Q1. What are the contributions in "The case for nit+ft in europe. an empirical optimal taxation exercise" ?

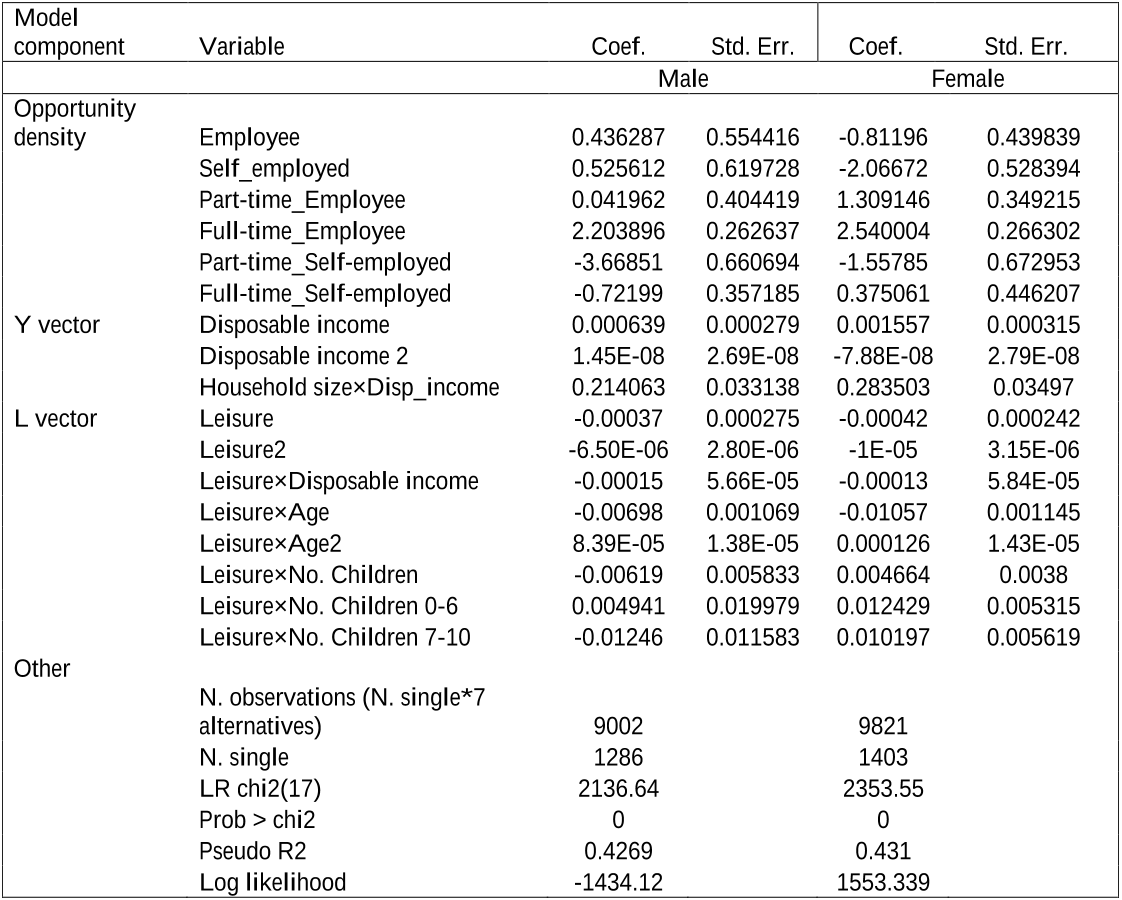

The authors present an exercise in empirical optimal taxation for European countries from three areas: Southern, Central and Northern Europe.

read more