NBER WORKING PAPER SERIES

CAN NEWS ABOUT THE FUTURE DRIVE THE BUSINESS CYCLE?

Nir Jaimovich

Sergio Rebelo

Working Paper 12537

http://www.nber.org/papers/w12537

NATIONAL BUREAU OF ECONOMIC RESEARCH

1050 Massachusetts Avenue

Cambridge, MA 02138

September 2006

We thank the editor, Mark Gertler, three anonymous referees, and Gadi Barlevy, Paul Beaudry, Larry

Christiano, Fabrice Collard, Wouter Denhaan, Martin Eichenbaum, Zvi Hercowitz, Erin Hoge, Navin

Kartik, Benjamin Malin, Franck Portier, and Laura Veldkamp for their comments. The views expressed

herein are those of the author(s) and do not necessarily reflect the views of the National Bureau of

Economic Research.

© 2006 by Nir Jaimovich and Sergio Rebelo. All rights reserved. Short sections of text, not to exceed

two paragraphs, may be quoted without explicit permission provided that full credit, including © notice,

is given to the source.

Can News About the Future Drive the Business Cycle?

Nir Jaimovich and Sergio Rebelo

NBER Working Paper No. 12537

September 2006, April 2008

JEL No. E24,E32

ABSTRACT

Aggregate and sectoral comovement are central features of business cycle data. Therefore, the ability

to generate comovement is a natural litmus test for macroeconomic models. But it is a test that most

existing models fail. In this paper we propose a unified model that generates both aggregate and sectoral

comovement in response to contemporaneous shocks and news shocks about fundamentals. The fundamentals

that we consider are aggregate and sectoral TFP shocks as well as investment-specific technical change.

The model has three key elements: variable capital utilization, adjustment costs to investment, and

a new form of preferences that allow us to parameterize the strength of short-run wealth effects on

the labor supply.

Nir Jaimovich

Department of Economics

579 Serra Mall

Stanford University

Stanford, CA 94305-6072

and NBER

njaimo@stanford.edu

Sergio Rebelo

Northwestern University

Kellogg School of Management

Department of Finance

Leverone Hall

Evanston, IL 60208-2001

and NBER

s-rebelo@northwestern.edu

1. Introduction

Business cycle data feature two important forms of comovement. The …rst is aggregate

comovement: major macroeconomic aggregates, such as output, consumption, investment,

hours worked, and the real wage tend to rise and fall together. The second is sectoral

comovement: output, employment, and investment tend to rise and fall together in di¤erent

sectors of the economy.

Lucas (1977) argues that these comovement properties re‡ect the central role that ag-

gregate shocks play in driving business ‡uctuations. However, it is surprisingly di¢ cult

to generate both aggregate and sectoral comovement, even in models driven by aggregate

shocks. Barro and King (1984) show that the one-sector growth model generates aggregate

comovement only in the presence of contemporaneous shocks to total factor productivity

(TFP). Other shocks generate a negative correlation between consumption and hours worked.

Christiano and Fitzgerald (1998) show that a two-sector version of the neoclassical model

driven by aggregate, contemporaneous TFP shocks does not generate sectoral comovement

of investment and hours worked.

In this paper we propose a model that generates aggregate and sectoral comovement in

response to both aggregate and sectoral shocks. The shocks that we consider are aggregate

TFP shocks, investment-sp eci…c shocks, and sectoral TFP shocks to the consumption and

investment sectors. We consider both contemporaneous shocks and news shocks. News

shocks consist of information that is useful for predicting future fundamentals but does not

a¤ect current fundamentals.

The early literature on business cycles (e.g. Beveridge (1909), Pigou (1927), and Clark

(1934)) emphasizes news shocks as potentially important drivers of business cycles. The idea

is that news shocks change agents’ expectations about the future, a¤ecting their current

investment, consumption, and work decisions. There is a revival of interest in this idea,

motivated in part by the U.S. investment boom of the late 1990s and the subsequent economic

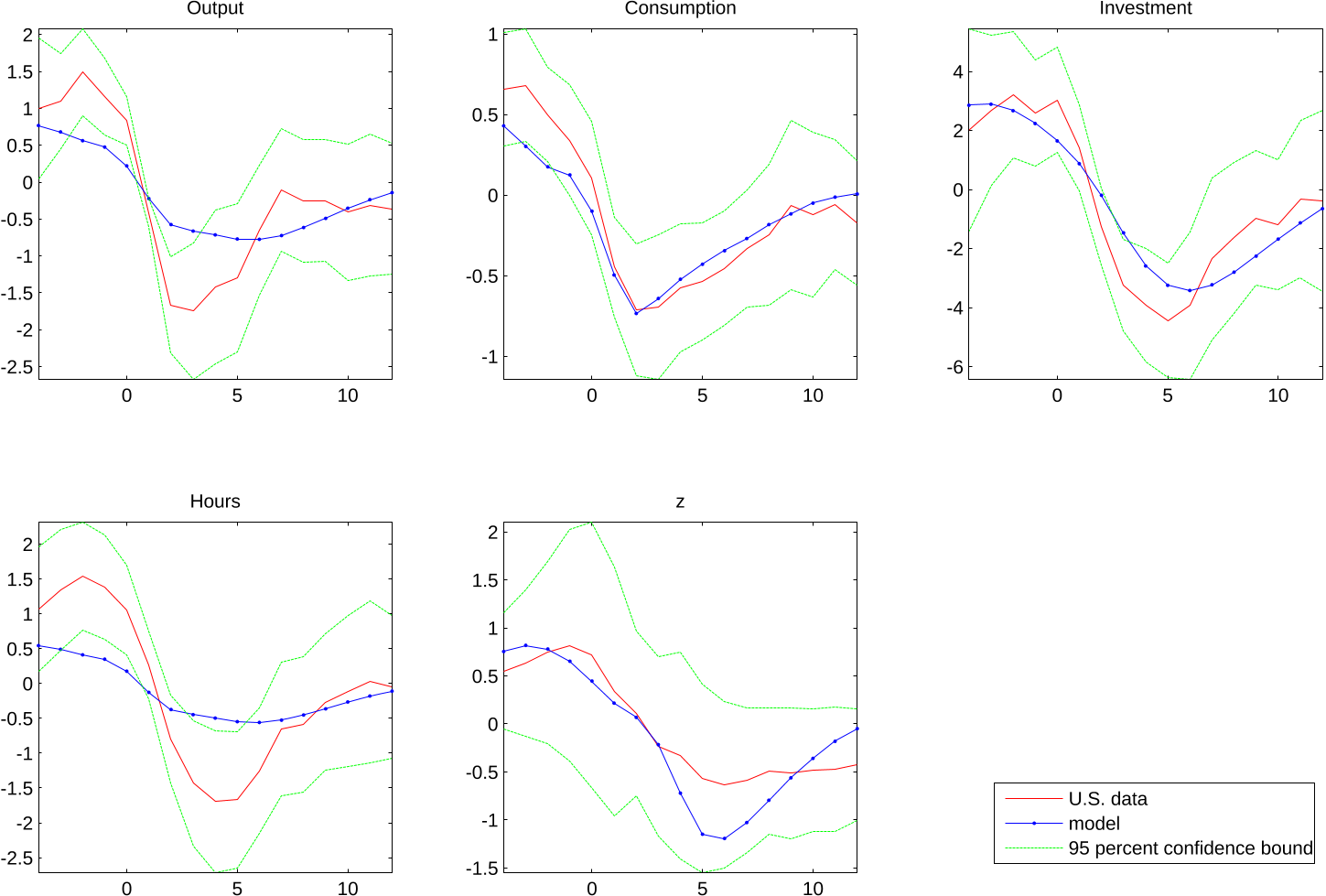

slowdown. Figure 1 displays some suggestive data for this episode. The …rst panel shows data

obtained from the Institutional Brokers Estimate System on the median analyst forecast of

the value-weighted long-run growth rate of earnings for companies in the Standard & Poors

500 index. The second panel shows the level of investment and realized earnings for the

same companies. We see that after 1995 the expected annual earnings growth rate rises

1

rapidly, from roughly 11:5 percent to 17:7 in 2001.

1

Investment and earnings forecasts are

positively correlated, whereas investment and realized earnings are negatively correlated.

2

One plausible interpretation of these data is that high expectations about earnings growth

driven by the prospects of new technologies lead to high levels of investment and to an

economic boom. When the new technologies fail to live up to what was expected, investment

falls, and a recession ensues.

It is surprisingly di¢ cult to make this story work in a standard business cycle model.

Cochrane (1994), Danthine, Donaldson, and Johnsen (1998), and Beaudry and Portier (2004,

2008) …nd that many variants of the neoclassical growth model fail to generate a boom in

response to expectations of higher future total factor productivity (TFP). Good news about

future productivity make agents wealthier, so they increase their consumption, as well as

their leisure, reducing the labor supply. This fall in labor supply causes output to fall.

Therefore, good news about tomorrow generates a recession today!

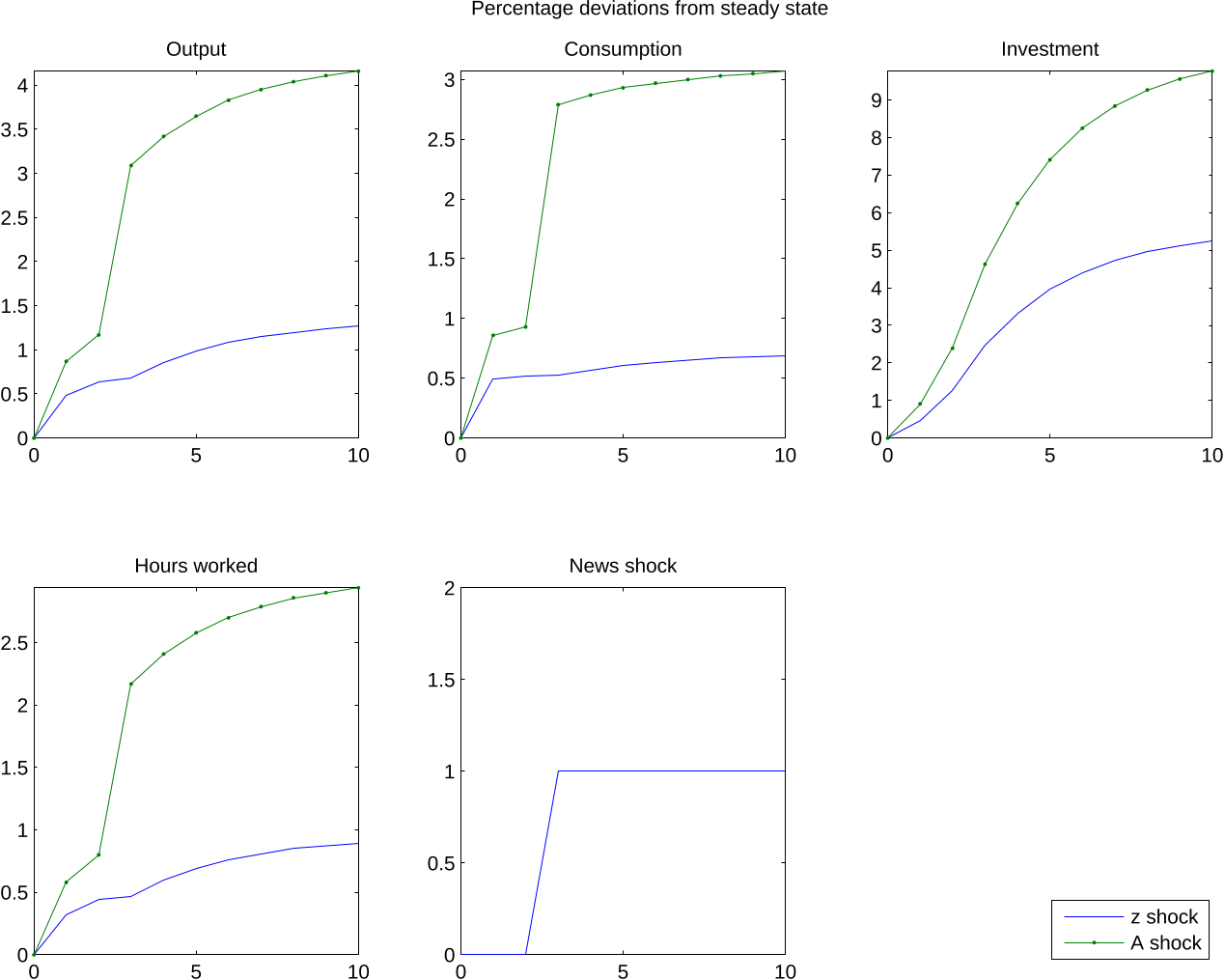

Our model introduces three elements into the neoclassical growth model that together

generate comovement in response to news shocks. These same elements generate comove-

ment in response to contemporaneous shocks. The …rst element, variable capital utilization,

increases the response of output to news about the future. The second element, adjustment

costs to investment, gives agents an incentive to resp ond immediately to news about future

fundamentals.

3

The third element, a weak short-run wealth e¤ect on the labor supply, helps

generate a rise in hours worked in response to positive news. We introduce this element by

using a new class of preferences which gives us the ability to parameterize the strength of

the short-run wealth e¤ect on the labor supply. These preferences nest, as special cases, the

two classes of utility functions most widely used in the business cycle literature, those char-

acterized in King, Plosser, and Rebelo (1988) and in Greenwood, Hercowitz, and Hu¤man

(1988).

In our quantitative work, we consider a one-sector and a two-sector version of our model.

The latter is used to study sectoral comovement. Using our preferences to vary the strength

1

The realized average annual earnings growth rate is 10 percent for the 1985-95 period and 11 percent

for the 1995-2000 period.

2

The correlation between investment and earnings growth forecasts is 0:48 for the whole sample and 0:72

for the 1995-2004 period. Earnings forecasts lead investment; the correlation between the earnings forecast

at time t and investment at time t + 1 is 0:52 for the full sample. The correlation between investment and

realized earnings is 0:40 for the whole sample and 0:57 for the 1995-2004 period.

3

The …rst two elements, variable capital utilization and adjustment costs to investment, are generally nec-

essary to generate comovement in response to contemporaneous investment-speci…c shocks, see Greenwood,

Hercowitz, and Krusell (2000).

2

of short-run wealth e¤ects on the labor supply we …nd that these e¤ects lie at the heart

of the model’s ability to generate comovement. We can generate aggregate comovement in

the presence of moderate labor-supply wealth e¤ects. However, low short-run labor-supply

wealth e¤ects are essential to generate sectoral comovement that is robust to the timing and

nature of the shocks.

4

Our work is related to several recent papers on the role of news and expectations as

drivers of business cycles. Beaudry and Portier (2004) propose the …rst model that produces

an expansion in response to news. Their model features two complementary consumption

goods, one durable and one non-durable. Both goods are produced with labor and a …xed

factor but with no physical capital. The model generates a boom in response to good news

about TFP in the non-durable goo ds sector. Christiano, Ilut, Motto, and Rostagno (2007)

show that habit persistence and investment adjustment costs pro duce aggregate comovement

in response to news about a future TFP shock. In their model, intertemporal substitution in

the supply of labor is large enough to comp ensate for the negative wealth e¤ect of the news

shock on the labor supply. However, hours worked fall when the shock materializes because

there continues to be a negative wealth e¤ect on labor supply, but there is no longer a strong

intertemporal substitution e¤ect on labor supply. Denhaan and Kaltenbrunner (2005) study

the e¤ects of news in a matching model. Matching frictions are a form of labor adjustment

costs, so their model is related to the version of our model with adjustment costs to labor,

which we discuss in section 4. Lorenzoni (2005) studies a model in which productivity has

a temporary and a permanent component and agents have imperfect information about the

relative importance of these two components. Blanchard (2007) emphasizes the importance

of news about future fundamentals in an open economy setting.

Our paper is organized as follows. In Section 2 we propose a one-sector model that gener-

ates aggregate comovement with respect to news about TFP and investment-sp eci…c shocks.

In Section 3 we explore the role that capital utilization, adjustment costs, and preferences

play in these results. In Section 4 we present a two-sector model that generates sectoral

comovement with respect to both contemporaneous and news shocks to fundamentals. The

fundamentals that we consider are aggregate TFP shocks and sectoral TFP shocks to con-

sumption and investment. In Section 5 we study simulations of a version of our one-sector

4

Imbens, Rubin, and Sacerdote (1999) provide microeconomic evidence that is consistent with the view

that short-run wealth e¤ects on the labor supply are weak. Their evidence is based on a sample of lottery

prize winn ers. They …nd that prizes of $15,000 per year for twenty years have no e¤ect on the labor supply.

3