Credit Constraints, Heterogeneous Firms and International Trade

Reads0

Chats0

TLDR

This article examined the detrimental consequences of financial market imperfections for international trade and developed a heterogeneous-firm model with countries at different levels of financial development and sectors of varying financial vulnerability.Abstract:

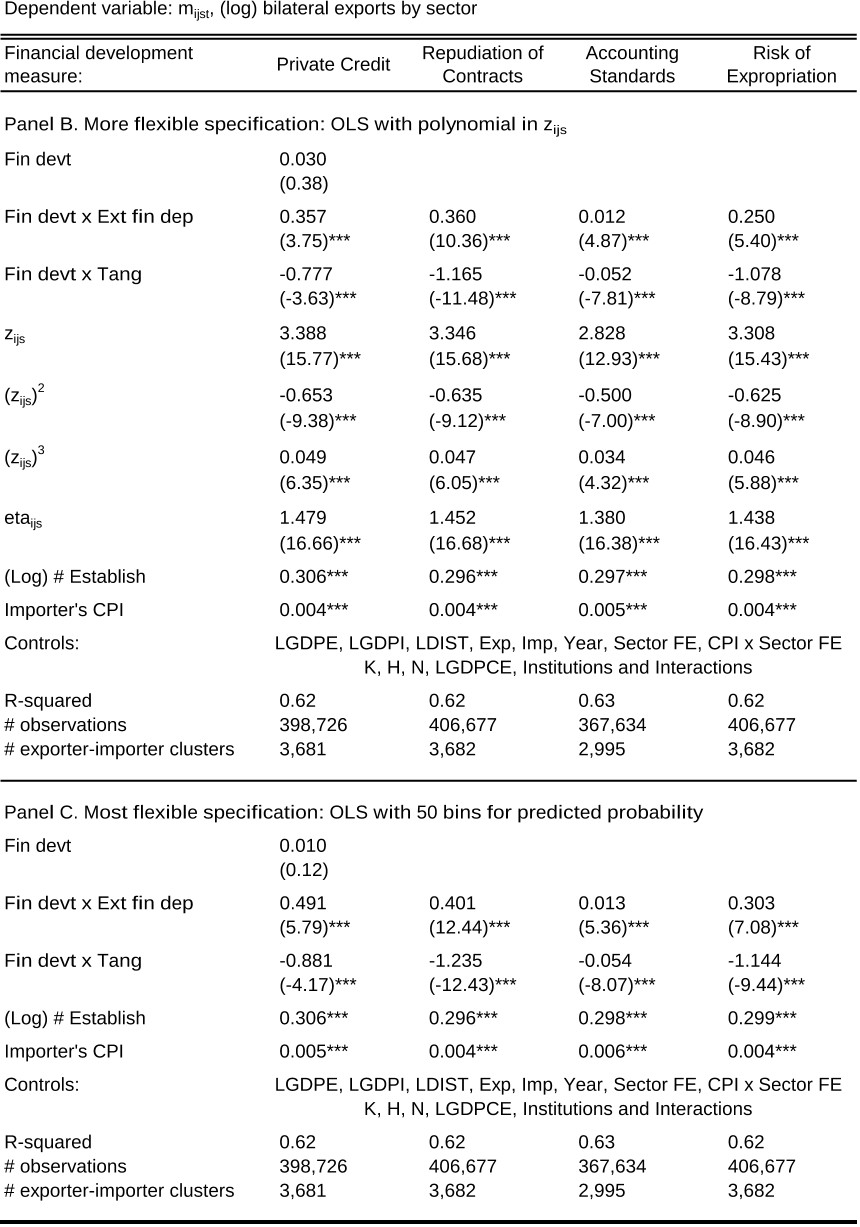

This paper examines the detrimental consequences of financial market imperfections for international trade. I develop a heterogeneous-firm model with countries at different levels of financial development and sectors of varying financial vulnerability. Applying this model to aggregate trade data, I study the mechanisms through which credit constraints operate. First, financial development increases countries' exports above and beyond its impact on overall production. Firm selection into exporting accounts for a third of the trade-specific effect, while two thirds are due to reductions in firm-level exports. Second, financially advanced economies export a wider range of products and their exports experience less product turnover. Finally, while all countries service large destinations, exporters with superior financial institutions have more trading partners and also enter smaller markets. All of these effects are magnified in financially vulnerable sectors. These results have important policy implications for less developed economies that rely on exports for economic growth but suffer from poor financial contractibility.read more

Figures

Table 10. Economic Significance: Predicted vs. Actual Trade Growth

Table 9. Economic Significance: Comparative Statics

Table 5. Financial Development and Firm-Level Exports

Figure 3. The Productivity Cut-off for Exporting

Table 5. Financial Development and Firm-Level Exports

Table 1. Export Patterns in the Data

Citations

More filters

Posted Content

The Margins of Multinational Production and the Roleof Intra-Firm Trade

Alfonso Irarrazabal,Andreas Moxnes,Andreas Moxnes,Andreas Moxnes,Luca David Opromolla,Luca David Opromolla +5 more

TL;DR: In this article, the gravity model of international trade also works well for foreign direct investment (FDI) flows or multinational production (MP), where the subsidiary is allowed to source inputs from the headquarters.

Journal ArticleDOI

Help or Hindrance? The Impact of Harmonised Standards on African Exports

TL;DR: In this paper, a new database of European Union (EU) product standards is constructed and the authors use a sample-selection gravity model to examine the impact of EU standards on African textiles and clothing exports, a sector of particular development interest.

Posted Content

Financial Constraints and Firm Export Behavior

TL;DR: The authors analyzes the link between financial constraints and firm export behavior, and finds that firms enjoying better financial health are more likely to become exporters and that financial constraints act as a barrier to export participation.

Journal ArticleDOI

Grossman–Hart (1986) Goes Global: Incomplete Contracts, Property Rights, and the International Organization of Production

TL;DR: Grossman and Hart's "The Costs and Benefits of Ownership: A Theory of Vertical and Lateral Integration" as mentioned in this paper is a seminal paper in the field of International Trade.

Journal ArticleDOI

Export Dynamics and Sales at Home

TL;DR: This article used a large French firm-level database that combines balance-sheet and product-destination-specific export information over the period 1995-2001 to study the interconnections between exports and domestic sales.

References

More filters

Posted Content

Law and Finance

Rafael La Porta,Rafael La Porta,Florencio Lopez de Silanes,Florencio Lopez de Silanes,Andrei Shleifer,Andrei Shleifer,Robert W. Vishny,Robert W. Vishny +7 more

TL;DR: This paper examined legal rules covering protection of corporate shareholders and creditors, the origin of these rules, and the quality of their enforcement in 49 countries and found that common law countries generally have the best, and French civil law countries the worst, legal protections of investors.

Journal ArticleDOI

Law and Finance

TL;DR: In this article, the authors examined legal rules covering protection of corporate shareholders and creditors, the origin of these rules, and the quality of their enforcement in 49 countries and found that common-law countries generally have the strongest, and French civil law countries the weakest, legal protections of investors, with German- and Scandinavian-civil law countries located in the middle.

Journal ArticleDOI

The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity

TL;DR: This paper developed a dynamic industry model with heterogeneous firms to analyze the intra-industry effects of international trade and showed how the exposure to trade will induce only the more productive firms to enter the export market (while some less productive firms continue to produce only for the domestic market).

Journal ArticleDOI

Finance and Growth: Schumpeter Might Be Right

TL;DR: In this paper, the authors examined a cross-section of about 80 countries for the period 1960-89 and found that various measures of financial development are strongly associated with both current and later rates of economic growth.

ReportDOI

Financial Dependence and Growth

Raghuram G. Rajan,Raghuram G. Rajan,Raghuram G. Rajan,Luigi Zingales,Luigi Zingales,Luigi Zingales +5 more

TL;DR: This paper examined whether financial development facilitates economic growth by scrutinizing one rationale for such a relationship; that financial development reduces the costs of external finance to firms, and found that industrial sectors that are relatively more in need of foreign finance develop disproportionately faster in countries with more developed financial markets.