WHY WERE LATIN AMERICA’S TARIFFS SO

MUCH HIGHER THAN ASIA’S BEFORE 1950?*

MICHAEL A. CLEMENS

Center for Global Development

a

JEFFREY G. WILLIAMSON

Harvard University and the University of Wisconsin

b

ABSTRACT

Latin America had the highest tariffs in the world before 1914; Asia had

the lowest. Heavily protected Latin America also boasted some of the most

explosive belle e

´

poque growth, while open Asia registered some of the least.

What brought the two regions to the opposite ends of the tariff policy spectrum?

We find that limits to Asian tariff policy autonomy may have lowered tariffs

substantially there, but by themselves they cannot explain why Asian tariffs

were so much lower than the Latin American tariffs before 1914; that natural

barriers, domestic political economy and strategic tariff policy seems to have

contributed much to the difference and that the origins of Asian post-World

War 2 import-substitution policies seem to lie in the interwar years when Asian

tariff levels caught up with those of Latin America.

Keywords: tariffs, Latin America, Asia, growth, history

JEL Code: F13, N70, O24

RESUMEN

Ame

´

rica Latina tuvo los aranceles ma

´

s altos del mundo antes de 1914;

Asia tuvo los ma

´

s bajos. Fuertemente protegida, Ame

´

rica Latina tambie

´

n

*

Received 12 April 2011. Accepted 19 July 2011.

a

1800 Massachusetts Avenue NW, 3

rd

floor, Washington, DC 20036, USA. mclemens@cgdev.org.

b

350 South Hamilton Street, Unit 1002, Madison, WI 53703, USA. jwilliam@fas.harvard.edu.

Revista de Historia Econo

´

mica, Journal of lberian and Latin American Economic History

Vol. 30, No. 1: 11-44. doi:10.1017/S021261091100019X & Instituto Figuerola, Universidad Carlos III de Madrid, 2011.

11

ofrecio

´

uno de los crecimientos ma

´

s explosivos de la belle e

´

poque mientras

Asia mostraba uno de los menores. +Fue el diferente espectro de la polı

´

tica

arancelaria lo que llevo

´

a estas dos regiones a destinos tan opuestos? Nosotros

encontramos: que los lı

´

mites a la autonomı

´

adelapolı

´

tica arancelaria en Asia

habrı

´

an contribuido considerablemente a reducir los aranceles, pero no pue-

den explicar por sı

´

mismos por que

´

los aranceles fueron mucho ma

´

s bajos que

en Ame

´

rica Latina antes de 1914; las barreras naturales, la economı

´

apolı

´

tica

nacional y las polı

´

ticas arancelarias estrate

´

gicas parecen haber contribuido

mucho a la diferencia en el comportamiento del crecimiento de estas dos zonas

ylosorı

´

genes de la polı

´

tica de sustitucio

´

n de importaciones asia

´

tica posterior a

la II Guerra Mundial parecen extenderse al periodo de entreguerras cuando los

niveles arancelarios asia

´

ticos convergieron con los de Ame

´

rica Latina.

Palabras clave: aranceles, Ame

´

rica Latina, Asia, crecimiento, historia

1. INTRODUCTION

While many have compared Latin American and Asian trade policy since

1950, few have extended the comparison to the preceding century. The best

evidence from the long 19

th

century through World War (WW) 2 reveals

tremendous contrasts between the two regions. These demand explanation.

Latin America had the highest tariffs in the world before 1914; Asia had

the lowest. The Latin American belle e

´

poque also boasted some of the highest

growth rates, while Asia registered some of the lowest. What brought the two

regions to the opposite ends of the tariff policy spectrum? Was it simply that

Latin America had policy autonomy, while most of colonial Asia did not, or

was the political economy of tariffs more complex? Why did Asian tariffs

catch up with those high Latin American tariffs in the 1920s and 1930s? Do

historical patterns of growth and tariff policy in the two regions accord with

recent conventional wisdom that free trade fosters growth?

This paper uses the historical record of tariff policy to begin an

exploration of all of these questions. We use average ad valorem-equivalent

tariff rates and describe their correlates with tariff autonomy and other

political economy forces in the two regions. Average tariff rates cannot, of

course, settle questions about «protection» more generally, which includes

policies other than tariffs, and they lack fine-grained information about

relative protection of different industries. Since overall tariffs differed vastly

between the two regions, they are certainly a good place to begin.

We first describe our tariff database. We use these data to explore the partial

correlations between import duty levels and the conditions under which they

were set — including colonial rule, «unequal treaties», world market condi-

tions, geography and the local political economy environments. We find that

while limits to Asian tariff policy autonomy certainly lowered tariffs there

MICHAEL A. CLEMENS/JEFFREY G. WILLIAMSON

12 Revista de Historia Econo

´

mica, Journal of lberian and Latin American Economic History

substantially, they cannot by themselves explain why Asian tariffs were so

much lower than the Latin American tariffs before 1914; that natural barriers,

domestic political economy and strategic tariff policy seem to have contributed

much to the difference and that the origins of Asian post-WW2 import-sub-

stitution policies seem to lie in the interwar years when Asian tariffs caught up

with those of Latin America. At the end of the paper, we pose a research

agenda: Does tariff policy explain most of the differences in industrialisation

experience within and between the two regions, or did other factors — like

terms of trade trends, the evolution of wage, fuel, and intermediate costs and

productivity catch up with the leaders — matter much more?

2. THE TARIFF DATA

A well-developed international literature makes it clear that trade shares

are very poor measures of openness, since they are endogenous and can be

driven by demand and supply factors within countries that are completely

independent of trade policy

1

. Among the explicit policy measures of openness

available, the average tariff rate is by far the most homogeneous protection

measure and the easiest to collect across countries and over time. We are, of

course, aware that countries can have the same average tariff levels, but very

different tariff structures

2

. Nevertheless, high average tariffs typically meant

even higher tariffs on manufactures in primary-product exporting countries

3

.

We are also aware that by the late 1930s every country had learnt how to use

non-tariff barriers (NTBs), especially the manipulation of the real exchange

rate to favour import-competing industries. However, NTBs were not used

very frequently before the early 1930s, and nearly every country was on a fixed

exchange standard before WW1 and again in the 1920s. In short, tariffs were

the main instrument of trade policy before the 1930s. In any case, high tariffs

were also positively correlated with the use of NTBs. Thus, it seems to us that

1

For example, see Anderson and Neary (1994), Sachs and Warner (1995) and Anderson (1998).

Indeed, it appears that totally 67 per cent of the late 20

th

century Organisation for Economic

Cooperation and Development trade boom can be explained by unusually fast income growth, and

not by the decline in trade barriers (Baier and Bergstrand 2001). To cite another example, 50 to 65

per cent of the European overseas trade boom in the three centuries following 1492 were driven by

income growth, rather than by any decline in trade barriers (O’Rourke and Williamson 2002,

p. 439). As a final example, 57 per cent of the world trade boom from 1870 to 1913 was explained by

the income growth (Estevadeordal et al. 2003, Table III).

2

See, for example, Lehmann and O’Rourke (2011) on 19

th

century Europe, and Nunn and

Trefler (2010) on the 20

th

century world economy.

3

See, for example, Bairoch (1993) and Williamson (2011a, Ch. 13). Antonio Ten

˜

a (personal

correspondence) has estimated ad valorem tariffs on British manufacturing exports for four Latin

American republics in 1914 (Argentina, Brazil, Chile and Mexico): while the tariff for all imports

averaged 21.5 per cent, the average tariff on British manufactures averaged 45 per cent, more than

twice as high. Similarly, for the European periphery (Greece, Italy, Portugal, Russia, Spain): while

the average tariff on all imports in 1914 was 18.4 per cent, the tariff on British manufactures was

46.2 per cent, almost three times higher.

LATIN AMERICA’S TARIFFS VS. ASIA’S PRE-1950

Revista de Historia Econo

´

mica, Journal of lberian and Latin American Economic History

13

as an overall measure of protection, average tariffs are the place to start any

empirical analysis of the political economy of protection, even if they are not

the place to finish it. In addition, while high tariffs may not necessarily be the

result of explicit pro-industrialisation goals, they are protectionist regardless

of their motivation.

This paper uses the computed average tariff rate to explore differences

between Asian and Latin American policy experience from shortly after the mid-

19

th

century to WW2. Our country observations from these two regions are part

of a larger world sample of thirty-five, extending up to 1950: the United States;

three members of the European industrial core (France, Germany and the United

Kingdom); three English-speaking European offshoots (Australia, Canada and

New Zealand); ten from the European periphery (Austria–Hungary, Denmark,

Greece,Italy,Norway,Portugal,Russia,Serbia,SpainandSweden);tenfrom

Asia and the Middle East (Burma, Ceylon, China, Egypt, India, Indonesia, Japan,

the Philippines, Siam (Thailand) and the Ottoman Empire (republican Turkey));

and eight from Latin America (Argentina, Brazil, Chile, Cuba, Colombia, Mexico,

Peru and Uruguay). Standard tariff histories focus mainly on seven — Denmark,

France, Germany, Italy, Sweden, the United Kingdom and the United States.

While the tariff data used here have already been exploited to help redress this

big world research imbalance (O’Rourke and Williamson 2002; Clemens and

Williamson 2004; Coatsworth and Williamson 2004a, 2004b; Williamson 2006b),

this paper does much more by focusing in depth on the ten Asian and eight Latin

American countries in our sample, which represent the poor periphery, and by

exploring the crucial interwar experience as well.

Average tariff rates are calculated as the total revenue from import duties

divided by the value of total imports in the same year. In some cases, the

sources used do not distinguish between import and export duties, and report

only total customs duties. However, total customs duties (instead of import

duties) are used in the calculation of average tariff rates only for countries

where the value of export duties have historically been an insignificant share

of total customs duties. Sometimes, the value of import duties collected is

reported for fiscal years, while import data generally refer to calendar years.

While making a consistent effort to compare calendar year duties with

calendar year import values, in cases where calendar year duties figures are

unavailable, fiscal year duties are divided by calendar year imports to calculate

average tariff. In these instances, fiscal year import duties are assumed to

belong to the calendar year in which most of the fiscal year falls

4

.

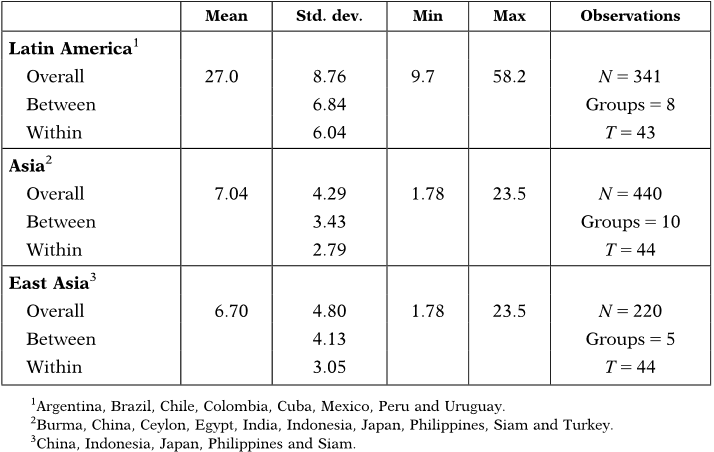

The remainder of this paper defines Latin America as the eight-country

sample consisting of Argentina, Brazil, Chile, Colombia, Cuba, Mexico, Peru

and Uruguay. Asia is defined as the ten-country sample consisting of Burma,

China, Ceylon, Egypt, India, Indonesia, Japan, the Philippines, Siam and

4

A complete appendix description of the sources and methods surrounding the tariff database

can be found in Blattman et al . (2002) and Clemens and Williamson (2004).

MICHAEL A. CLEMENS/JEFFREY G. WILLIAMSON

14 Revista de Historia Econo

´

mica, Journal of lberian and Latin American Economic History

Turkey, while East Asia is defined by the sub-sample of China, Indonesia,

Japan, the Philippines and Siam.

3. EXPLORING TARIFF AUTONOMY

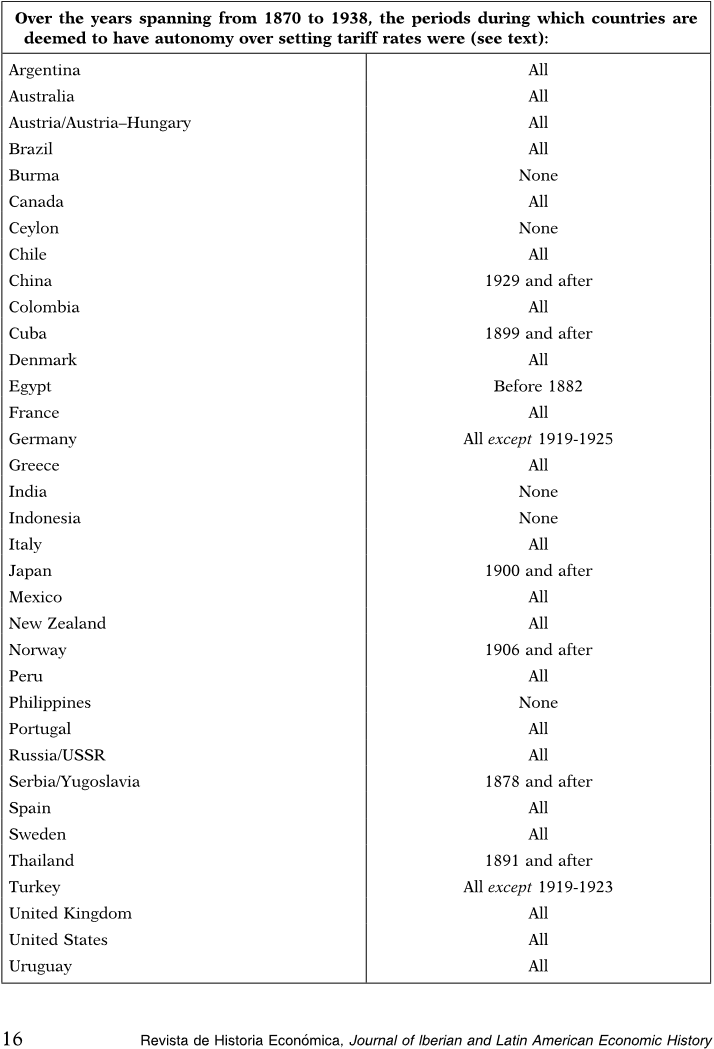

Our analysis requires formalisation of the concept of tariff autonomy, the

freedom to set tariff levels independent of another state’s military and poli-

tical power. Table 1 lists the years in which we judge each country to have

had tariff autonomy. Burma, Ceylon and India were subject to British

imperial tariff collection policies, as Cuba was to the Spanish through 1899,

Indonesia (Netherlands Indies) was to the Dutch and the Philippines was to

both the Spanish up to 1898 and the United States thereafter. The British

Foreign Office in China largely eliminated the tariff restrictions imposed by

the treaties of Nanking and Tientsin in 1929. Norway did not have an inde-

pendent tariff policy under the Swedish crown through 1905. Gradual weak-

ening of Ottoman control in Serbia is construed to imply tariff autonomy

following the 1878 Treaty of Berlin. Egypt is taken to hold tariff autonomy

under non-interventionist Ottoman rule during the years prior to the British

invasion of 1882, but not thereafter. Thailand is taken to recover autonomy

from the grasp of the unequal treaties in 1891, following Ingram (1971,

p. 138), and Japan in 1900, following Lockwood (1968, p. 539). We take

Turkey to have lost tariff autonomy in the brief years between its defeat in

WW1 and Mustafa Kemal’s establishment of the Turkish Republic thereafter.

With these definitions of tariff autonomy in mind, we turn next to colonial

tariff policy, followed by tariff policy under gunboat diplomacy.

3.1. Did Asian Colonies Simply Mimic their Masters?

This is a good place to explore the tariff autonomy issue within the

colonies. There are five colonies in our sample, all in Asia: Burma, Ceylon,

India, Indonesia and the Philippines, although foreign influence was strong

enough (including occupation) to make Egypt behave like a colony after 1881

(see, e.g. Owen 1993, p. 122). To what extent did these six simply mimic their

colonial masters?

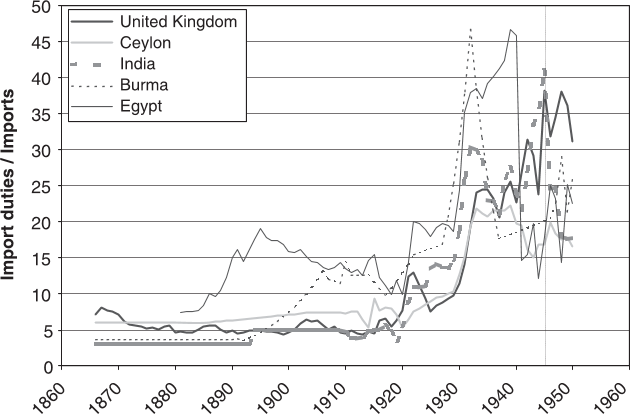

Figure 1 reveals a clear correlation in timing and magnitudes of change in

tariff rates between the United Kingdom and her four colonies in the sample

(Burma, Ceylon, Egypt and India). Figure 2 shows the same for the Philippines,

first for Spain and then for the United States (becoming the imperialist master

in 1899). Table 2 reports the master colony tariff rate correlations for these four

and for the Philippines

5

. Colonial tariff policy did indeed mimic that of the

5

The Netherlands is not part of our sample, and thus we cannot explore the same correlations

between it and Indonesia.

LATIN AMERICA’S TARIFFS VS. ASIA’S PRE-1950

Revista de Historia Econo

´

mica, Journal of lberian and Latin American Economic History

15