LBS Research Online

M Becht, J R Franks, J Grant and H F Wagner

Returns to Hedge Fund Activism: An International Study

Article

This version is available in the LBS Research Online repository:

https://lbsresearch.london.edu/

id/eprint/831/

Becht, M, Franks, J R, Grant, J and Wagner, H F

(2017)

Returns to Hedge Fund Activism: An International Study.

Review of Financial Studies, 30 (9). pp. 2933-2971. ISSN 0893-9454

DOI: https://doi.org/10.1093/rfs/hhx048

Oxford University Press (OUP)

https://academic.oup.com/rfs/article/30/9/2933/385...

Users may download and/or print one copy of any article(s) in LBS Research Online for purposes of

research and/or private study. Further distribution of the material, or use for any commercial gain, is

not permitted.

Returns to Hedge Fund Activism: An International Study

Marco Becht

Solvay Brussels School, Université libre de Bruxelles, CEPR, and ECGI

Julian Franks

London Business School, CEPR, and ECGI

Jeremy Grant

Berenberg Bank

Hannes F. Wagner

Bocconi University and IGIER

Review of Financial Studies, forthcoming

27 May 2014

Revised 15 September 2016

We are grateful to Robin Greenwood and Andrew Karolyi (the editors); two anonymous referees; and

John Armour, Tara Bhandari, Alon Brav, Nick Gantchev, Pedro Matos, Janis Skrastins, Oren Sussman,

Phillip Goldstein (Bulldog Investors), David Trenchard (formerly Knight Vinke), John Armstrong-

Denby (Edmond de Rothschild), and Mark Levine (Elliott Management). We also thank the

participants at the Transatlantic Corporate Governance Dialogue (TCGD) in Washington DC in

December 2011, the EU-ASIA Corporate Governance Dialogue Inaugural Conference in Tokyo in June

2012, the European Financial Management Association in Rome in June 2014, the European Finance

Association in Lugano in August 2014, the 4nations Cup in Rome in May 2015, and the Western

Finance Association in Seattle in June 2015 and seminar participants at Bar Ilan, Bocconi University,

the Hanken School of Economics, Koç Business School, the London Business School, Luxembourg

School of Finance, Rotterdam University, University of Oxford, and Tilburg University for comments.

Song Zhang and Yordana Mavrodieva provided excellent research assistance. We acknowledge

research support from the ESRC [grant no. R060230004], the London Business School’s Centre for

Corporate Governance, the BNP Paribas Hedge Fund Centre, the Goldschmidt Chair at the Solvay

Brussels School of Economics and Management, Université libre de Bruxelles, and the PEGGED

(Politics, Economics and Global Governance: The European Dimensions) collaborative research

project supported by the Seventh Framework Programme for Research and Technological

Development [contract no. SSH7-CT-2008-217559]. Send correspondence to Marco Becht, Universite

libre de Bruxelles, Avenue F. D. Roosevelt 50, CP114, 1050 Brussels, Belgium; telephone: +32 2 650

4466. E-mail: mbecht@ulb.ac.be.

Returns to Hedge Fund Activism: An International Study

Abstract

This paper provides evidence on the incidence, characteristics, and performance of activist

engagements across countries. We find that the incidence of activism is greatest with high institutional

ownership, particularly for U.S. institutions. We use a sample of 1,740 activist engagements across 23

countries and find that almost one-quarter of engagements are by multi-activists engaging the same

target. These engagements perform strikingly better than single activist engagements. Engagement

outcomes, such as board changes and takeovers, vary across countries and significantly contribute to

the returns to activism. Japan is an exception, with high initial expectations and low outcomes. (JEL

G32)

1

This paper provides evidence on the incidence, characteristics, and performance of activist

engagements across countries. The scope of this paper allows us to address the question of how

different patterns of ownership and institutional arrangements influence the growth and performance

of activism. Our paper is the first comparative study of publicly observable activism across 23

countries in Asia, Europe, and North America. We analyze 1,740 activist interventions, mainly

initiated by hedge funds and focus funds, for the 2000-2010 period. The three largest markets for

shareholder activism are the United States (1,125 interventions), Japan (184 interventions), and the

United Kingdom (165 interventions). Despite this apparent concentration, activism is a significant

phenomenon relative to the size of stock markets in other countries (e.g., Italy). Further, because

activists hold limited stakes—11%, on average—they require the support of other investors, including

pension funds and other activists. We interpret our results as showing that the pattern of ownership is

an important source of influence on activism activity across countries.

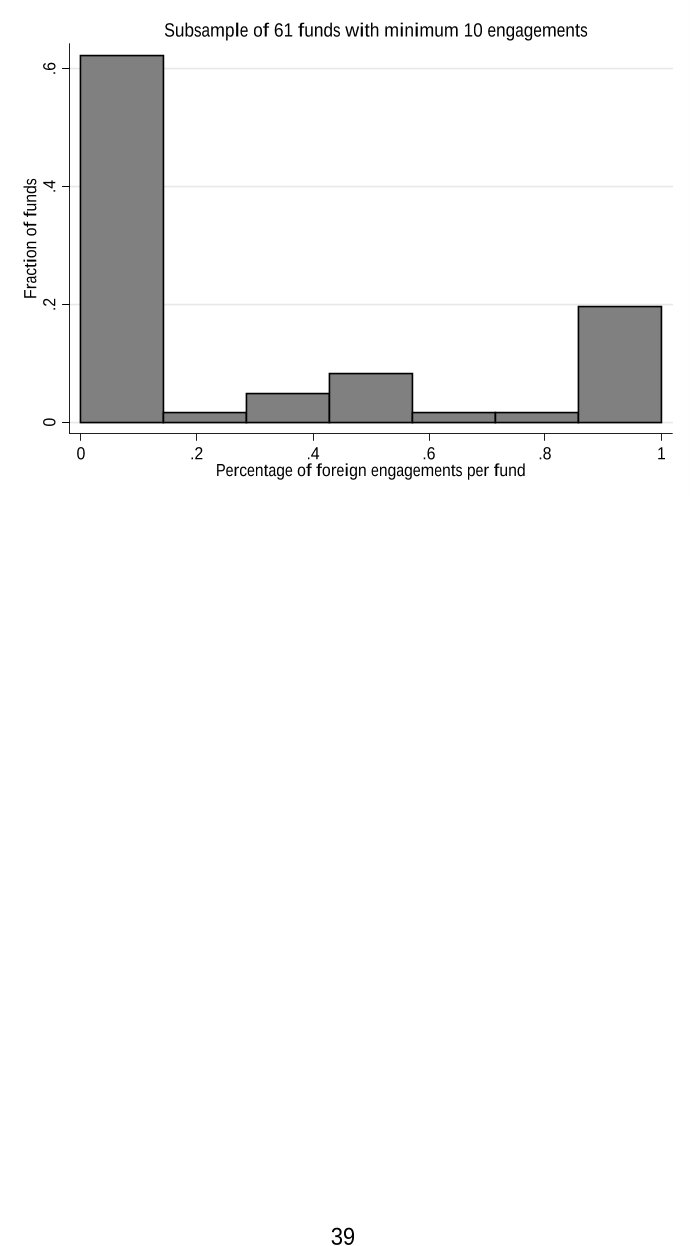

Our sample covers 330 different activist funds. Most funds have a clear domestic focus, but

foreign engagements account for 24% of the total, roughly equally split between U.S.-based and non-

U.S.-based activists, allowing us to compare domestic and foreign models of activism. Hedge fund

engagements frequently involve more than one hedge fund (“wolf pack”) that may coordinate

formally or informally. We estimate that wolf packs are associated with almost one quarter of all

engagements and we show that they achieve some of the highest returns for target shareholders.

How do activist engagements perform? The conventional measure of activists’ performance is

the abnormal return around the public announcement of the activist’s stake. We find abnormal

announcement returns of 7.0% for the United States during a (-20, 20) day window, which are virtually

identical to those reported by Brav et al. (2008) and related studies. The European and Asian

2

announcement returns are significant at 4.8% and 6.4%, respectively, and are comparable to the United

States.

How successful are activists in their engagements with target firms? For this analysis, we

identify the outcomes of each engagement, including changes to payout policy, governance, corporate

restructuring and takeovers. Compiling data on activist outcomes internationally is particularly

challenging; while activists engaging U.S.-listed firms need to provide information on the stated

purpose of their investment in Schedule 13D filings, no exact equivalent exists elsewhere. Through

extensive news searches, we identify outcomes of the engagements.

For the entire sample, the unconditional probability of an activist being successful in achieving

at least one engagement outcome is 53%. However, the incidence of outcomes varies considerably

across countries. In North America activists achieve outcomes in 61% of all engagements and 50% in

Europe, but only 18% in Asia. Japan, in particular, is a country of unfulfilled expectations with high

disclosure returns but very few outcomes.

We also show that the incidence of engagement outcomes and the type of outcome dramatically

affect the abnormal returns over the entire engagement, from block disclosure to exit. The

announcement of an engagement outcome contributes significantly to holding period returns during the

engagement. Abnormal returns around the announcement of outcomes average 6.4% across all

countries during a (-20, 20) window, with the highest returns of 8.8% in Europe, 6.0% in North

America and 2.7% in Asia. These returns are in addition to the block disclosure returns for the

subsample of engagements with successful outcomes. To investigate the potential importance of

governance changes initiated by the activist, we test whether engagements with multiple outcomes, for

example, a board change or spin-off followed by a takeover, have a higher total return than a single

outcome, such as a takeover. The differences are striking, particularly engagements with multiple