Q2. What procedure was used to choose the bandwith parameter?

To choose the bandwith parameter the authors followed a procedure called generalized cross-validation, described in Craven and Wahba (1979) and used in the context of option pricing in Broadie et. al. (1995).

Q3. What are the two critical assumptions used in the American option case?

1Two critical assumptions, namely (1) a constant dividend rate and(2) constant volatility, are often cited as restrictive and counter-factual.

Q4. What is the main goal of the nonparametric approach?

the nonparametric approach does achieve the main goal of their econometric anaylsis, namely to determine whether the volatility and/or the dividend rate a ect the valuation of the contract and the exercise policy.

Q5. What is the widely used kernel estimator of g in 3.1?

The most widely used kernel estimator of g in (3.11) is the NadarayaWatson estimator de ned byĝ (z) =Pn i=1K Zi zYiPni=1K Zi z ; (3.12) so thatĝ (Z1); : : : ; ĝ (Zn) 0 =WKn ( )Y; where Y = (Y1; : : : ; Yn) 0 and WKn is a n n matrix with its (i; j)-th element equal to K Zj Zi Pn k=1K Zk Zi : WKn is called the in uence matrix associated with the kernel K:

Q6. What is the argument for the EGARCH volatilities?

The argument is that for a wide variety of misspeci ed ARCH models the di erence between the (EG)ARCH volatility estimates and the true underlying di usion volatilities converges to zero in probability as the length of the sampling time interval goes to zero at an appropriate rate.

Q7. What papers were devoted to the subject?

Several papers were devoted to the subject, namely Nelson (1990, 1991, 1992, 1996a,b) and Nelson and Foster (1994, 1995), which brought together two approaches, ARCH and continuous time SV, for modelling time-varying volatility in nancial markets.

Q8. What is the value of a contingent claim?

In this context, the value ofany contingent claim is simply given by its shadow price, i.e., the priceat which the representative agent is content to forgo holding the asset.

Q9. What are the state variables required to model a stochastic dividend yield?

Two state variables are required tomodel a stochastic dividend yield which is imperfectly correlated with thevolatility coe cients of the stock price process.

Q10. What is the simplest explanation for the volatility of options?

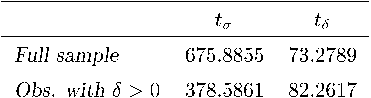

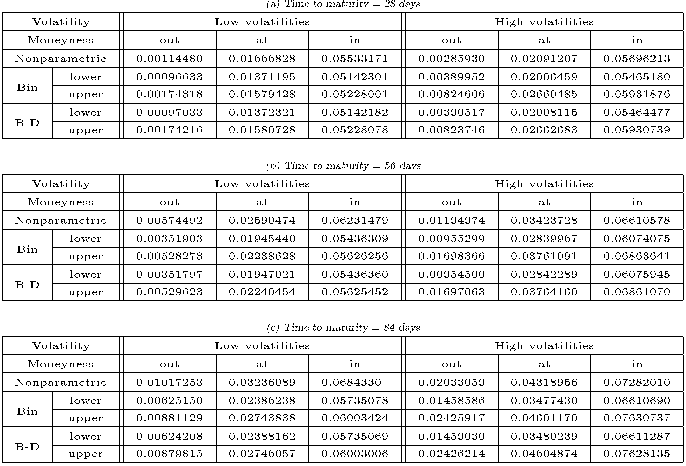

The results so far seem to suggest two things: (1) conditioning on t does not displace pricing of options and (2) the volatility e ect seems to be present only for large (fourth quartile) volatilities.