YOUR HOUSE OR YOUR CREDIT CARD, WHICH

WOULD YOU CHOOSE?

PERSONAL DELINQUENCY TRADEOFFS AND

PRECAUTIONARY LIQUIDITY MOTIVES

Working Paper No. QAU09-5

Ethan Cohen-Cole

University of Maryland – College Park

Jonathan Morse

Federal Reserve Bank of Boston

This paper can be downloaded without charge

from:

The Quantitative Analysis Unit of the Federal

Reserve Bank of Boston

http://www.bos.frb.org/bankinfo/qau/index.htm

The Social Science Research Network Electronic

Paper Collection:

http://www.ssrn.com/link/FRB-Boston-Quant-

Analysis-Unit.htm

Your House or Your Credit Card, Which Would You Choose?

Personal Delinquency Tradeoffs and Precautionary Liquidity Motives

Ethan Cohen-Cole

University of Maryland - College Park

Jonathan Morse

Federal Reserve Bank of Boston

January 28, 2010

Abstract

This paper presents evidence that precautionary liquidity concerns lead many individuals to pay

credit card bills even at the cost of mortgage delinquencies and foreclosures. While the popular press

and some recent literature have suggested that this choice may emerge from steep declines in housing

prices, we nd evidence that individual-level liquidity concerns are more important in this decision. That

is, choosing credit cards over housing suggests a precautionary liquidity preference.

By linking the mortgage delinquency decisions to individual-level credit conditions, we are able to

assess the compound impact of reductions in housing prices and retrenchment in the credit markets.

Indeed, we nd the availability of cash-equivalent credit to be a key component of the delinquency

decision. We nd that a one standard deviation reduction in available credit elicits a change in the

predicted probability of mortgage delinquency that is similar in both direction and nearly double in

magnitude to a one standard deviation reduction in housing price changes (the values are -25% and -

13% respectively). Our ndings are consistent with consumer nance literature that nds individuals

have a preference for preserving liquidity - even at signicant cost.

Ethan Cohen-Cole: Robert H Smith School of Business. 4420 Van Munching Hall, University of Maryland, College Park,

MD 20742. email: ecohencole@rhsmith.umd.edu. (301) 541-7227. Jonathan Morse: 600 Atlantic Avenue, Boston MA. email:

jonathan.morse@bos.frb.org. The authors are grateful to Yiorgos Allayannis, George Aragon, Ezra Becker, Zahi Ben-David,

Jonathan Berk, David Dicks, Janice Eberly, Alex Edmans, Mark Flannery, Paolo Fulghieri, Diego Garcia, Adair Morse, Judit

Montoriol-Garriga, David Musto, Adriano Rampini, Anil Shivdasani, Anjan Thakor, Peter Tufano, Haluk Unal, and seminar par-

ticipants at the American Economic Association meetings, the FDIC-JFSR 9th annual research conference, George Washington

University, Fannie Mae and the Jackson Hole Finance Group for helpful comments. Cohen-Cole thanks the FDIC Center for Fi-

nancial Policy and the Robert H Smith School of Business for nancial support. The views expressed in this paper are those of the

authors and do not necessarily reect those of the Federal Reserve Bank of Boston or the Federal Reserve System.

For years, the conventional wisdom in the consumer nance industry has been that a consumer will pay

their mortgage bill long after they have gone delinquent on other nancial obligations. This paper nds

strong evidence that many individuals in fact make the opposite choice, paying credit card bills even at the

cost of mortgage delinquencies and foreclosures. Indeed the recent crisis has highlighted that many may do

so because of housing price declines. We nd an alternate motivation for this choice: the availability of cash

equivalent credit. Empirically, a one standard deviation drop in available credit on credit cards lead to an

increase in mortgage delinquency of 25%. Indeed, the number of people choosing to become delinquent on

mortgages while paying on their credit cards increased by a full 127% between June of 2006 and December

of 2007.

1

Our inference from these patterns is the presence of a high precautionary demand for liquidity;

individuals wish to ensure future access to lines of credit to cover regular costs of living.

2

The fact that housing loans come with collateral not only makes these decisions particularly surprising,

but also had led to the general perception that mortgages were a much safer lending option than credit

cards. In the past couple of years; however, the decline in housing prices has called into question consumer

preference for paying mortgages before other obligations.

3

As almost a quarter of US homeowners are

now underwater on their mortgages by the end of November, 2009, this concern remains in the political

spotlight.

4

Our analysis below shows that amongst the varied potential explanations for this phenomenon, liquidity

concerns play a central and dominant role. Indeed, they are of larger magnitude than housing price changes,

which have been highlighted both in the popular press and the nance literature as a primary cause of

mortgage delinquency. This result suggests that recent attempts to modify mortgages to assist borrowers

may be unsuccessful; not because of strategic default decisions of borrowers but because lack of access

to alternate forms of liquidity means that continued economic distress or a subsequent minor shock can

push a borrower to protect his credit cards and drop even the modied mortgage. In addition to individual

level shocks, a reduction in the supply of credit can have similar impacts. This past year, the Credit Card

1

While to our knowledge, this paper is to rst to tackle the question of delinquency priority, a recent paper (Lusardi and Tufano,

2009) makes the argument that a study of consumer credit must include the joint-probabilities across types of credit and delinquency

behavior. They also provide survey evidence from 1000 individuals for a wide panel of behaviors and product usage.

2

Indeed, Transunion has found evidence that "consumers...have become more conscientious in protecting those

credit instruments still available to them and are making every effort to pay their credit card bills on time."

http://newsroom.transunion.com/index.php?s=43&item=516. Downloaded April 15, 2009.

3

Guiso, Sapienza and Zingales, (2009) nd that 26% of all individuals who default on their mortgage are capable of pay-

ing their mortgage. The topic of strategic default has become ever more salient in the current environment. This litera-

ture, in general, considers if housing price declines are a sufcient condition for agents to engage in strategic default be-

havior. A WSJ editor also published his own potential plan to default strategically as recently as December 2008 (see

http://online.wsj.com/article/SB10001424052748704240504574585873167451840.html)

4

23% of homeowners according to data from First American CoreLogic. See

http://online.wsj.com/article/SB125903489722661849.html

2

Accountability, Responsibility, and Disclosure (CARD) Act imposed additional requirements on lenders

that will limit fee income and likely reduce lending to low quality borrowers. This could exacerbate existing

difculties with mortgage modication programs.

We believe the role of liquidity is important for a few reasons. One, the consumer nance literature has

found liquidity concerns to be particularly salient (see, for example, Telyukova, 2009). Our paper supports

these ndings. Individuals under increasing credit constraints nd liquidity to be of increased relevance.

This nding mirrors the corporate nance literature's conclusions on the use of lines of credit as committed

liquidity insurance.

5

Two, we will show below that when liquidity concerns lead to delinquency increases,

they can have systemic implications. As liquidity concerns increase and foreclosures follow, neighboring

houses can experience price declines, which trigger additional delinquencies.

Our empirical strategy follows four steps. To start, our goal is to isolate a group of individuals that are

in the position to choose between their house and their credit cards. That is, we wish to evaluate individuals

that have faced a shock large enough to force a delinquency, but not one large enough to force a nancial

catastrophe. We do so as follows. We begin with individuals in June of 2006 who had both a credit card and

a mortgage, but no current delinquencies. In December 2007, we assess the individuals again and keep only

those that experienced a delinquency on one type of loan, either their mortgage or their credit cards. We

exclude those that become delinquent on both or none. Thus, we isolate individuals who have an effective

option on the type of debt they wish to keep and on the type they wish to enter delinquency. We highlight

this group as these individuals have some ability to direct their nancial resources, providing us the ability

to assess the tradeoffs they make in isolation of other concerns.

Our second step allows us to marry this information with specics on individual liquidity position. Our

measure of liquidity is the amount of available credit at the beginning of our sample period. Available credit

is measured is the total credit line net of any balances already incurred. Because we begin with individuals

that had no delinquencies in June of 2006, we can interpret this amount as the liquidity already available

at the time of the shock. Similarly to corporate insurance, available credit can be interpreted as liquidity

insurance. Our data permit precise information on all credit lines, mortgages, and other types of debt held

by the individual in June of 2006. We show in Figure 1 the average available credit for individuals during

the months leading up to a delinquency. The pattern in this gure is consistent with individuals preparing

5

See, among others Boot, Thakor, and Udell, 1987, Berkovitch and Greenbaum, 1991, Campello, et al, 2009, Holmstrom and

Tirole, 1998, and Thakor, 1995. This literature broadly nds the nds use lines of credit as liquidity insurance. While some recent

work (Huang 2009) nds that the insurance is imperfect, it nonetheless fullls a role that is conceptually similar to the consumer

need.

3

for the shock by increasing liquidity access ex-ante.

6

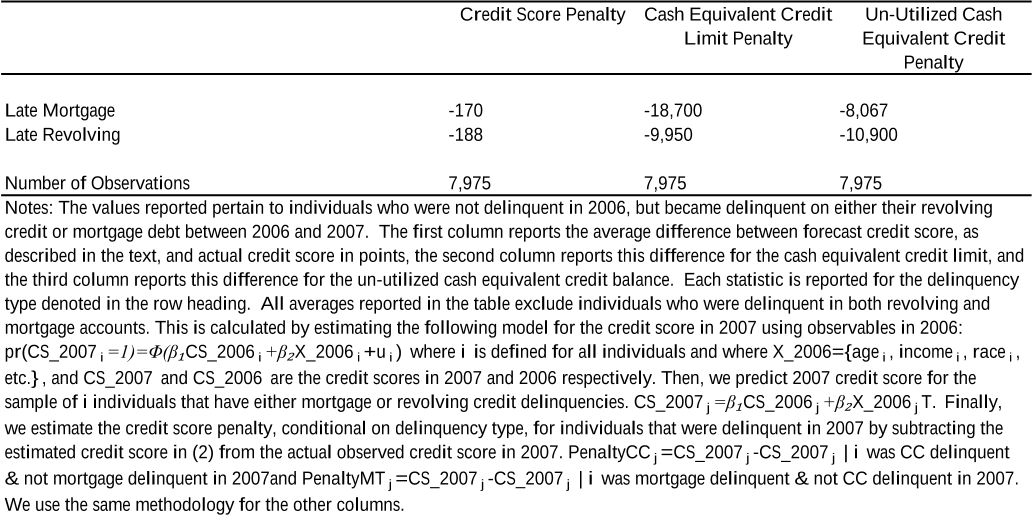

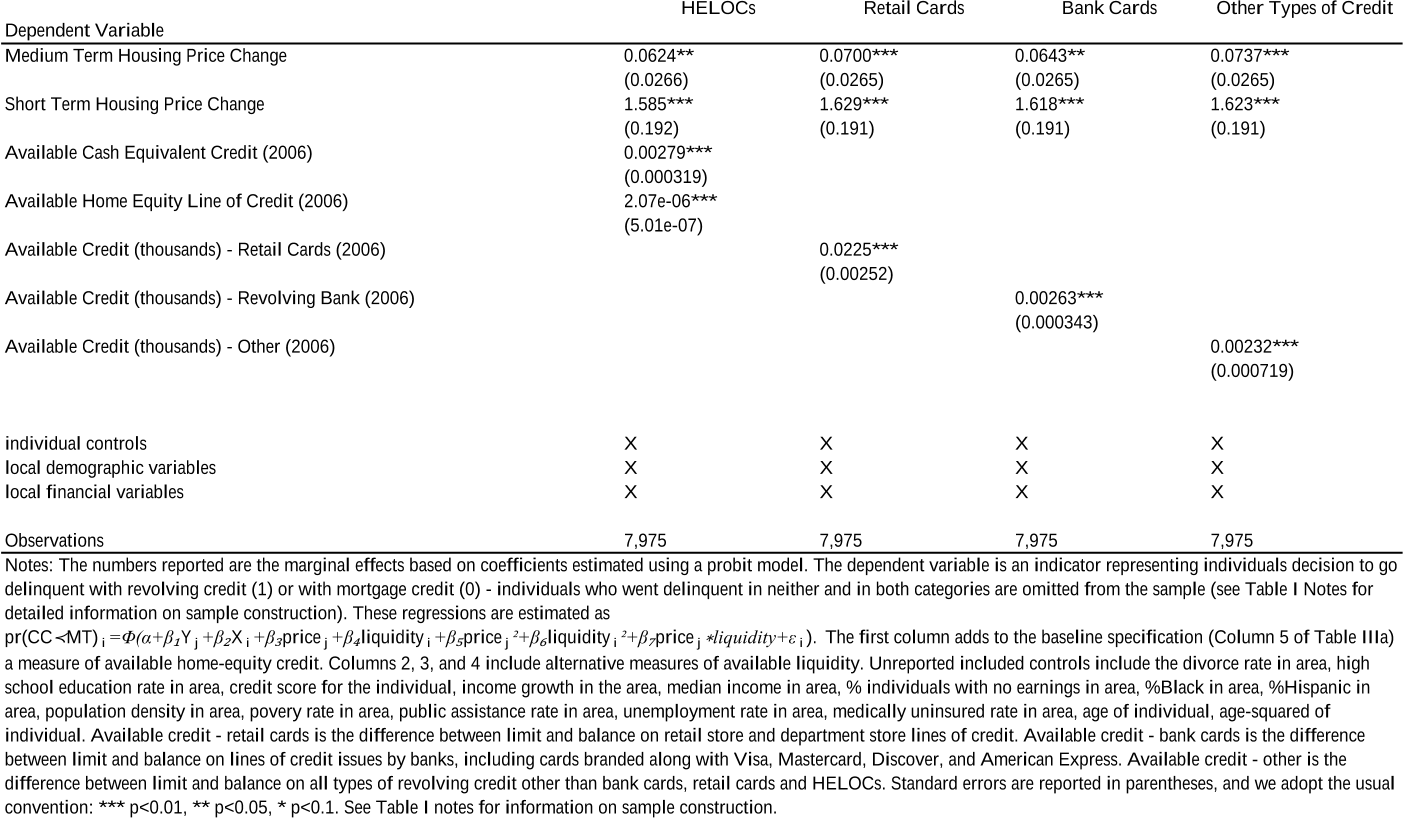

Our third step evaluates the rationale for the decision to keep one type of debt versus the other. With

our measure of liquidity, we can now estimate a binary choice model of the decision to choose delinquency

on credit cards or mortgages. Such a choice has many potential inuences; indeed, because of the detail

available in the dataset, we will be able to control for a wide range of them. In addition to the credit

available at the time of the delinquency choice, the choice itself has asymmetric inuences on the ability to

obtain new credit in the future. We will show that missing payments on a credit card costs marginally more

in terms of access to credit cards than missing payment on a mortgage. As well, changes in housing prices

can inuence this choice. If housing princes fall, the incentive to repay mortgages fall, even if individuals

are nancially capable of making payments. This phenomenon is discussed in Guiso, Sapienza and Zingales

(2009). We evaluate each of these concerns as well as a range of other potential inuences, including various

credit constraints, the availability of other types of cash equivalents such as home equity lines of credit, the

availability of payday loans, and the relative scale of mortgages.

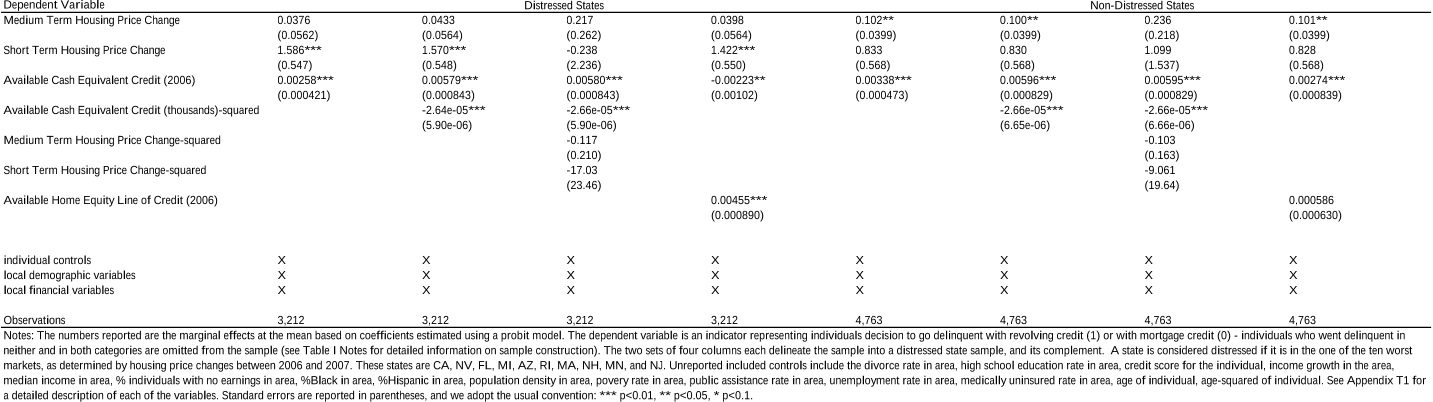

We nd in each case that the role of liquidity is the predominant factor in the delinquency decision.

Indeed, individuals in areas with large housing price declines respond to that incentive by choosing to protect

credit cards; remarkably, the liquidity effect is nearly identical in areas that had not yet had price declines in

2007 (see Figure 2). This is consistent with the story that individuals refuse to pay as their mortgages rise

above 100 percent loan to value ratio. However, it shows that the liquidity effect is salient across contexts.

Finally, we briey illustrate the potential for spillovers to the remainder of the economy. This is impor-

tant in particular in understanding the consequences of government intervention programs. The mechanism

for this is straightforward and comes from existing literature on the impact of foreclosures on surrounding

home values.

7

To quantify the magnitude of the choices to stop paying on mortgages rather than credit

cards, we regress community level delinquency rates on the individual-level mortgage delinquency. To han-

dle endogeneity, we instrument the mortgage delinquency decision with the liquidity measure we show to be

a predictor. This sheds light on the pass-through from individual tradeoffs to systemic difculties. Notably,

we nd that this impact is both economically relevant and passes through only to mortgage delinquency, not

to credit cards. Decreases in liquidity actually increase community level credit card payment probabilities.

This implies that changes in regulation on credit cards may have perverse impacts on credit and mortgage

6

It is worth noting that this does not reect increased credit causing delinquency. Indeed, utilization rates decrease linearly

during the time leading up to a delinquency. Emphasizing the role of credit limits as liquidity insurancec for unexpected shocks,

the pattern in Figure 1 is reversed for individuals prior to bankruptcy. Because a bankruptcy ling comes with the ability to

expunge debt, instead of building a precautionary buffer, these borrowers on average use up remaining credit. This suggests that

the predelinquency borrowers in our dataset are not strategically defaulting, at least with the intention of bankruptcy.

7

A survey of this literature is available in Lee (2008) and in a Center for Responsible Lending report (2008).

4