The Nature of Credit Constraints and Human Capital

Reads0

Chats0

TLDR

This paper developed a human capital model with borrowing constraints explicitly derived from government student loan (GSL) programs and private lending under limited commitment, which helps explain the persistent strong positive correlation between ability and schooling in the U.S., as well as the rising importance of family income for college attendance.Abstract:

We develop a human capital model with borrowing constraints explicitly derived from government student loan (GSL) programs and private lending under limited commitment. The model helps explain the persistent strong positive correlation between ability and schooling in the U.S., as well as the rising importance of family income for college attendance. It also explains the increasing share of undergraduates borrowing the GSL maximum and the rise in student borrowing from private lenders. Our framework ofiers new insights regarding the interaction of government and private lending as well as the responsiveness of private credit to economic and policy changes.read more

Figures

Table 3: Baseline Model Parameters

Figure 4: dU , hU , hX , and hG for high wealth individuals (w > w̄)

Figure 3: dU , hU , hX , and hG for low wealth individuals (w ≤ w̄)

Figure 8: ‘Year 2000’ GSL and Private Lending Constraints

Figure 9: Private Borrowing (‘Year 2000’)

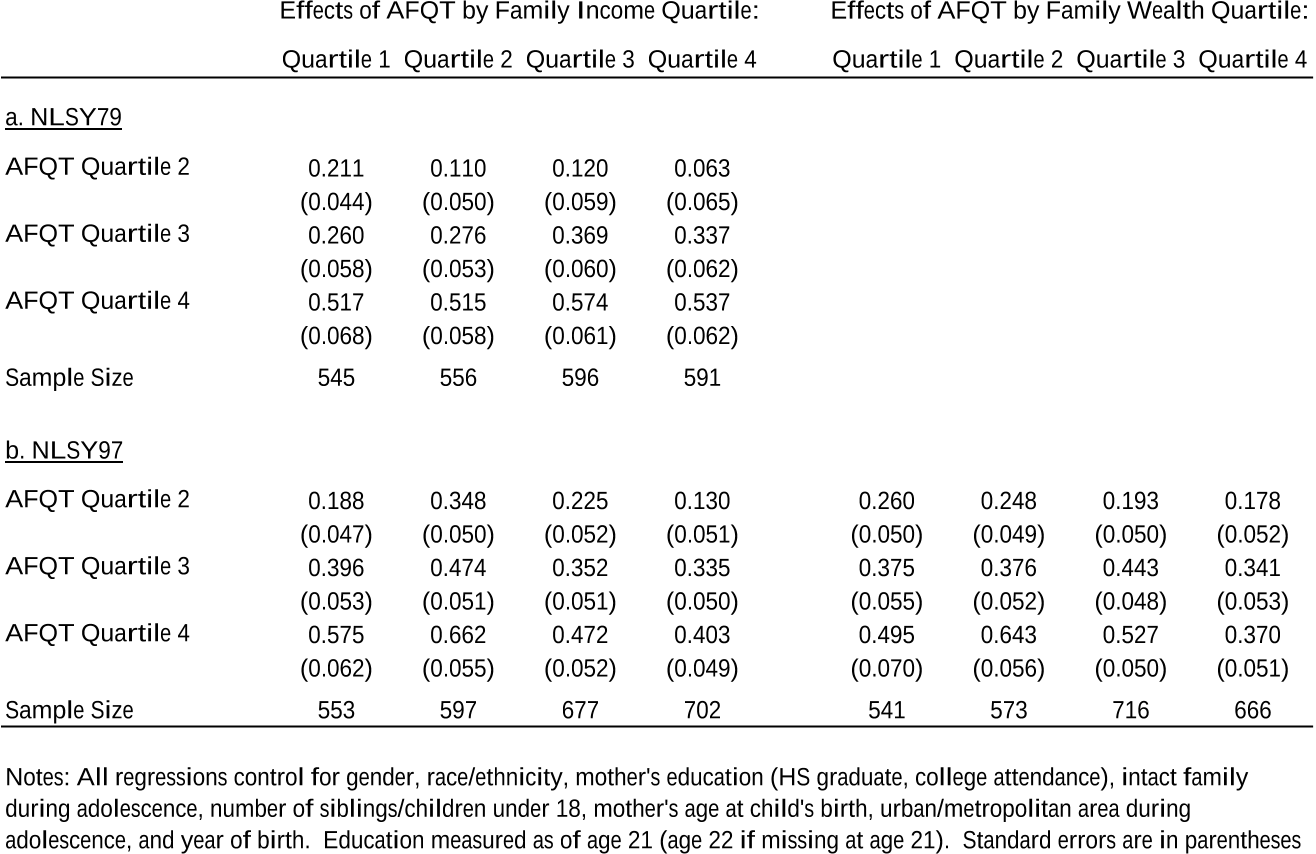

Table 2: Estimated Effects of AFQT on College Attendance by Family Income and Wealth (NLSY79 and NLSY97)

Citations

More filters

Journal ArticleDOI

Credit Constraints in Education

TL;DR: In this article, the impact of credit constraints on the accumulation of human capital has been studied, and the authors highlight the importance of early childhood investments, since their response largely determines the impact on the overall lifetime acquisition of human resources.

Journal ArticleDOI

Debt, jobs, or housing: What's keeping millennials at home?

Zachary Bleemer,Meta Brown,Donghoon Lee,Donghoon Lee,Wilbert van der Klaauw,Wilbert van der Klaauw +5 more

TL;DR: For example, this paper found that state-cohort groups who were more heavily reliant on student debt while in school are significantly and substantially more likely to move home to parents when living independently, and are significantly more likely not to move away from parents while living at home.

Posted Content

What Explains Trends in Labor Supply among U.S. Undergraduates, 1970-2009? NBER Working Paper No. 17744.

Journal ArticleDOI

Borrowing Constraints, College Aid, and Intergenerational Mobility

TL;DR: In this paper, a comparison of general tuition subsidies, need-based student aid, merit-based aid, and income-contingent loans (ICL) is made, and each of these policies is analyzed through a dynamic general equilibrium model.

Journal ArticleDOI

What explains schooling differences across countries

Juan Carlos Cordoba,Marla Ripoll +1 more

TL;DR: In this paper, the authors provide a theory that explains the cross-country distribution of average years of schooling, as well as the so-called human capital premium puzzle, and find that credit frictions and differences in access to public education, fertility and mortality turn out to be the key reasons why schooling differs across countries.

References

More filters

Journal ArticleDOI

The Production of Human Capital and the Life Cycle of Earnings

TL;DR: In this paper, the authors provide a framework for the understanding of many aspects of observed behavior regarding education, health, occupational choice, mobility, etc., as rational investment of present resources for the purpose of enjoying future returns.

Book ChapterDOI

Changes in the Wage Structure and Earnings Inequality

Lawrence F. Katz,David H. Autor +1 more

TL;DR: In this article, the authors present a framework for understanding changes in the wage structure and overall earnings inequality, emphasizing the role of supply and demand factors and the interaction of market forces and labor market institutions.

ReportDOI

Interpreting the evidence on life cycle skill formation

TL;DR: In this paper, the authors formalize the concepts of self-productivity and complementarity of human capital investments and use them to explain the evidence on skill formation, and provide a theoretical framework for interpreting the evidence from a vast empirical literature, for guiding the next generation of empirical studies, and for formulating policy.

Journal ArticleDOI

Life Cycle Schooling and Dynamic Selection Bias: Models and Evidence for Five Cohorts of American Males

TL;DR: This article examined the statistical model used to establish the empirical regularity and the intuitive behavioral interpretation often used to rationalize it, and showed that the implicit economic model assumes myopia and that the intuitive interpretive model is identified only by imposing arbitrary distributional assumptions onto the data.

Related Papers (5)

The Evidence on Credit Constraints in Post-Secondary Schooling†

Pedro Carneiro,James J. Heckman +1 more