Q2. What is the main purpose of the free allocation of emissions allowances?

A main purpose of the free allocation of emissions allowances under the US capand-trade programmes for SO2 and NO x , as well as under the EU ETS for CO 2 , is to obtain thepolitical support of large emitters.

Q3. What is the effect of emissions trading on the infra-marginal unit?

if the infra-marginal unit is more carbon-intensive than the marginal unit, it suffers from a loss, as the increase in power price is lower than the increase in its carbon costs per MWh; notably if allowances have to be bought on the market.

Q4. What is the effect of emissions trading on the price of electricity?

The extent to which carbon costs are passed through to power prices also depends on changes in the merit order of the supply curve due to emissions trading.

Q5. What is the reason for the increase in the price of gas-generated power?

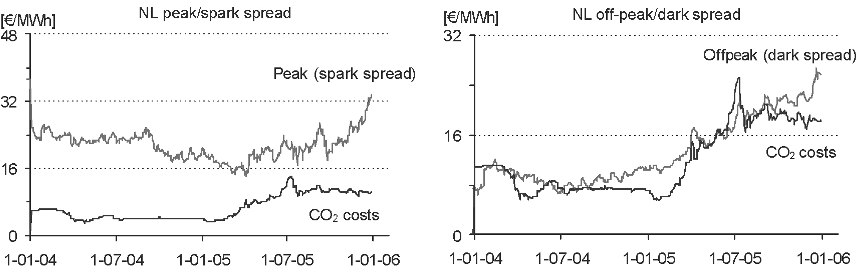

CO2costs of gas-generated power have also increased over this period, but less dramatically, i.e. from d4 to d11/MWh (partly due to the relatively low – but constant – emission factor of gas-generated electricity).

Q6. What is the effect of the increase in gas prices on the pass-through rate of coal-?

As coal generators benefit from this gas cost-induced increase in power prices, this leads to an overestimation of the pass-through rate of CO2 costs for coal-generated power.

Q7. What is the cost of CO2 emissions per MWh?

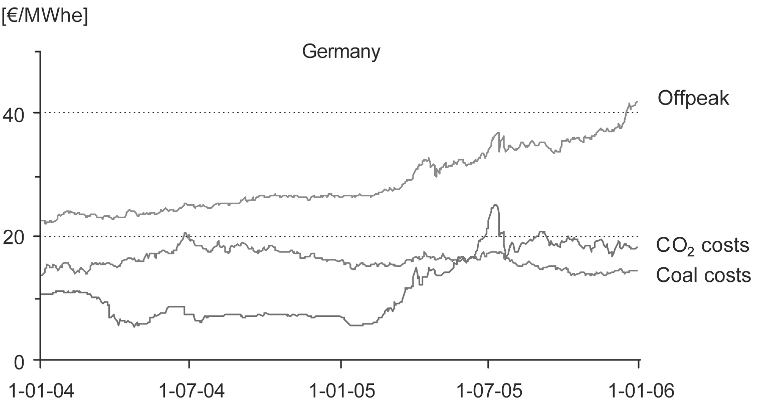

Earthscanshows the costs of CO 2 allowances required to cover the emissions per MWh generated by a coalfired power plant (with an emission factor of 0.85 tCO 2 /MWh).

Q8. What is the reason for some grandfathering to this infra-marginal unit?

in the latter case, some grandfathering to this inframarginal unit may be justified to break even, depending on the relative carbon intensity of this unit.

Q9. What is the effect of a smaller market on the profits of power generators?

While all generators profit from the higher prices, the effect of a smaller market dominates this effect and therefore slightly reduces their revenues.