read more

the arrival rate for fill-in customers depends on the prices charged via a downward sloping demand function, ( )ff pλ , where fp is the price charged for fill-in customers.

From a managerial standpoint, if the factory is very lightly loaded or customers are relatively insensitive to delays, it is best to ignore the state of the factory in deciding which jobs to accept – only price should be used to discourage or encourage customers.

The probability that this system is idle is approximately 0.0603, and thus the expected additional revenue due to the fill-in jobs is approximately $1073 per month.

It is interesting to note that the expected performance of this relatively simple form of state-dependent pricing exceeds that of state-independent pricing by approximately 8.4% in this example.

Of note in Theorem 3 is that for a non-binding waiting time constraint, it is optimal to use state-independent pricing for fill-in jobs.

The explanation for this effect is that admitting jobs only when idle gets costly for a lightly loaded system; such a policy does not allow any queueing of fill-in jobs, which can result in unnecessary idle time.

In this subsection the authors study a general state-dependent pricing scheme in which price maybe changed dynamically without constraint, i.e., fill-in job arrivals at time t are charged a price that is a function of the congestion levels in time t.

A parallel picture in the grocery industry is the emergence of loyalty cards where “loyal” (or long-term) customers are promised better deals than “walk-in” customers who have to pay the price they face during that week.

The expected waiting time in the system for core arrivals is given by:( ) ( ) +∏ ++= ∑ ∞=− =1100 11 iifjcij c iW µλλµ π.

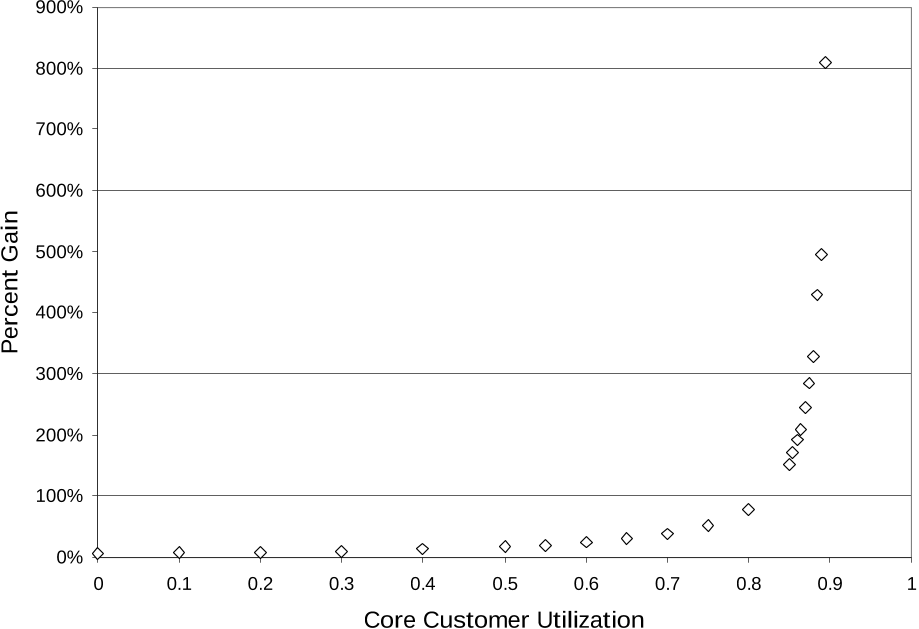

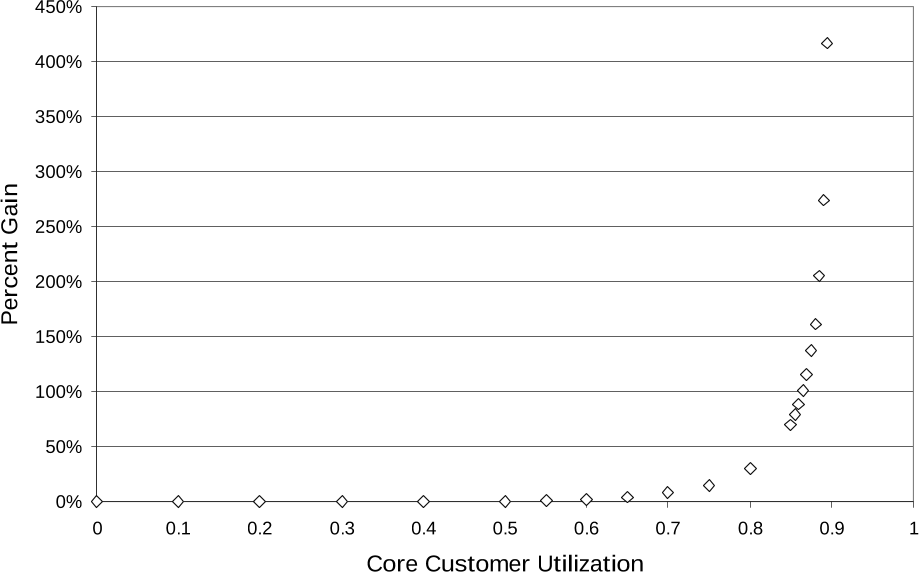

Example 4. Following Examples 1-3, fill-in customers exhibit demand of the form ( ) ppf 1.0100 −=λ ; core customers arrive at an average rate of 8 per month and the production system can complete 10 jobs per month on average.

The expected waiting time in the system for core customer arrivals is given by:( ) ( ) − + − + +=µ λ µ λµλλ µ π cc fc cW1111 12 0 .