Stock Return Synchronicity and the Informativeness of

Stock Prices: Theory and Evidence

1

Sudipto Dasgupta

∗

Jie Gan

+

Ning Gao

#

JEL Classification Code: G14, G39

Keywords: Stock return synchronicity; R

2

; Firm-specific return variation; Informativeness

of stock prices; Transparency; Seasoned equity offering; Cross listing.

1

We thank Utpal Bhattacharya, Michael Brennan, Kalok Chan, Craig Doidge, Art Durnev, Robert Engle, Li Jin,

Ernst Maug, Stewart Myers, Wei Jiang, Anil Makhija, Bill Megginson, Randall Morck, Mark Seasholes, Jeremy

Stein, Martin Walker, Bernard Yeung and participants at the 2006 Financial Intermediation Research Society

Conference and the 2006 WFA Conference for helpful comments and discussions. We are grateful to Hendrik

Bessembinder (the editor) and two anonymous referees for their comments and suggestions which greatly improved

the paper.

∗

Department of Finance, Hong Kong University of Science and Technology, Clear Water Bay, Kowloon, Hong

Kong. Email: dasgupta@ust.hk.

+

Department of Finance, Hong Kong University of Science and Technology, Clear Water Bay, Kowloon, Hong

Kong. Email: jgan@ust.hk.

#

The Manchester Accounting and Finance Group, Manchester Business School, the University of Manchester,

Booth Street West, Manchester, M15 6PB, United Kingdom. Email: ning.gao@mbs.ac.uk.

1

Stock Return Synchronicity and Informativeness of Stock

Prices: Theory and Evidence

Abstract

This paper argues that, contrary to the conventional wisdom, stock return synchronicity (or R

2

) can

increase when transparency improves. In a simple model, we show that, in more transparent

environments, stock prices should be more informative about future events. Consequently, when the

events actually happen in the future, there should be less “surprise”, i.e., there is less new information

impounded into the stock price. Thus a more informative stock price today means higher return

synchronicity in the future. We find empirical support for our theoretical predictions in three settings,

namely firm age, seasoned equity issues, and listing of ADRs.

JEL Classification Code: G14, G39

Keywords: Stock return synchronicity; R

2

; Firm-specific return variation; Informativeness

of stock prices; Transparency; Seasoned equity offering; Cross listing.

2

I. Introduction

Financial economists generally agree that in efficient markets, stock prices change to

reflect available information – either firm-specific or market-wide. Recent literature has

addressed the question of how a firm’s information environment (disclosure policy, analyst

following) or its institutional environment (property rights protection, quality of government,

legal origin) can affect the relative importance of firm-specific as opposed to market wide factors

(Jin and Myers (2006), Piotroski and Roulstone (2003), Chan and Hameed (2006), and Morck,

Yeung, and Yu (2000)). This literature has taken the perspective that if the firm’s environment

causes stock prices to aggregate more firm-specific information, market factors should explain a

smaller proportion of the variation in stock returns. In other words, the stock return synchronicity

or R

2

from a standard market model regression should be lower.

This perspective, while intuitive, is at odds with another equally intuitive implication of

market efficiency. In efficient markets, stock prices respond only to announcements that are not

already anticipated by the market. When the information environment surrounding a firm

improves and more firm-specific information is available, market participants are also able to

improve their predictions about the occurrence of future firm-specific events. As a result,

prevailing stock prices are likely to already “factor in” the likelihood of occurrence of these

events. When the events actually happen in the future, the market will not react to such news,

since there is little “surprise”. In other words, more informative stock prices today should be

associated with less firm-specific variation in stock prices in the future. Therefore, the return

synchronicity should be higher.

In this paper, we present a simple model to illustrate the point that a more transparent

information environment can lead to higher, rather than lower, stock return synchronicity. This is

3

because, for a more transparent firm, there is already more information available to market

participants, reducing the “surprise” from future announcements. In our model, we distinguish

between two types of firm-specific information. One pertains to time-varying firm

characteristics, reflecting the current state of the firm, such as next quarter’s earnings. The other

is time-invariant, such as managerial quality.

2

Stock return synchronicity can increase

subsequent to an improvement in transparency through disclosure of both types of information.

First, greater transparency can lead to early disclosure of time-variant information. This can

happen around major events such as seasoned equity issues (SEOs) or cross-listings, during

which a big chunk of information about future events is revealed. Thus when future events

actually happen, there is less “surprise” and hence less additional information to be incorporated

in the stock price, resulting in a higher return synchronicity.

3

While the positive effect of greater

transparency on return synchronicity is most significant in the case of a one-time lumpy

disclosure, we show that it also holds in the more general setting with regular, early disclosure of

information. In particular, we show that in a dynamic setting, if at the beginning of every period,

outsiders get to know (one period ahead of time) some of the information that otherwise would

come out at the end of the period, the return synchronicity is actually higher.

The second channel through which greater transparency increases stock return

synchronicity is due to learning about time-invariant firm-specific characteristics, such as

managerial quality. In particular, better disclosure allows market participants to learn about time-

invariant firm fundamentals with greater precision (e.g., in the extreme case where the

2

Strictly speaking all firm characteristics are time varying in the very long run. Here we refer to those

characteristics that do not change frequently or do not change much over time (so that they do not affect valuation

significantly) as “time-invariant.”

3

Shiller (1981) notes theoretically that if dividend news arrives in a lumpy and infrequent way, stock price volatility

becomes lower. If much of the dividend news reflects firm specific information, one would also expect return

synchronicity to become higher.

4

fundaments are completely known, there is no new learning). Therefore, with more disclosure,

the priors about these fundamentals will be revised less drastically as new information comes in.

As a result, there will be less firm-specific variation in stock prices, i.e., the return synchronicity

will be higher.

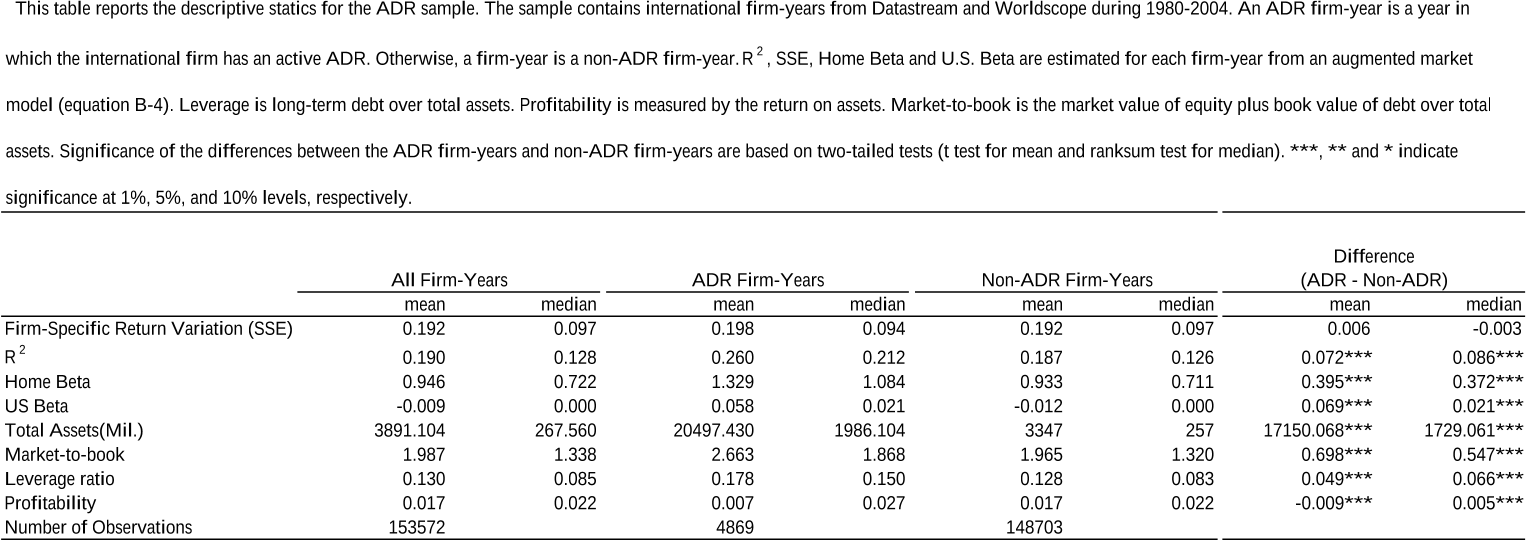

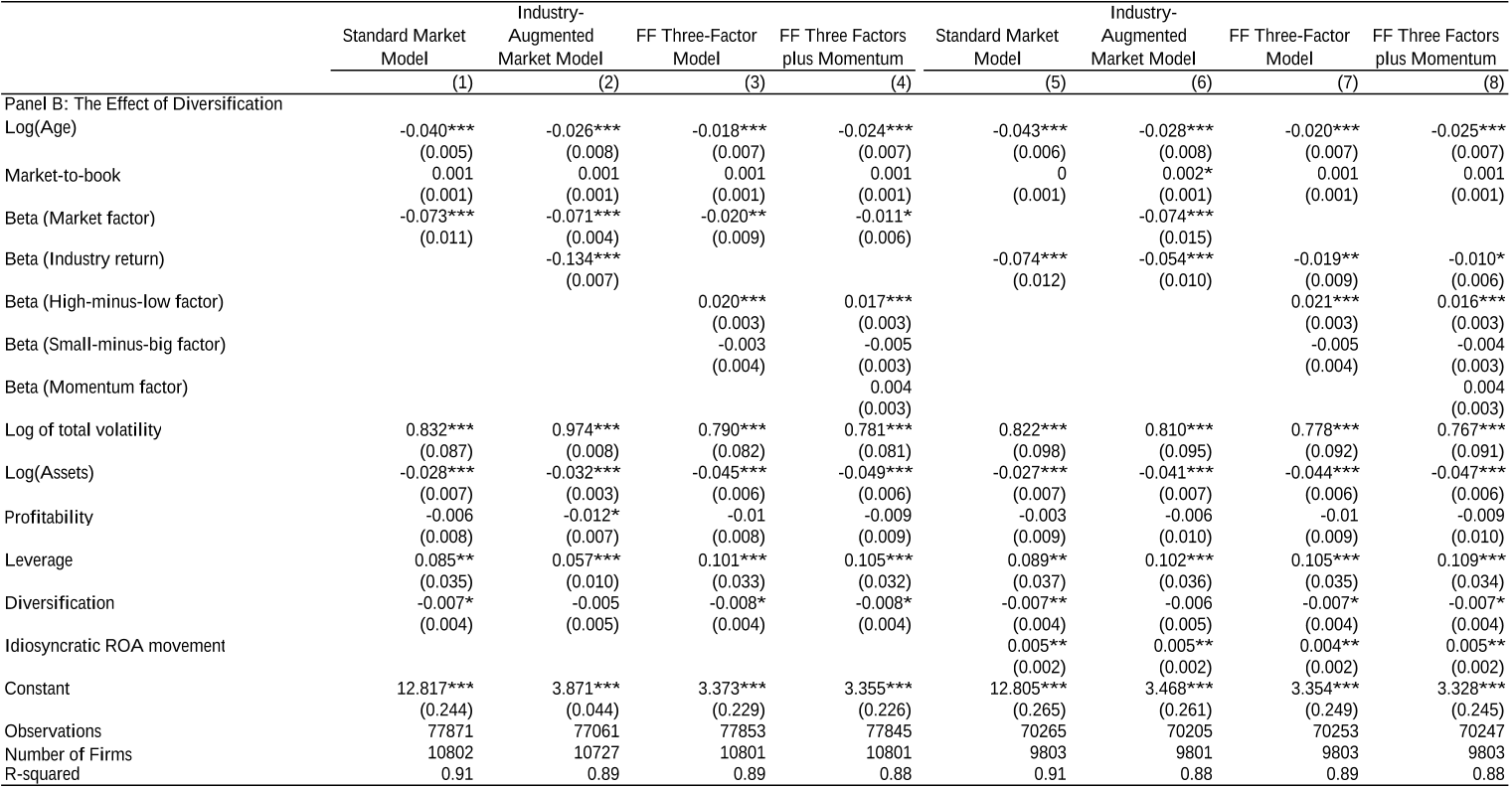

We present three pieces of empirical evidence consistent with our model’s predictions.

We first provide evidence of learning about time-invariant firm-specific information. The idea is

that, as a firm becomes older, the market learns more about its time-invariant characteristics, e.g.,

the firm’s intrinsic quality. Therefore, return synchronicity should be higher for older firms,

since more of the (time-invariant) firm-specific information is already reflected in the stock

price. This prediction is strongly supported by the data.

Second and third, we exploit the fact that the effect of greater transparency on stock

return synchronicity is likely to be especially clear when the disclosure is “lumpy”, in the sense

that the market receives a big chunk of information relevant for future cash flows. Therefore, we

focus on seasoned equity offerings (SEOs) and cross-listings in the U.S.

4

It is well known that

both events are associated with significant amounts of information disclosure and market

scrutiny (see, e.g., Almazan et al. (2002) for SEO, and Lang et al. (2003) for ADR listings). Our

model suggests a dynamic response of return synchronicity to an improvement in the information

environment. At the time when new information is disclosed and impounded into stock prices,

the firm-specific return variation will increase, as suggested by conventional wisdom. However,

since a big chunk of relevant information is already reflected in stock prices, we would expect

the firm-specific return variation of SEO and cross-listed firms to be subsequently lower. This

dynamic response of the firm-specific return variation around seasoned equity issues and cross-

4

While firms can list their shares in the U.S. exchanges either through ADRs or through direct listings, the literature

sometimes uses the two terms “cross listings” and “ADR listings” interchangeably (see, e.g., Lang, Lins, and Miller

(2003)). In the rest of this paper, we follow this convention, except when we discuss our sample.

5