prices to reflect information, arbitrageurs need to expend resources uncovering proprietary information about the firm (Grossman (1976), Shleifer and Vishny (1997))....

[...]

10,954 citations

2,805 citations

2,761 citations

...5Lang and Lundholm (1996) examine the relation between firms’ disclosure policies, analyst following, and the accuracy of analysts’ forecasts....

[...]