Paul Mason

Baylor University

(254) 710-6129

p_mason@baylor.edu

Steven Utke

University of Connecticut

(860) 486-2374

sutke@uconn.edu

and

Brian Williams*

Indiana University

(812) 855-5725

bw63@indiana.edu

November 2, 2020

Keywords: Tax Evasion, Tax Morale, Quality of Government, Perceived Influence, Procedural

Fairness

JEL codes: H26

Data Availability: Data used in this study are available from public sources identified in the

paper, except as otherwise specified.

*Corresponding Author: Brian Williams, Kelley School of Business, Indiana University,

Bloomington IN 47403, 812-855-5725, bw63@indiana.edu

_______________

We gratefully acknowledge the support of our respective institutions. This paper has benefited

from helpful comments from Shannon Chen (discussant), Jennifer Glenn, David Guenther, Brad

Hepfer, Jenny Luchs, Sean McGuire, Bridget Stomberg, John Robinson, Connie Weaver (editor),

Dave Weber, two anonymous reviewers, the University of Arizona Tax Readings Group, the

Texas A&M Tax Readings Group, conference participants at the 2018 American Taxation

Association Midyear meeting, and workshop participants at the University of Connecticut. The

analysis in this paper uses data from the World Bank Group’s Enterprise Surveys and was

accessed by the authors under a strict confidentiality agreement. The analysis, interpretations,

and conclusions expressed in this paper are those of the authors and do not represent official

positions of the World Bank.

2

Why Pay Our Fair Share? How Perceived Influence over Laws Affects Tax Evasion

Abstract

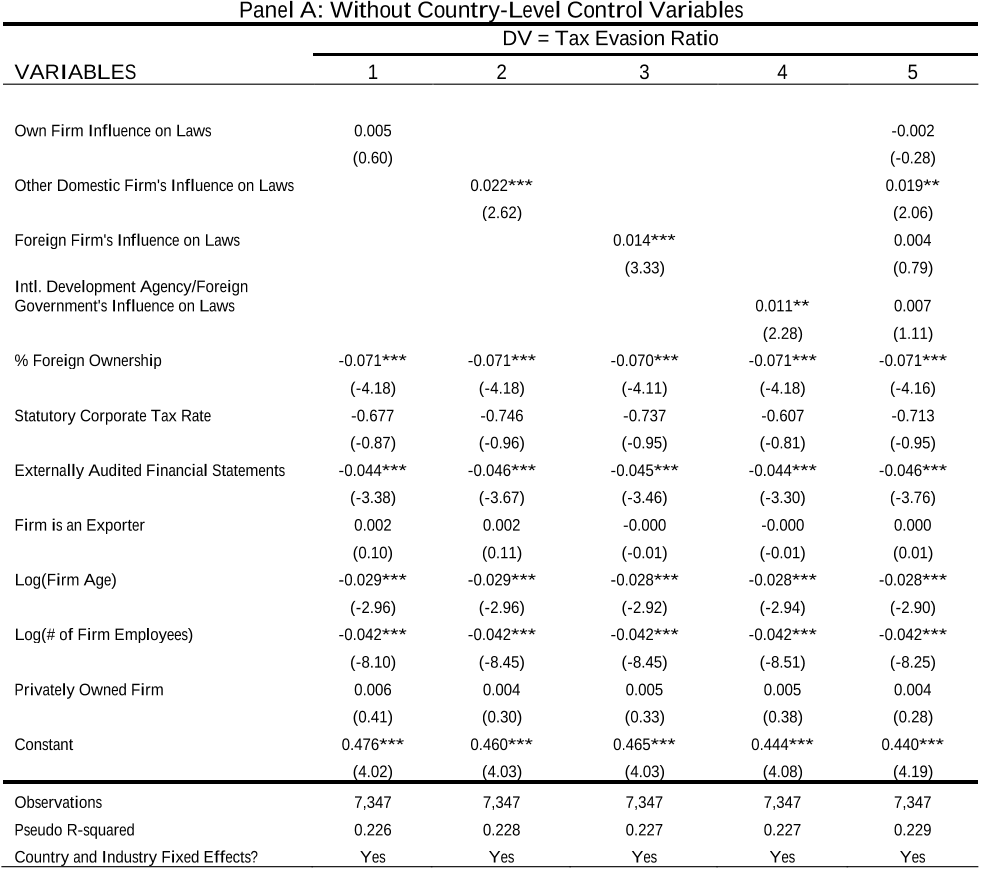

We examine how the relation between taxpayers and their government affects tax evasion.

Specifically, we examine how perceived influence over government policymaking affects firms’

decisions to evade tax. We argue that firms are less willing to comply with tax laws when they

perceive the influence over their government to be unfavorable to them or the result of an unfair

policymaking process. Consistent with this argument, we find that firms evade more tax when

other domestic firms have more perceived influence over domestic government policymaking.

This suggests a potential negative externality of lobbying: higher tax evasion by other firms.

However, government effectiveness or lack of corruption eliminates the positive relation

between evasion and perceived influence over policymaking. Our results suggest that limiting

domestic firms’ influence over policymaking could help governments decrease tax evasion.

1

INTRODUCTION

Tax evasion continues to gain public and governmental attention (Beck, Lin, and Ma

2014; Hanlon, Maydew, and Thornock 2015; Slemrod 2018), especially following the 2008

financial crisis and the subsequent criticism of firms not paying their “fair share” of taxes (e.g.,

Starbucks in the UK; Barford and Holt 2013). Tax evasion is particularly problematic in

developing countries, the subject of our study, and has especially negative effects in those

countries (Bearak 2016). However, tax evasion is also an issue in developed countries such as

the U.S.; the Internal Revenue Service (IRS) estimates that lost revenue from underreporting of

income (i.e., tax evasion) exceeds $350 billion annually, with a non-compliance rate of 18.3

percent.

1

That is, 18.3 percent of the tax that should be collected is not collected because of

evasion. With governments world-wide facing budgetary issues, understanding tax evasion is

particularly important due to the economic significance of the lost governmental revenue

involved.

In this study, we explore an important but understudied aspect of tax evasion: firms’

relation with the government. Specifically, we explore how firms’ perceptions of who influences

domestic government policymaking affects firms’ decisions to evade taxes.

2

We identify three

separate and distinct groups that firms can perceive as influencing policymaking: domestic firms

(including the taxpaying firm and other domestic firms), foreign firms, and international

development agencies/foreign governments. We propose that this perceived influence affects

firms’ tax compliance decisions.

3

Existing literature on non-deterrence aspects of tax compliance

1

https://www.irs.gov/PUP/newsroom/tax%20gap%20estimates%20for%202008%20through%202010.pdf, accessed

April 10, 2017.

2

Consistent with recent research (e.g., Bertrand and Schoar 2003), we acknowledge that managers, not firms, make

the firms’ decisions. Despite this, for ease of exposition throughout the paper we refer to firms’ decisions, rather

than the decisions of the firms’ managers.

3

Prior tax evasion research often focuses on individual taxpayers (e.g., Allingham and Sandmo 1972). However,

Slemrod (2018) points out that the majority of individuals’ tax evasion stems from the underreporting of business

2

often focuses on individual taxpayers’ attitudes and perceptions regarding other taxpayers

(Slemrod 2018).

4

However, tax compliance may also be a function of firms’ attitudes towards the

government and the perceived fairness of the tax system (e.g., Levi 1989; Alm, Jackson, and

McKee 1992a; Bordignon 1993; Braithwaite and Levi 1998). Thus, we extend this literature to

incorporate the role of perceived influence over government policymaking on tax evasion.

Consistent with Tyler (1997, 2006) and Levi (1998), we conjecture that taxpayers are less

likely to pay tax when they view government policymaking as legitimate, trustworthy, and

following a fair process (i.e., procedural fairness). If procedural fairness decreases (or increases)

due to other parties’ influence on policymaking, we should observe an effect on tax evasion.

Perceived influence on government policymaking includes influence over tax policies as well as

non-tax policies such as those regarding expenditures of tax revenue, with influence over either

type of policy potentially affecting the procedural fairness of policymaking and thus tax evasion

decisions. Moreover, the perceived influence over government policymaking and its effect on tax

evasion may vary depending on the source of the influence. That is, whether firms perceive the

influence to have a positive or negative effect may depend on who influences the government.

5

How perceptions of influence over government policymaking affect tax evasion presents an

important open empirical question, especially considering that the overall effect of the perceived

income in small businesses, which are the focus of our study. Thus, we refer to survey respondents in our sample as

firms rather than individuals. Importantly, our sample contains a significant number of closely held firms (>60

percent of sample firms) where the survey respondent is likely the firm’s majority (controlling) owner. Furthermore,

even when a firm is not closely held, the manager’s survey response reflects the manager’s attitude towards tax

evasion and the manager’s personal tax evasion decisions, which are reflected in firm behaviors (Johnson,

Kaufmann, McMillan and Woodruff 2000; Joulfaian 2000; Chyz 2013). See also Cen and Doukas (2018).

4

Non-deterrence aspects of tax compliance include “behavioral” considerations such as intrinsic willingness to pay

tax (see Slemrod (2018) and Alm (2019) for reviews) whereas deterrence aspects include items such as audits,

penalties, and the probability of detection (Allingham and Sandmo 1972). Perceived influence over policymaking, as

we study in this paper, is a non-deterrence aspect of tax compliance. The next section provides a more detailed

discussion of both non-deterrence and deterrence models of tax compliance. Note that tax compliance and tax

evasion are inverses (i.e., evasion equals non-compliance), and we use both terms in this paper.

5

Frumin (2015), Helderman, Hsu, and Hamburger (2016), Kalla and Broockman (2016), and Brown and Huang

(2017) show that government policy is subject to influence.

3

fairness of the tax system on tax evasion is ambiguous (see Cowell 1990 for a review).

As is common in the tax evasion literature (e.g., Andreoni, Erard, and Feinstein 1998),

we explore this question using a survey. Specifically, we obtain survey data covering 37

developing countries from the World Bank Private Enterprise Survey for years 2002 through

2004 (similar data is used, for example, in Beck et al. [2014]). Using this data, we measure

firms’ tax evasion as a function of the perceived influence over government policymaking by

various separate and distinct groups including the taxpaying firm, other domestic firms, foreign

firms, and international development agencies or foreign governments. This data enables us to

understand the association, if any, between tax evasion decisions and perceived influence over

government policymaking. Our sample consists of developing countries, which are most likely to

suffer negative consequences from tax evasion (e.g., Bearak 2016).

6

However, understanding the

behavioral responses to perceived influence on policymaking, especially the influence of foreign

entities, is increasingly important across all countries as globalization continues (see, e.g.,

Swanson [2016] for an example unrelated to tax evasion).

We acknowledge that survey data on tax evasion is often subject to self-reporting bias

(Slemrod 2007). However, our survey has an advantage over some prior surveys in that, rather

than asking about the firm’s own (potentially incriminating) evasion, the survey asks about the

firm’s perception of the tax evasion of other local businesses in the industry to elicit more

truthful responses. Prior literature suggests that one’s perception of others’ evasion is linked to

one’s own evasion (e.g., Sandmo 2005) and therefore generally uses this perception to proxy for

6

For example, Brazilian firms created a large ‘informal economy’ to evade tax. The informal economy harms

development by discouraging legitimate business while encouraging organized crime (Rapoza 2004). Further, the

loss of governmental revenue leads to higher taxes, and thus more evasion, creating the need to devote significant

portions of scarce government resources to combating evasion (Rapoza 2004; Soto 2012).