NBER WORKING PAPER SERIES

WHY DOES STOCK MARKET VOLATILITY CHANGE OVER TIME?

C. William

Schwert

Working Paper

No. 2798

NATIONAL BUREAU OF ECONOMIC RESEARCH

1050

Massachusetts Avenue

Cambridge,

MA 02138

December 1988

Discussions with Ken French and Rob

Stambaugh

have contributed

significantly

to this

paper.

I received

helpful

comments

from Fischer

Black, Harry

DeAngelo,

Ken

French,

Dan

Nelson,

Charles

Plosser,

Paul

Seguin,

Jerold

Zimmerman and seminar

participants

at Yale

University,

and

at the Univer-

sities of

Chicago, Michigan,

Rochester and

Washington.

The

Bradley Policy

Research

Center at the

University

of

Rochester

provided support

for this

research. This research is

part

of NBER's

program

in Financial Markets and

Monetary

Economics.

Any opinions expressed

are those of the author not those

of the National Bureau of Economic

Research.

NBER

Working Paper

#2798

December

1988

WHY DOES STOCK MARKET VOLATILITY CHANGE OVER TIME?

ABSTRACT

This

paper analyzes

the relation of

stock

volatility

with real and nominal

macroeconomic

volatility,

financial

leverage,

stock

trading activity,

default

risk,

and firm

profitability using

monthly

data from 1857-1986. An

important

fact, previously

noted

by

Officer[l973],

is that stock return

variability

was

unusually

high during

the

1929-1940 Great

Depression.

Moreover,

leverage

has

a

relatively

small effect on stock

volatility.

The

amplitude

of the fluctuations

in

aggregate

stock

volatility

is difficult to

explain

using

aimple

models of

stock valuation.

G.

William Schwert

William E. Simon Graduate School

of Business Administration

University

of Rochester

Rochester,

NY 1462]

Wlfl DOES STOCK MARKET VOLATILITY

ChANCE OVER TIME?

C. William

Schwert

1.

Introduction

Many

researchers have

noted that

aggregate

atock market

volatility changes

over time.

Officer[l973]

relates these

changes

to the

volatility

of

macroeconomic

variables.

Black[197g]

and

Christie(l982] argue

that financial

leverage

explains

some of this

phenomenon.

Recently,

there have been

many

attempts

to relate

changes

in stock market

volatility

to

changes

in

expected

returns to

stocks, including

Mertonl9gO]

,

Pindyck[l984]

,

Poterba and

Susssers(l9SSJ, French,

Schwert and

Stambaugh[l987, Eollerslev, Engle

and

Wooldridge[l9Sg]

,

Cenotte and

Marsh[1987)

,

and

Abel[lSgg]

Shiller[l98la,l9glb] argues that

the level of stock market

volatility

is

too

high

relative

to the ex

post

variability

of

dividends

in the context of a

simple present

value model.

In

present

value models such as

Shiller's,

a

change

in the

volatility

of either future cash flows

or discount rates causes a

change

in

the

volatility

of stock returns.

There have been

many

critiques

of Shiller's

work,

notably

Kleidon[1986].

Nevertheless,

no one has

analyzed

the relation

between time-variation in stock

return

volatility

and fundaisental determinants

of value.

This

paper

characterizes the

changes

in

stock market

volatility

through

time.

In

particular,

the

goal

is to

relate stock market

volatility

to

the

time-varying volatility

of

a

variety

of economic vsriables. Relative

to the

1857-1986

period, volatility

was

unusually high

from 1929-1940 for

many

economic

series, including

inflation, money growth,

industrial

production,

and

other measures of economic

activity.

I find evidence that stock market

volatility

increases with financial

leverage,

as

predicted by

Black

and

Christie,

although

this factor

explains only

a small

part of the

variation in

stook market

volatility.

In

addition,

interest rate and

corporate

bond return

volatility

is correlated

with stock return

volatility. Finally,

stock market

volatility

increases

during

recessions and is relsted

to

measures

of

corporate

profitability.

None of these

factors,

however,

plays

a dominant role in

explaining

the behavior

of stock

volatility

over time.

Section

2

describes

the time series

properties

of the

data and

the

empirical strategy

for

modeling rime-varying volatility.

Section 3

analyzes

the relations of stock and bond return

volatility

with the

volatility

of five

important

macroeconomic

variables. Section 4 studies the relation between

stock market

volatility

and

corporate

profitability.

Section 5

analyzes

the

relation

between financial

leverage

and stock return

volatility,

and the

relation between stock

market

trading activity

and

volatility.

Finally,

section 6

synthesizes

the results from the

preceding

sections and

presents

concluding

remarks.

2. Time Series

Properties

of

the

Data

The

Appendix

describes

the sources used to construct the data

in

this

paper.

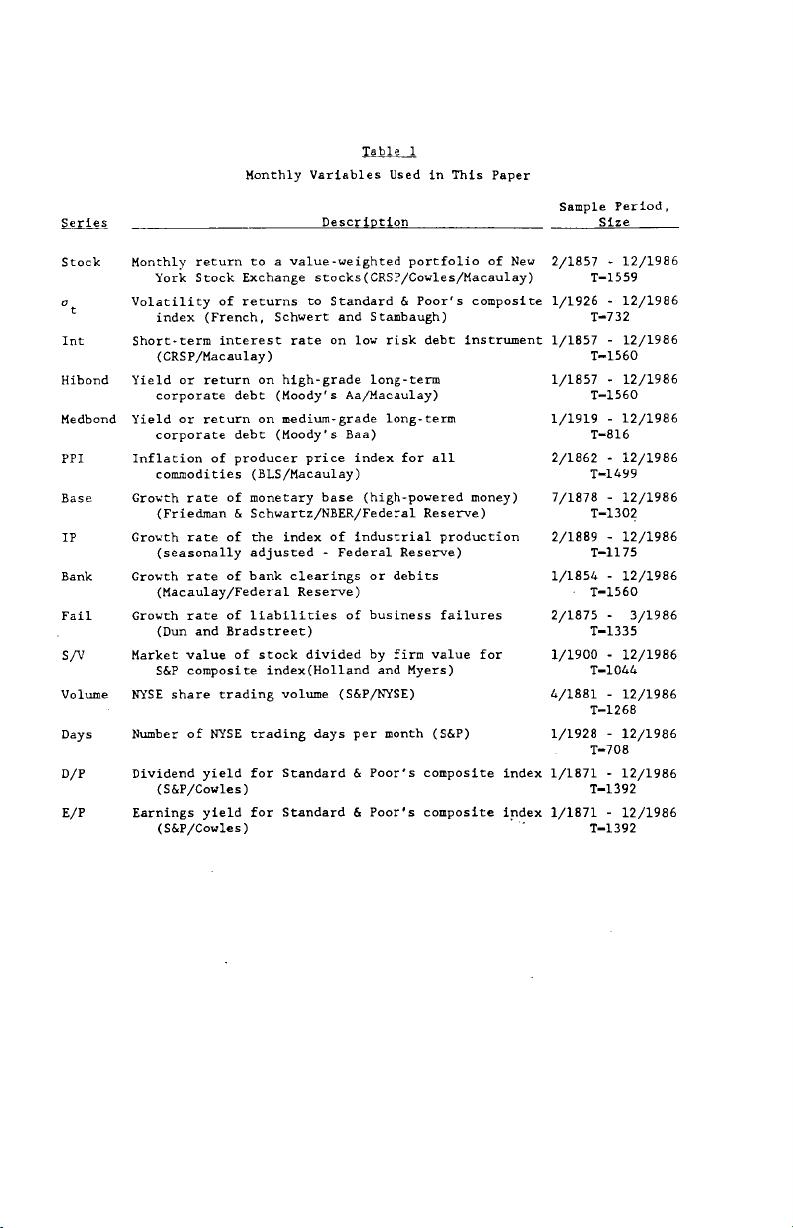

Table 1 lists these

variables. There are measures of;

stock

returns

(Stock).

short

(Int)

and

long-term

bond

yields

and returns

(Nibond

and

Medbond).

inflation

monetary growth

(Baser).

aggregate

real economic

activity

(IP, Fail

and

Bank).

financial

leverage

(S/Vs).

dividend

(D/F)

and

earnings yields

for

stocks,

and stock market

trading activity,

including

the

growth

rate of share

trading

volume

(Volume)

and

the

number of

trading days per

month

(Days).

The measure of stock

marker

volatility

based

Table 1

Monthly

Variables Used in This

Paper

Sample

Period,

Series Size

Stock

Monthly

return

to a

value-weighted portfolio

of New

2/1857

-

12/1986

York Stock

Exchange stocks(CRSP/Cowles/Macaulay)

T-.1559

Volatility

of returns to Standard & Poor's

composite 1/1926

-

12/1986

index (Ftench,

Schwert and

Stambaugh)

T—732

mt Short-term interest rate on low risk

debt

instrument

1/1857

-

12/1986

(GRSP/Macaulay)

T—1560

Nibond Yield or rerurn on

high-grade long-term

1/1857

-

12/1986

corporate

debt

(Moody's Aa/Macaulay)

T—l560

Medbond Yield or return on

medium-grade long-term

1/1919

-

12/1986

cotporate

debt

(Moody's

Baa)

T—8l6

PPI Inflation of

producer price

index

for all

2/1862

-

12/1986

commodities

(BLS/Macaulay)

T—1499

Base Growth rate of

monetary

base

(high-powered money) 7/1878

-

12/1986

(Friedman

&

Schwartz/NBER/Fedecal

Reserve)

T—l302

IP Grovth rate of the index of industrial

production 2/1889

-

12/1986

(seasonally adjusted

-

Federal

Reserve)

T—1l75

Bank Growth rate of bank

clearings

or debits

1/1854

-

12/1986

(Macaulay/Federal Reserve)

T—l560

Fail Growth rate of liabilities of business failures

2/1875

-

3/1986

(Dun

and

Bradstreet)

T—l335

S/V

Market value of stock divided

by

firm value for

1/1900

-

12/1986

S&P

composite index(Nolland

and

Myers)

T—1044

Volume NYSE share

trading

volume

(SEP/NYSE) 4/1881

-

12/1986

T—l268

Days

Number of NYSE

trading days pet

month

(S&P)

1/1928

-

12/1986

T—708

D/P

Dividend

yield

for Standard & Poor's

composite

index

1/1871

-

12/1986

(S&P/Cowles)

T—l392

E/P Earnings yield

for Standard &

Poor's

composite

index

1/1871

-

12/1986

(S&P/Gowles)

T—1392