BIS WORKING PAPERS

No. 88 – June 2000

EVIDENCE ON THE RESPONSE

OF US BANKS TO CHANGES

IN CAPITAL REQUIREMENTS

by

Craig Furfine

BANK FOR INTERNATIONAL SETTLEMENTS

Monetary and Economic Department

Basel, Switzerland

BIS Working Papers are written by members of the Monetary and Economic Department of the Bank for

International Settlements, and from time to time by other economists, and are published by the Bank. The papers

are on subjects of topical interest and are technical in character. The views expressed in them are those of their

authors and not necessarily the views of the BIS.

Copies of publications are available from:

Bank for International Settlements

Information, Press & Library Services

CH-4002 Basel, Switzerland

Fax: +41 61 / 280 91 00 and +41 61 / 280 81 00

This publication is available on the BIS website (www.bis.org).

© Bank for International Settlements 2000.

All rights reserved. Brief excerpts may be reproduced or translated provided the source is stated.

ISSN 1020-0959

BIS WORKING PAPERS

No. 88 – June 2000

EVIDENCE ON THE RESPONSE

OF US BANKS TO CHANGES

IN CAPITAL REQUIREMENTS

by

Craig Furfine *

Abstract

This paper develops a structural, dynamic model of a banking firm to analyse how

banks adjust their loan portfolios over time. In the model, banks experience capital

shocks, face uncertain future loan demand, and incur costs based on their proximity

to regulatory minimum capital requirements. Non-linear relationships between

bank capital levels and lending are derived from the model, and key parameters are

estimated using panel data on large US commercial banks operating continuously

between December 1989 and December 1997. Using the estimated model, the

optimal bank response to changes in capital requirements, shocks to bank capital,

and changes to bank loan demand is simulated. The simulations predict that

increases in risk-based and leverage capital requirements, negative capital shocks,

or a decline in loan demand cause a reduction in loan growth. Nevertheless, by

calculating the optimal portfolio response to these various changes, it is shown that

changes in capital regulation are a necessary ingredient to explain the decline in

loan growth and the rise in bank capital ratios witnessed nearly a decade ago.

Thus, this study suggests that the current effort to redesign bank capital

requirements should work under the assumption that banks will optimally respond

to the economic incentives found in the regulation.

* The views expressed do not necessarily represent those of the Bank for International Settlements

Contents

1. Introduction .................................................................................................................1

2. The model....................................................................................................................4

2.1 The balance sheet.............................................................................................. 4

2.2 Capital requirements ......................................................................................... 5

2.3 Adjustment costs............................................................................................... 6

2.4 Market setting.................................................................................................... 7

2.5 Uncertainty and the evolution of capital ...........................................................7

2.6 The bank maximisation problem.......................................................................7

2.7 Estimation framework.......................................................................................8

3. Estimation....................................................................................................................8

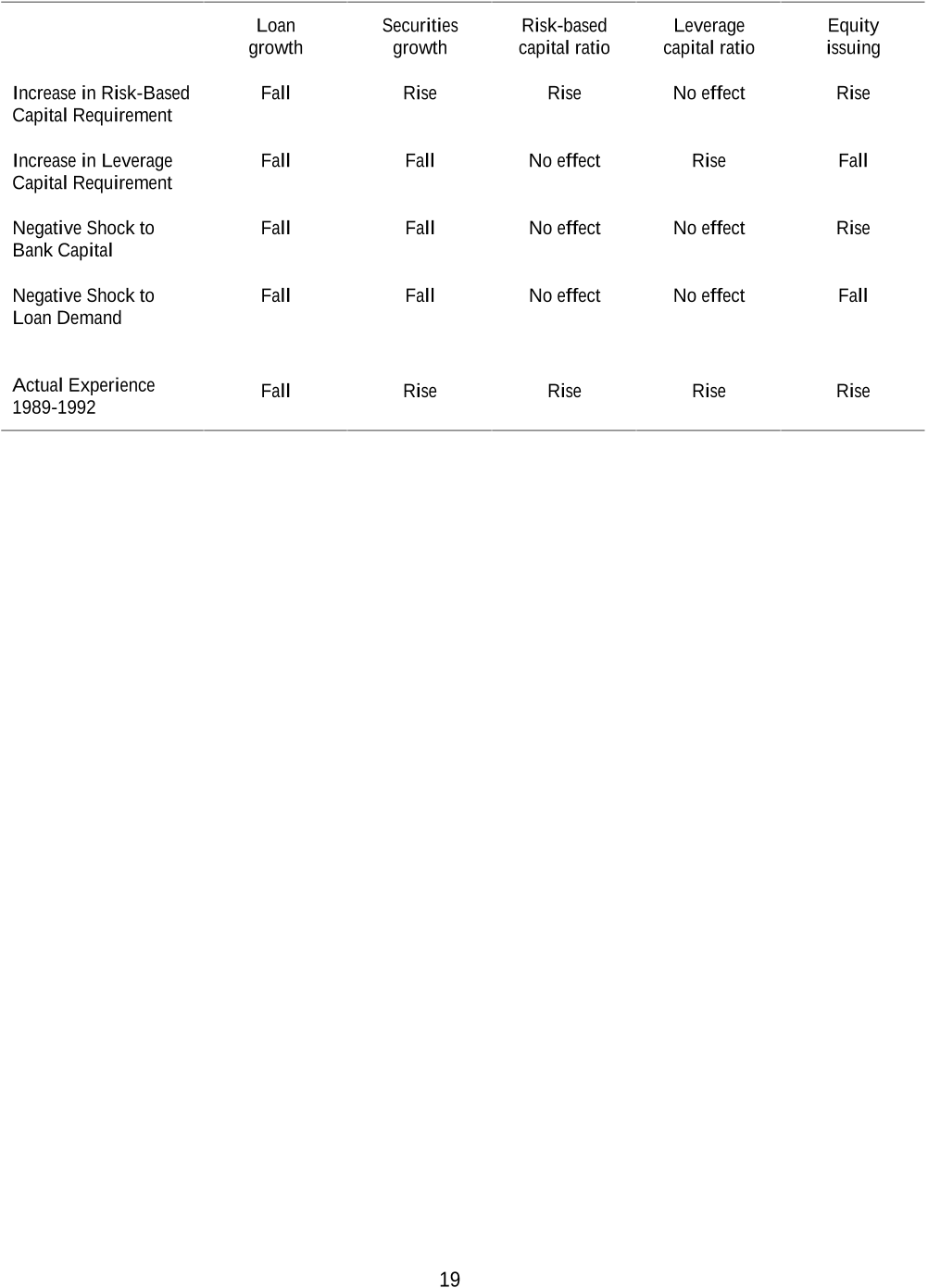

4. Simulation results...................................................................................................... 11

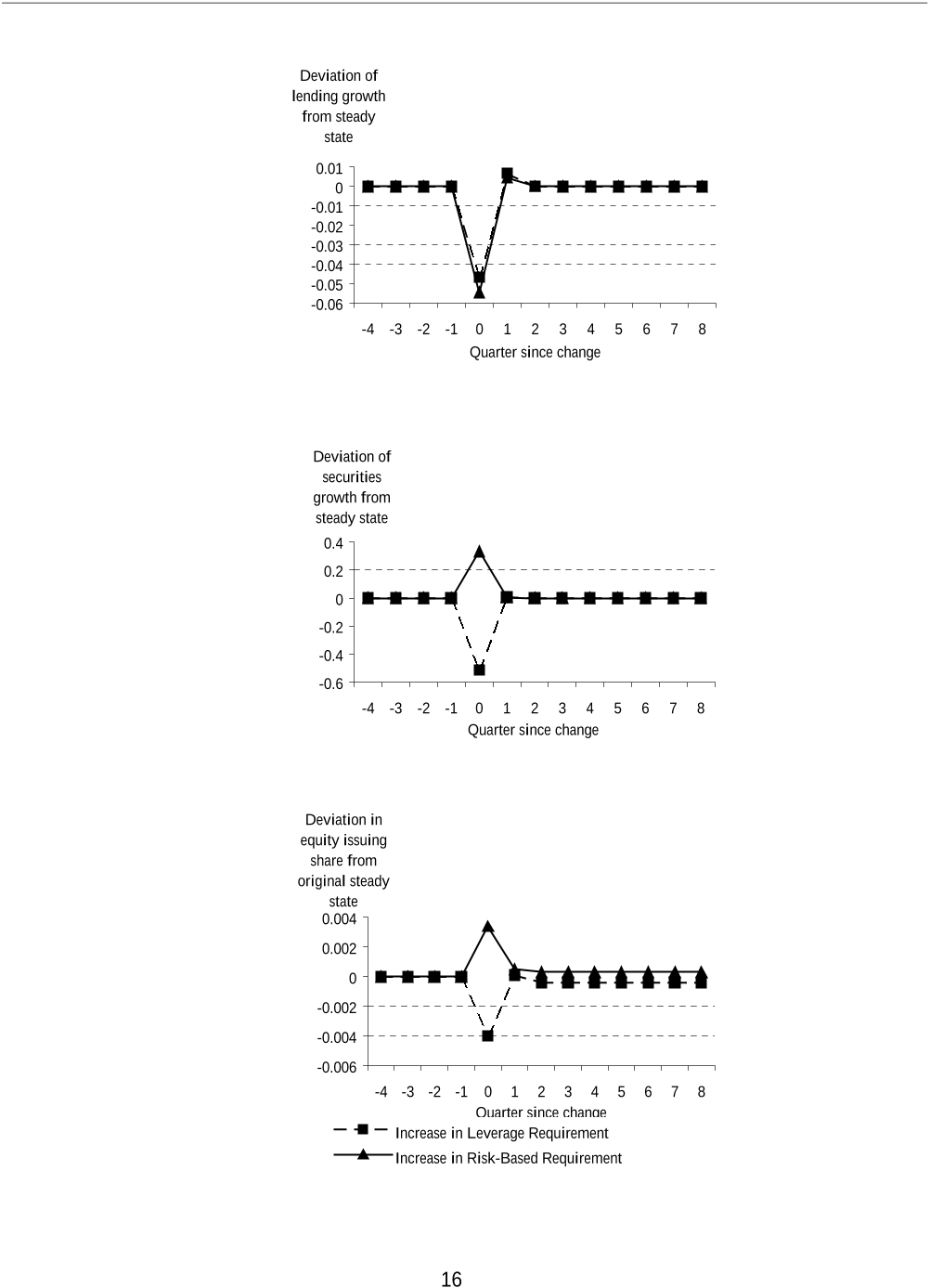

4.1 An increase in capital requirements................................................................ 11

4.2 A negative shock to bank capital and a negative shock to loan demand.........12

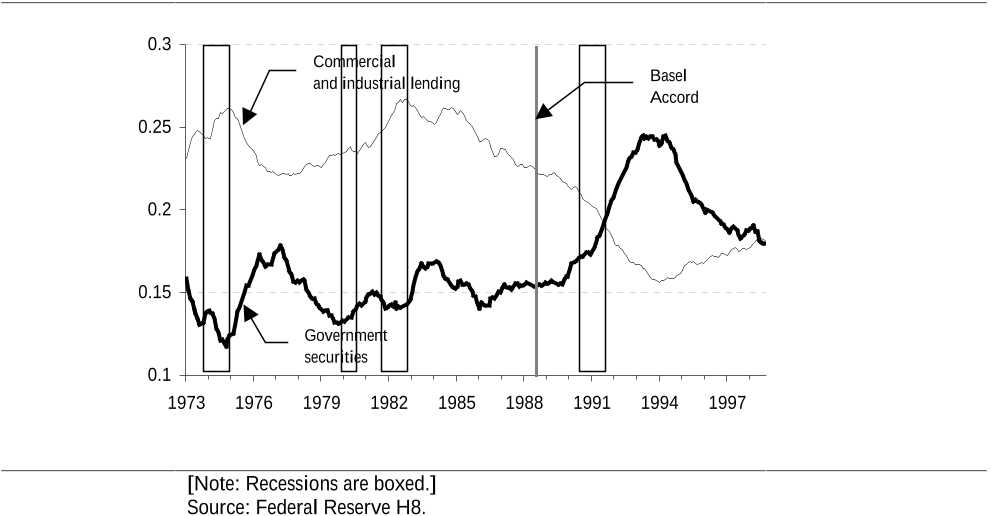

4.3 Implications for the last US credit crunch....................................................... 13

5. Conclusions...............................................................................................................14

References................................................................................................................................. 20