Credit Constraints, Heterogeneous Firms and International Trade

Reads0

Chats0

TLDR

This article examined the detrimental consequences of financial market imperfections for international trade and developed a heterogeneous-firm model with countries at different levels of financial development and sectors of varying financial vulnerability.Abstract:

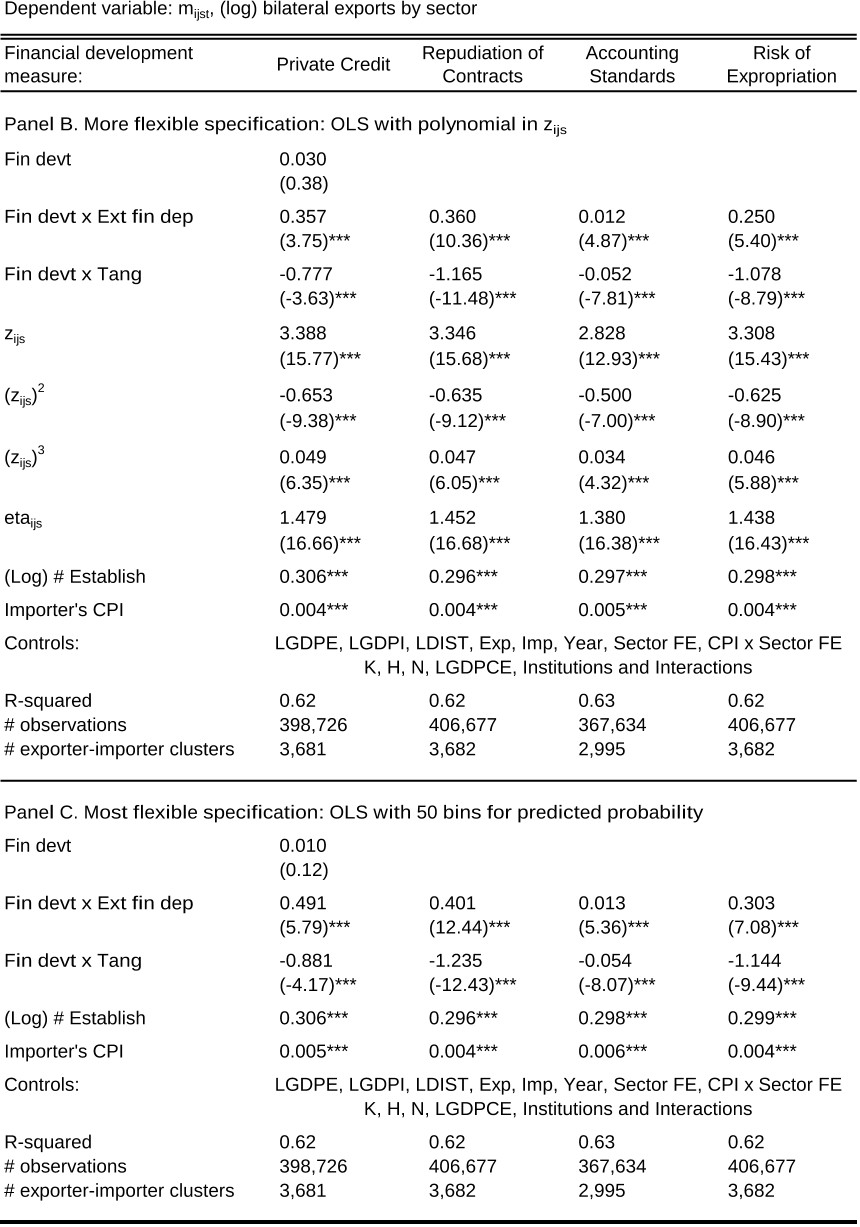

This paper examines the detrimental consequences of financial market imperfections for international trade. I develop a heterogeneous-firm model with countries at different levels of financial development and sectors of varying financial vulnerability. Applying this model to aggregate trade data, I study the mechanisms through which credit constraints operate. First, financial development increases countries' exports above and beyond its impact on overall production. Firm selection into exporting accounts for a third of the trade-specific effect, while two thirds are due to reductions in firm-level exports. Second, financially advanced economies export a wider range of products and their exports experience less product turnover. Finally, while all countries service large destinations, exporters with superior financial institutions have more trading partners and also enter smaller markets. All of these effects are magnified in financially vulnerable sectors. These results have important policy implications for less developed economies that rely on exports for economic growth but suffer from poor financial contractibility.read more

Figures

Table 10. Economic Significance: Predicted vs. Actual Trade Growth

Table 9. Economic Significance: Comparative Statics

Table 5. Financial Development and Firm-Level Exports

Figure 3. The Productivity Cut-off for Exporting

Table 5. Financial Development and Firm-Level Exports

Table 1. Export Patterns in the Data

Citations

More filters

Posted Content

Estimating Trade Flows: Trading Partners and Trading Volumes

TL;DR: In this paper, the impact of trade frictions on trade flows can be decomposed into the intensive and extensive margins, where the former refers to the trade volume per exporter and the latter referred to the number of exporters.

Journal ArticleDOI

Finance and Development: A Tale of Two Sectors †

TL;DR: This article developed a model co-determining aggregate total factor productivity (TFP), sectoral TFP, and scales across industrial sectors and found that financial frictions disproportionately affect TFP in tradable sectors where production requires larger costs.

Posted Content

Exports and Financial Shocks

Mary Amiti,David E. Weinstein +1 more

TL;DR: In this article, a causal link between the health of banks providing trade finance and growth in a firm's exports relative to its domestic sales is established, suggesting that trade finance accounts for about one-third of the decline in Japanese exports in the financial crises of the 1990s.

Journal ArticleDOI

Off the Cliff and Back? Credit Conditions and International Trade During the Global Financial Crisis

TL;DR: This article studied the collapse of international trade flows during the global financial crisis using detailed data on monthly US imports and showed that credit conditions were an important channel through which the crisis affected trade volumes, by exploiting the variation in the cost of capital across countries and over time.

Journal ArticleDOI

The Empirics of Firm Heterogeneity and International Trade

Andrew B. Bernard,Andrew B. Bernard,Andrew B. Bernard,J. Bradford Jensen,J. Bradford Jensen,Stephen J. Redding,Peter K. Schott,Peter K. Schott,Peter K. Schott +8 more

TL;DR: A review of empirical evidence on firm heterogeneity in international trade can be found in this article, where a first wave of empirical findings from micro data on plants and firms proposed challenges for existing models of international trade and inspired the development of new theories emphasizing firm heterogeneity.

References

More filters

Journal ArticleDOI

Institutional quality and international trade

TL;DR: In this article, a simple model of international trade is proposed, in which institutional differences are modeled within the framework of incomplete contracts and empirically whether institutions act as a source of trade, using data on US imports disaggregated by country and industry.

Journal ArticleDOI

Dissecting Trade: Firms, Industries, and Export Destinations

TL;DR: In this article, the authors examine entry across 113 national markets in 16 different industries using a comprehensive data set of French manufacturing firms and find that variation in market share translates nearly completely into firm entry.

Report SeriesDOI

Comparative advantage and heterogeneous firms

TL;DR: In this article, the authors examine how country, industry, and firm characteristics interact in general equilibrium to determine nations' responses to trade liberalization and find that simultaneous within-and across-industry reallocations of economic activity generate substantial job turnover in all sectors, even while there is net job creation in comparative advantage industries and net job destruction in comparative disadvantage industries.

Posted Content

Zeros, Quality and Space: Trade Theory and Trade Evidence

TL;DR: This paper proposed a variant of the Melitz model that can account for all the facts and showed that high quality firms are the most competitive, with heterogeneous quality increasing with firms' heterogeneous cost.

BookDOI

Financial and legal constraints to firm growth: does size matter?

TL;DR: In this paper, the authors investigate the effect of financial, legal, and corruption problems on firms' growth rates and find that it is consistently the smallest firms that are most constrained.