UC Berkeley

Coleman Fung Risk Management Research Center Working

Papers 2006-2013

Title

A Class of Singular Control Problems and the Smooth Fit Principle

Permalink

https://escholarship.org/uc/item/8w46j0td

Authors

Guo, Xin

Tomecek, Pascal

Publication Date

2007-10-07

eScholarship.org Powered by the California Digital Library

University of California

University of California

Berkeley

Working Paper # 2007 -05

A Class of Singular Control Problems

and the Smooth Fit Principle

Xin Guo, UC Berkeley and Cornell University

Pascal Tomecek, Cornell University

October 7,2007

A Class of Singular Control Problems and the Smo oth Fit

Principle

∗

Xin Guo

†

UC Berkeley and Cornell

Pascal Tomecek

‡

Cornell University

October 7, 2007

Abstract

This paper analyzes a class of singular control problems for which value functions

are not necessarily smooth. Necessary and sufficient conditions for the well-known

smooth fit principle, along with the regularity of the value functions, are given. Explicit

solutions for the optimal policy and for the value functions are provided. In particular,

when payoff functions satisfy the usual Inada conditions, the boundaries between action

and no-action regions are smooth and strictly monotonic as postulated and exploited in

the existing literature (Dixit and Pindyck (1994); Davis, Dempster, Sethi, and Vermes

(1987); Kobila (1993); Abel and Eberly (1997); Øksendal (2000); Scheinkman and

Zariphopoulou (2001); Merhi and Zervos (2007); Alvarez (2006)). Illustrative examples

for both smooth and non-smooth cases are discussed, to highlight the pitfall of solving

singular control problems with a priori smoothness assumptions.

∗

This research is generously supported by grants from OpenLink Fund at the Coleman Fung Risk Man-

agement Research Center at UC Berkeley

†

Department of Industrial Engineering and Operations Research, UC Berkeley, CA 94720-1777, USA,

Phone (510) 642 3615, email: xinguo@ieor.berkeley.edu.

‡

Scho ol of Operations Research and Industrial Engineering, Cornell University, Ithaca, NY 14853-3801,

USA, Phone (607) 255 1270, Fax (607) 255 9129, email: pascal@orie.cornell.edu.

1

1 Introduction

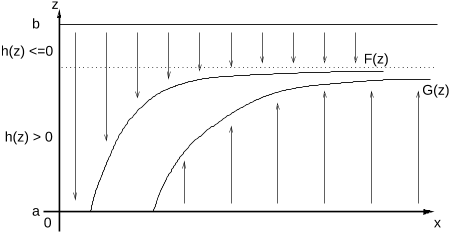

Consider the following problem in reversible investment/capacity planning that arises nat-

urally in resource extraction and power generation. Facing the risk of market uncertainty,

companies extract resources (such as oil or gas) and choose the capacity level in response

to the random fluctuation of market price for the resources, subject to some capacity con-

straints, as well as the associated costs for capacity expansion and contraction. The goal of

the company is to maximize its long-term profit, subject to these constraints and the rate

of resource extraction.

This kind of capacity planning with price uncertainty and partial (or no) reversibility

originated from the economics literature and has since attracted the interest of the ap-

plied mathematics community. (See Dixit and Pindyck (1994); Brekke and Øksendal (1994);

Davis, Dempster, Sethi, and Vermes (1987); Kobila (1993); Abel and Eberly (1997); Baldurs-

son and Karatzas (1997); Øksendal (2000); Scheinkman and Zariphopoulou (2001); Wang

(2003); Chiarolla and Haussmann (2005); Guo and Pham (2005) and the references therein.)

Mathematical analysis of such control problems has evolved considerably from the initial

heuristics to the more sophisticated and standard stochastic control approach, and from

the very special case study to general payoff functions. (See Harrison and Taksar (1983);

Karatzas (1985); Karatzas and Shreve (1985); El Karoui and Karatzas (1988, 1989); Ma

(1992); Davis and Zervos (1994, 1998); Boetius and Kohlmann (1998); Alvarez (2000, 2001 );

Bank (2005); Boetius (2005)). Most recently, Merhi and Zervos (2007) analyzed this problem

in great generality and provided explicit solutions for the special case where the payoff is of

Cobb-Douglas type. Their method is to directly solve the HJB equations, assuming certain

regularity conditions for both the value function and the boundaries between the action and

no-action regions. Guo and Tomecek (2007) later established sufficient conditions for the

smoothness of the value function by connecting the singular control problem with a collection

of optimal switching problems.

However, for many singular control problems in reversible investment and in areas such

as queuing and wireless communications (Martins, Shreve, and Soner (1996); Assaf (1997);

Harrison and Van Mieghem (1997); Ata, Harrison, and Shepp (2005)), there is no regularity

for either the value function or the boundaries. Therefore, two important mathematical issues

remain: 1) necessary conditions for regularity properties; and 2) characterization for the

value function and for the action and no-action regions when these regularity conditions fail.

Understanding these issues is especially important in cases where only numerical solutions

are available, and for which the assumption on the degree of the smoothness is wrong (see

also discussions in Section 5.2).

This paper addresses these two issues via the study of a class of singular control problems.

Both necessary and sufficient conditions on the differentiability of the value function and on

the smooth fit principle are established. Moreover, these conditions lead to a derivative-

based characterization of the investment, disinvestment and continuation regions even for

non-smooth value functions. In fact, when the payoff function is not smooth, this paper is the

2

first to rigorously characterize the action and no-action regions, and to explicitly construct

both the optimal policy and the value function. To be consistent with the literature in

(ir)reversible investment, the running payoff function in this paper depends on the resource

extraction rate and the market price in the form of H(Y )X

λ

. It is worth noting that H(·)

is any concave function of the capacity, and may be neither monotonic nor differentiable.

This includes the special cases investigated by Guo and Pham (2005); Merhi and Zervos

(2007); Guo and Tomecek (2007). In particular, when H satisifies the well-known Inada

conditions (i.e., continuously differentiable, strictly increasing, strictly concave, with H(0) =

0, H

0

(0

+

) = ∞, H

0

(∞) = 0), our results show that the boundaries between regions are

indeed continuous and strictly increasing as postulated and exploited in previous works:

Dixit and Pindyck (1994); Davis, Dempster, Sethi, and Vermes (1987); Kobila (1993); Abel

and Eberly (1997); Øksendal (2000); Scheinkman and Zariphopoulou (2001); Merhi and

Zervos (2007); Alvarez (2006). Also note that our method can be applied to more general

(diffusion) processes for the price dynamics, other than the geometric Brownian motion

assumed for explicitness in this paper. Finally, the construction between the functional form

of the boundaries and the payoff function itself is also novel, as the value function and the

boundaries may be neither smooth nor strictly monotonic as in the existing literature.

The most relevant and recent work to this paper is Alvarez (2006), which provides a

great deal of economic insight into the problem. However, Alvarez (2006) only handles

payoff functions satisfying the Inada conditions. In contrast, our solution is independent of

the regularity of the payoff and value functions.

Outline. The control problem is formally stated, with its value function and optimal p olicy

described in Section 2; details of the derivation are in Section 3. The main result of this

paper regarding the regularity of the value function is in Section 4. Examples are provided

in Section 5, including cases for which the value function is not differentiable, the optimal

controlled process not continuous, the boundaries of the action regions not smooth, and the

interior of the continuation region not simply connected.

2 Mathematical Problem and Solution

2.1 Problem

Let (Ω, F, F, P) be a filtered probability space and assume a given bounded interval [a, b] ⊂

(−∞, ∞). Consider the following problem:

Problem A.

V

H

(x, y) := sup

(ξ

+

,ξ

−

)∈A

00

y

J

H

(x, y; ξ

+

, ξ

−

),

3