The Nature of Credit Constraints and Human Capital

Reads0

Chats0

TLDR

This paper developed a human capital model with borrowing constraints explicitly derived from government student loan (GSL) programs and private lending under limited commitment, which helps explain the persistent strong positive correlation between ability and schooling in the U.S., as well as the rising importance of family income for college attendance.Abstract:

We develop a human capital model with borrowing constraints explicitly derived from government student loan (GSL) programs and private lending under limited commitment. The model helps explain the persistent strong positive correlation between ability and schooling in the U.S., as well as the rising importance of family income for college attendance. It also explains the increasing share of undergraduates borrowing the GSL maximum and the rise in student borrowing from private lenders. Our framework ofiers new insights regarding the interaction of government and private lending as well as the responsiveness of private credit to economic and policy changes.read more

Figures

Table 3: Baseline Model Parameters

Figure 4: dU , hU , hX , and hG for high wealth individuals (w > w̄)

Figure 3: dU , hU , hX , and hG for low wealth individuals (w ≤ w̄)

Figure 8: ‘Year 2000’ GSL and Private Lending Constraints

Figure 9: Private Borrowing (‘Year 2000’)

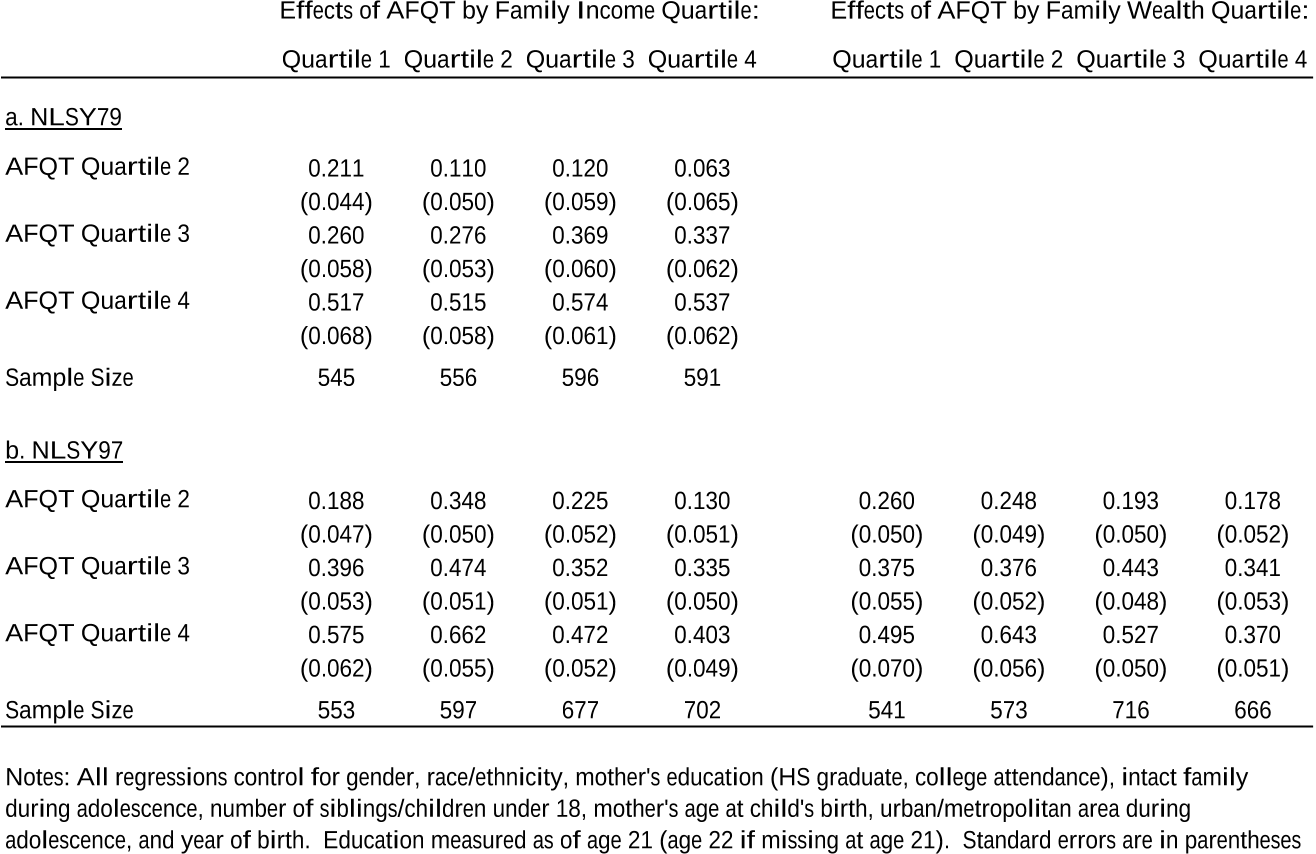

Table 2: Estimated Effects of AFQT on College Attendance by Family Income and Wealth (NLSY79 and NLSY97)

Citations

More filters

Journal ArticleDOI

Life in shackles? The quantitative implications of reforming the educational financing system

TL;DR: In this article, the authors conduct a quantitative analysis of educational financing systems in a stochastic overlapping generations model in which human capital can be enhanced through both formal schooling and learning-by-doing The model is calibrated to the United States economy, including a stylized version of its student loan system.

Investment-Specific Technological Change and Universal Basic Income in the U.S.

TL;DR: In this article , the authors developed an overlapping generations model, with multiple sources of technological change and four different occupations, and found that the welfare-maximizing level of UBI is actually quite low, 0.5% of GDP.

Journal ArticleDOI

More Credit, More Problems? Federal Student Loan Limits and Education Outcomes

Cullen F. Goenner,Chih Ming Tan +1 more

TL;DR: In this paper, the authors examined how borrowing, composition of credit, and student outcomes were impacted by the policy changes and found that despite having access to more credit, student academic outcomes did not improve as a result of the changes, and in some cases worsened.

Journal ArticleDOI

The Investment Side of College Savings

TL;DR: The authors found that more than 85% of households allocate college savings to risky assets, in particular more than 60% to stocks, and that college savings motives explain approximately one-third of stock market participation probability outside of retirement accounts for households with children.

References

More filters

Journal ArticleDOI

The Production of Human Capital and the Life Cycle of Earnings

TL;DR: In this paper, the authors provide a framework for the understanding of many aspects of observed behavior regarding education, health, occupational choice, mobility, etc., as rational investment of present resources for the purpose of enjoying future returns.

Book ChapterDOI

Changes in the Wage Structure and Earnings Inequality

Lawrence F. Katz,David H. Autor +1 more

TL;DR: In this article, the authors present a framework for understanding changes in the wage structure and overall earnings inequality, emphasizing the role of supply and demand factors and the interaction of market forces and labor market institutions.

ReportDOI

Interpreting the evidence on life cycle skill formation

TL;DR: In this paper, the authors formalize the concepts of self-productivity and complementarity of human capital investments and use them to explain the evidence on skill formation, and provide a theoretical framework for interpreting the evidence from a vast empirical literature, for guiding the next generation of empirical studies, and for formulating policy.

Journal ArticleDOI

Life Cycle Schooling and Dynamic Selection Bias: Models and Evidence for Five Cohorts of American Males

TL;DR: This article examined the statistical model used to establish the empirical regularity and the intuitive behavioral interpretation often used to rationalize it, and showed that the implicit economic model assumes myopia and that the intuitive interpretive model is identified only by imposing arbitrary distributional assumptions onto the data.

Related Papers (5)

The Evidence on Credit Constraints in Post-Secondary Schooling†

Pedro Carneiro,James J. Heckman +1 more