Liquidity, Moral Hazard, and

Interbank Market Collapse

∗

Enisse Kharroubi

a

and Edouard Vidon

a,b

a

Banque de France

b

International Monetary Fund

This paper proposes a framework to analyze the functioning

of the interbank liquidity market and the occurrence of liquid-

ity crises. The model relies on three key assumptions: (i) ex

ante investment in liquid assets is not verifiable—it cannot be

contracted upon, (ii) banks face moral hazard when confronted

with liquidity shocks—unobservable effort can help overcome

the shock, and (iii) liquidity shocks are private information—

they cannot be diversified away. Under these assumptions,

the aggregate volume of capital invested in liquid assets is

shown to exert a positive externality on individual decisions

to hoard liquid assets. Due to this property, the collapse of

the interbank market for liquidity is an equilibrium. More-

over, such an equilibrium is more likely when the individual

probability of the liquidity shock is lower. Banks may there-

fore provision too few liquid assets compared with the social

optimum.

JEL Codes: D53, D82, D86.

∗

We thank Nuno Cassola, Edouard Challe, Denis Gromb, Arvind Krish-

namurthy, Henri Pag`es, Jean-Charles Rochet, Rafael Repullo, Tano Santos,

Jean Tirole, and two anonymous referees for helpful comments and suggestions.

All remaining errors are ours. A previous version of the paper was circulated

under the title “Increasing Returns in Inter-Bank Liquidity Market.” The views

expressed herein are those of the authors and should not be attributed to the

Banque de France, the Eurosystem, or the International Monetary Fund, its

executive board, or its management. Corresponding author: Enisse Kharroubi.

Address: Banque de France. 49-1374. 1, rue de la Vrilli`ere. 75049 Paris cedex 01.

E-mail: enisse.kharroubi@banque-france.fr. Tel: + 33 1 42 92 47 39. Fax: + 33 1

42 92 49 50.

51

52 International Journal of Central Banking December 2009

1. Introduction

The financial market turmoil that has been under way since the sum-

mer of 2007 hit the core of the global financial system, the interbank

market for liquidity. While this paper does not endeavor to account

for all the features of the recent crisis, be it hard evidence or casual

stories about the motivations of market players, it argues that a

proper modeling of the collapse in the market for liquidity involves

a close look at incentives to provision/hoard liquidity and moral haz-

ard mechanisms in the interbank market. In addition, it makes sense

to do so in a framework where banks can actually fail and default

on their borrowing. Both of these assumptions are strongly vindi-

cated by salient features of the recent crisis. Many observers have

argued that securitization may have provided the wrong incentives

regarding the monitoring of underlying asset quality, in a clear-cut

case of moral hazard. In addition, recent developments have shown

that bank failure scenarios are only too realistic.

We investigate the possible role of insufficient ex ante liquidity

provision in paving the way to an interbank market collapse. We

thus highlight the benefits of situations where banks set aside large

amounts of liquid assets in order to better deal with shocks affecting

their illiquid investments. By liquidity provisions, we mean specifi-

cally holdings of assets that can be used to safely transfer wealth over

a short period of time. This may be seen as a form of “balance-sheet

liquidity.” In practice, such liquid holdings could be remunerated

reserves held at the central bank, or short-term Treasury securities.

1

Indeed, the secular decline in the share of liquid assets on banks’ bal-

ance sheets is a striking stylized fact that has been underscored by

Goodhart (2008) as a troubling feature of risk management. A situ-

ation where market and funding liquidity appeared to be high may

thus have hidden vulnerabilities stemming from limited holdings of

liquid assets.

Against such a background, this paper shows that across equilib-

ria, the risk-adjusted return on liquid assets can be increasing with

1

We do not model a risk-free asset market as such; however, we will simply

assume that a technology providing a risk-free rate of return is available as an

alternative to illiquid investments on the one hand, and to interbank lending on

the other hand.

Vol. 5 No. 4 Liquidity, Moral Hazard 53

the aggregate volume of such assets in the economy. When a bank

faces a liquidity shock, it needs to reinvest in its impaired assets.

Moreover, success in reinvestment depends on the effort the bank

undertakes. When it has provisioned a large volume of liquidity ex

ante, reinvestment is mostly financed through internal funds. Hence,

the distressed bank pays particular attention to improving the prob-

ability that reinvestment succeeds. Consequently, the moral hazard

problem is mitigated and the distressed bank benefits from a large

capacity to borrow liquidity on the interbank market. This tends

to raise the demand for liquidity and hence the price of liquidity,

which in turn raises incentives to provision liquid assets ex ante. As

a result, both the risk-adjusted return on liquidity provisioning and

the total volume of liquidity in the economy are large.

By contrast, with low ex ante liquidity provision, the argument is

reversed: the moral hazard problem is amplified through the afore-

mentioned channel—reinvestment is mostly financed through exter-

nal funds. Intact lending banks then impose a tight constraint on

the volume of liquidity distressed banks can borrow on the inter-

bank market so as to restore their incentives to deliver effort. This,

however, reduces the demand for liquidity and drives down the price

of liquidity, which in turn depresses banks’ incentives to provision

liquidity ex ante. Consequently, the risk-adjusted return on liquid-

ity provisioning and the total volume of liquidity in the economy are

low. The two polar cases of high and low liquidity provisions can

therefore both be equilibrium outcomes.

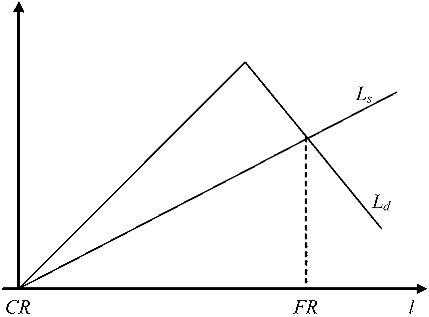

Turning to comparative statics, the credit-rationing equilibrium

happens to be more likely when the liquidity shock is less likely. We

call this property the curse of good times. When the probability of

facing the liquidity shock is low, banks reduce their liquidity holdings

because they are less likely to need these liquid assets for reinvest-

ment. This tightens the moral-hazard-induced liquidity constraint,

reducing the demand for liquid assets and thereby the return on

liquid assets on the interbank market, which in turn reduces incen-

tives to provision liquidity ex ante. Conversely, the equilibrium with

large liquidity provision and high risk-adjusted return is more likely

when the liquidity shock is more likely, a property we call the virtue

of bad times. When the probability of facing the liquidity shock

is high, banks raise their liquidity holdings because they are more

likely to need these provisions for reinvestment. This relaxes the

54 International Journal of Central Banking December 2009

moral-hazard-induced liquidity constraint, raising the demand for

liquidity and thereby the price of liquidity on the interbank market,

which in turn raises incentives to provision liquidity ex ante. Hence,

when the probability of the liquidity shock is intermediate, multiple

equilibria emerge: large (resp. low) aggregate investment in liquid

assets tends to raise (resp. reduce) the return on liquid assets and

thereby raise (resp. reduce) individual incentives to invest in liquid

assets.

Finally, the paper investigates how policy can prevent or dampen

a collapse of the market for liquidity. The main result is that policies

aimed at tackling the collapse of the interbank market ex post—i.e.,

after the collapse has happened—are unlikely to reach their goal. In

particular, liquidity injections as well as interest rate cuts cannot

help distressed banks overcome their liquidity shocks. By contrast,

ex ante policies, especially those that modify the relative return of

liquid assets compared with illiquid assets, can be successful in pre-

venting a collapse of the interbank market. In other words, monetary

policy, by setting short-term interest rates which provide incentives

to invest in liquid assets, can be helpful in reducing the occurrence

of liquidity crises. Regulatory policies requiring liquidity provision

can also be useful.

The model in this paper builds on the standard literature on

moral hazard and liquidity crisis. The demand for liquidity is mod-

eled in a basic, standard fashion, similar to that of Holmstr¨om and

Tirole (1998). Agents (in our case, banks) with long-term assets

face stochastic liquidity shocks which trigger a reinvestment need

and a moral hazard problem: success in reinvestment depends on

unobservable effort by banks.

2

We, however, depart from this sem-

inal paper in an important way, by assuming that idiosyncratic

liquidity shocks cannot be diversified away: this opens the door

to an interbank market where liquidity can be reallocated interim.

Because of this feature, our framework is closely related to the

2

The main alternative modeling of liquidity is based on the Diamond and

Dybvig (1983) approach—enriched by Diamond and Rajan (2001)—in which

banks with illiquid assets supply liquidity to consumers through liquid deposits

(funding liquidity). While this approach can account for bank runs that have

taken place during the current financial crisis, the Holmstr¨om and Tirole (1998)

approach, focused on market liquidity, seems more relevant given the particular

initial circumstances of the crisis.

Vol. 5 No. 4 Liquidity, Moral Hazard 55

model of liquidity demand developed by Caballero and Krishna-

murthy in a series of papers (in particular, Caballero and Krish-

namurthy 2004) dealing with access to international financing. Our

model shares their features that (i) idiosyncratic shocks cannot be

written into insurance contracts, generating the need for domestic

financial transactions, and (ii) borrowers cannot transfer the full

surplus generated by reinvestment resources. Likewise, we therefore

have situations where private decisions are biased against hoarding

liquidity.

Our paper is connected to the literature on interbank markets, as

a mechanism for managing, and potentially eliminating, risks stem-

ming from idiosyncratic liquidity shocks. Bhattacharya and Gale

(1987) in particular studied the case where neither banks’ invest-

ments in the illiquid technology nor liquidity shocks are observ-

able. In their framework, banks have an incentive to underprovision

liquidity ex ante and free-ride the common pool of liquidity. Rochet

and Tirole (1996) adapted the Holmstr¨om-Tirole framework to the

interbank market in order to study systemic risk and “too-big-to-

fail” policy. The existence of interbank market imperfections has

been established empirically by Kashyap and Stein (2000), which

showed the role of liquidity positions, the so-called “liquidity effect.”

Building on such evidence, Freixas and Jorge (2008) analyzed the

functioning of the interbank market in order to show the conse-

quences of its imperfections for monetary policy. In particular, they

established the relevance of heterogeneity in banks’ liquid asset hold-

ings for policy transmission.

Our work is also related to recent work on liquidity crises. A

recent strand of literature has explored the propagation of crises

through banks’ balance sheets, while treating the level of liquidity

held by banks as endogenous. This approach builds on Allen and

Gale’s (1998) analysis of distressed liquidation of risky assets, to

explore the mechanism whereby anticipation of fire-sale pricing of

such assets determines banks’ ex ante portfolio allocation. Allen and

Gale (2004) as well as Acharya, Shin, and Yorulmazer (2007, 2009)

have concentrated on this interaction between equilibrium liquid-

ity and endogenously determined fire sales. In particular, Acharya,

Shin, and Yorulmazer (2007) showed that banks’ holdings of liquid-

ity may be too low or too high compared with the social optimum,

depending on the pledgeability of their assets and the possibility to